Find Payment Total Cost And Total Interest Of A Loan With Down Payment

Total Loan Cost Formula And Calculator In other words, the purchase price of a house should equal the total amount of the mortgage loan and the down payment. often, a down payment for a home is expressed as a percentage of the purchase price. as an example, for a $250,000 home, a down payment of 3.5% is $8,750, while 20% is $50,000. Calculate loan payments, loan amount, interest rate or number of payments. use this calculator to try different loan scenarios for affordability by varying loan amount, interest rate, and payment frequency. create and print a loan amortization schedule to see how your loan payment pays down principal and bank interest over the life of the loan.

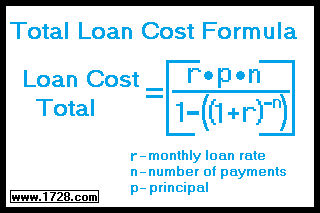

Find Payment Total Cost And Total Interest Of A Loan Wi Calculate the total payment by multiplying the periodic payment by the number of payments. therefore, the total payment is 111.02 × 120 = $13,322.46. the interest payment is the difference between the total payment and the principal balance (or loan amount). that is, the interest on the above loan is 13,322.46 – 10,000 = $3,322.46. Loan calculator: estimate your repayment. your loan estimate. monthly payment. $212.47. total principal $10,000. total interest payments $2,748.23. total loan payments $12,748.23. payoff date 09. Nearly all loan structures include interest, which is the profit that banks or lenders make on loans. interest rate is the percentage of a loan paid by borrowers to lenders. for most loans, interest is paid in addition to principal repayment. loan interest is usually expressed in apr, or annual percentage rate, which includes both interest and. The auto loan calculator lets you estimate monthly payments, see how much total interest you’ll pay and the loan amortization schedule. the calculator doesn’t account for costs such as taxes.

Total Interest On A Loan Youtube Nearly all loan structures include interest, which is the profit that banks or lenders make on loans. interest rate is the percentage of a loan paid by borrowers to lenders. for most loans, interest is paid in addition to principal repayment. loan interest is usually expressed in apr, or annual percentage rate, which includes both interest and. The auto loan calculator lets you estimate monthly payments, see how much total interest you’ll pay and the loan amortization schedule. the calculator doesn’t account for costs such as taxes. Step 1. enter the input data into the respective fields, including loan amount, loan term, estimated interest rate, and start date. note: in the loan terms field, click on or tap the drop down arrow, then select either the years or months option for your loan term. step 2. A personal loan calculator shows your monthly personal loan payments based on the loan amount, interest rate and repayment term. it also shows the total interest cost, with or without an.

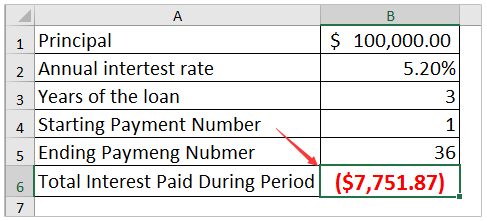

How To Calculate Total Interest Paid On A Loan In Excel Step 1. enter the input data into the respective fields, including loan amount, loan term, estimated interest rate, and start date. note: in the loan terms field, click on or tap the drop down arrow, then select either the years or months option for your loan term. step 2. A personal loan calculator shows your monthly personal loan payments based on the loan amount, interest rate and repayment term. it also shows the total interest cost, with or without an.

Comments are closed.