Fillable Online Dor Mo Public Service Company Property Tax Retur

Fillable Online Dor Mo Public Service Company Propertyо The missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid for the year. the credit is for a maximum of $750 for renters and $1,100 for owners who owned and occupied their home. the actual credit is based on the amount of real. What is a property tax credit (mo ptc)? certain individuals are eligible to claim up to $750 if they pay rent or $1,100 if they pay real estate tax on the home they own and occupy. if you rent from a facility that does not pay property taxes, you are not eligible for a property tax credit. note: a 2020 claim must be filed by may 17, 2024, or a.

Fillable Online Dor Mo Dor Mo Govformsmo 1040 Print Only2021form E file federal and state individual income tax return. the department has entered into an agreement with certain software providers to offer free online filing services to qualified missouri taxpayers. this agreement is called free file alliance. through this agreement, taxpayers can file their federal and missouri income tax returns using. Property tax credit claim am i eligible? use the diagram below to determine if you or your spouse are eligible to claim the property tax credit. please note, direct deposit of a property tax credit refund claim is not an option with this filing method. yes continue to file. no return home. More about the missouri form mo ptc tax credit. we last updated missouri form mo ptc in january 2024 from the missouri department of revenue. this form is for income earned in tax year 2023, with tax returns due in april 2024. we will update this page with a new version of the form for 2025 as soon as it is made available by the missouri. Taxation division attach to form mo ptc or mo pts and mail to the missouri department of revenue. form mo crp (revised 12 2023) ever served on active duty in the united states armed forces? if yes, visit dor.mo.gov military to see the services and benefits we offer to all eligible military individuals.

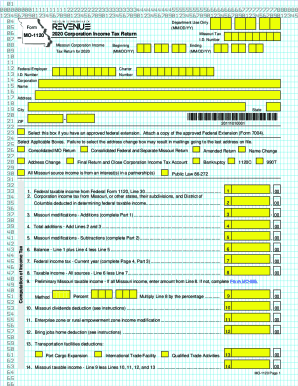

Fillable Online Dor Mo Form Mo 1120 2020 Corporqation Income Tax More about the missouri form mo ptc tax credit. we last updated missouri form mo ptc in january 2024 from the missouri department of revenue. this form is for income earned in tax year 2023, with tax returns due in april 2024. we will update this page with a new version of the form for 2025 as soon as it is made available by the missouri. Taxation division attach to form mo ptc or mo pts and mail to the missouri department of revenue. form mo crp (revised 12 2023) ever served on active duty in the united states armed forces? if yes, visit dor.mo.gov military to see the services and benefits we offer to all eligible military individuals. Government. local license renewal records and online access request [form 4379a] request for information or audit of local sales and use tax records [4379] request for information of state agency license no tax due online access [4379b]. The missouri department of revenue is the agency authorized with issuing and renewing driver’s licenses. their website is. information 24 7 (interactive voice response system) (573) 526 2407. driver license (general information) (573) 751 4600. administrative alcohol (dwi) suspensions, hearings (573) 526 2407.

Comments are closed.