Financial Ratios How To Analyze Financial Statements

Financial Ratios How To Calculate And Analyze Pareto Labs Riset The numbers found on a company’s financial statements – balance sheet, income statement, and cash flow statement – are used to perform quantitative analysis and assess a company’s liquidity, leverage, growth, margins, profitability, rates of return, valuation, and more. financial ratios are grouped into the following categories. The income statement for financial ratio analysis. analyzing the liquidity ratios. the current ratio. the quick ratio. analyzing the asset management ratios accounts receivable. receivables turnover. average collection period. inventory, fixed assets, total assets. inventory turnover ratio.

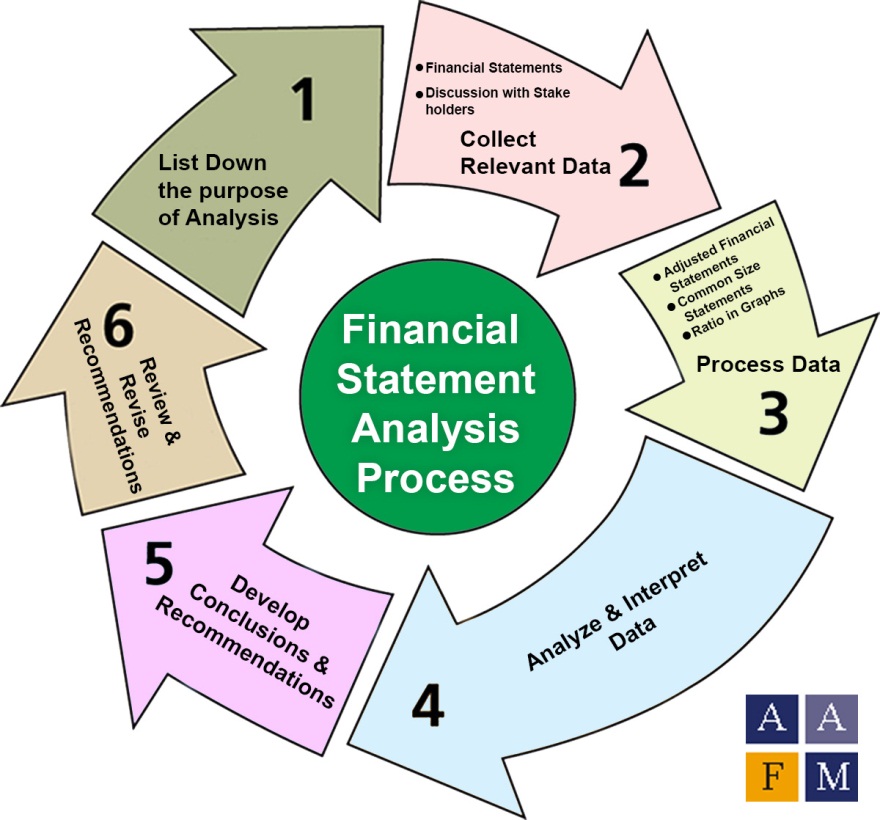

Financial Ratios How To Calculate And Analyze Pareto Labs Ratio analysis is a method of analyzing a company's liquidity, operational efficiency, and profitability by comparing line items on its financial statements. Financial statement analysis is the process of evaluating a company’s financial health and performance by reviewing its financial statements, including the income statement, balance sheet, and cash flow statement. this analysis involves using various metrics and methods to assess profitability, liquidity, solvency, and efficiency, helping. 💥financial ratios cheat sheets → accountingstuff shopin this short tutorial you'll learn how financial ratio analysis works. we'll break financi. These three financial ratios let you do a basic analysis of your balance sheet. 1. current ratio. the current ratio measures your liquidity —how easily your current assets can be converted to cash in order to cover your short term liabilities. the higher the ratio, the more liquid your assets.

What Is A Financial Ratio The Complete Beginner S Guide To Financial 💥financial ratios cheat sheets → accountingstuff shopin this short tutorial you'll learn how financial ratio analysis works. we'll break financi. These three financial ratios let you do a basic analysis of your balance sheet. 1. current ratio. the current ratio measures your liquidity —how easily your current assets can be converted to cash in order to cover your short term liabilities. the higher the ratio, the more liquid your assets. Financial statement analysis is used by internal and external stakeholders to evaluate business performance and value. financial accounting calls for all companies to create a balance sheet. Ratio analysis refers to the analysis of various pieces of financial information in the financial statements of a business. they are mainly used by external analysts to determine various aspects of a business, such as its profitability, liquidity, and solvency. analysts rely on current and past financial statements to obtain data to evaluate.

Financial Statement Analysis Fsa Ratios Process Tools Uses Users Financial statement analysis is used by internal and external stakeholders to evaluate business performance and value. financial accounting calls for all companies to create a balance sheet. Ratio analysis refers to the analysis of various pieces of financial information in the financial statements of a business. they are mainly used by external analysts to determine various aspects of a business, such as its profitability, liquidity, and solvency. analysts rely on current and past financial statements to obtain data to evaluate.

Comments are closed.