Fintech And Banking Impact On Banks Future вђ Techmagic

Fintech And Banking Impact On Banks Future вђ Techmagic Optimizing risk management processes. all these prospects of the impact of fintech on banks promise us rapid growth of the fintech industry: according to predictions, in the next year, 2022, the global fintech market will cost about $309.98 billion (in 2018, the same figures were only about $127.66 billion). With a projected compound annual growth rate (cagr) of 22.5% between 2023 and 2032, the financial industry is poised to witness a transformative wave propelled by the integration of generative ai. banking industry stands to gain the most from gen ai, with a potential surge in productivity ranging between 22 30%.

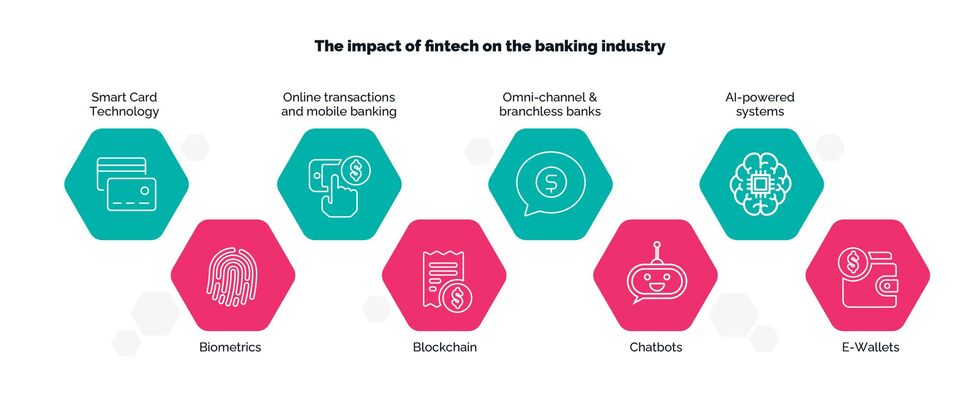

Fintech And Banking Impact On Banks Future вђ Techmagic The market is expected to reach an average annual growth rate of over 22% by 2026. experts also claim that the adoption of cloud technologies in the banking industry will grow from 26% to 56% of the market by 2025, which leads us to common cloud based core modernization strategies. refactor. Given the importance of banks in the financial system, it is critical to understand the risks and opportunities that fintech creates for banks and its impact on the main functions of financial intermediaries as well as their role in the modern ecosystems of financial services. 1 specifically, it is not altogether clear whether the fintech revolution will completely disrupt traditional banking. The fintech sector, currently holding a mere 2% share of global financial services revenue, is estimated to reach $1.5 trillion in annual revenue by 2030, constituting almost 25% of all banking valuations worldwide. with 42% of all incremental revenues, the largest market is projected to be asia pacific (apac), especially emerging asia (china. Currently, financial services are only a small part of big tech’s global business. however, given their size and customer reach, big techs’ entry into finance has the potential to spark rapid change in the industry. they may even become dominant through their collection of valuable data and their large, established networks (bis 2019).

Comments are closed.