Figure 03 6 Eps

Eea Page Url Qr Agriculture and food system air pollution bathing water quality biodiversity: state of habitats and species buildings and construction chemicals circular economy climate change impacts, risks and adaptation climate change mitigation: reducing emissions electric vehicles. Figure 03 6.eps. file. analysis and data. maps and charts. water exploitation index (wei) in the late 1990s. figure 03 6.eps. figure 03 6.eps. about us. faqs careers.

Figure 03 6 Eps Earnings per share definition. eps is a profitability indicator and it’s just one of several ratios that can be used to gauge a company’s financial health. to find eps, you would simply divide a company’s reported net income after tax minus its preferred stock dividends by its outstanding shares of stock. the eps ratio uses net profits. To calculate earnings per share, simply use this eps formula: eps = (net income – dividends on preferred stock) average outstanding common shares. where: net income – total earnings (profit) of the company, calculated as the costs subtracted from the total revenue. dividends on preferred stock – preferred stock is a class of assets that. You can use this earnings per share (eps) calculator to calculate the earnings per share based on the total net income, preferred dividends paid and the number of outstanding common shares. follow the next steps to determine the earnings per share: first, choose the currency you wish to use (optional) next, enter the total net income. Eps = (net income available to shareholders) (weighted average number of shares outstanding) amount of the company’s earnings attributable to each common shareholder in a hypothetical scenario in which all dilutive securities are converted to common shares. basic eps is always larger than diluted eps. diluted eps is always smaller than.

Figure 03 6 France Ok Eps You can use this earnings per share (eps) calculator to calculate the earnings per share based on the total net income, preferred dividends paid and the number of outstanding common shares. follow the next steps to determine the earnings per share: first, choose the currency you wish to use (optional) next, enter the total net income. Eps = (net income available to shareholders) (weighted average number of shares outstanding) amount of the company’s earnings attributable to each common shareholder in a hypothetical scenario in which all dilutive securities are converted to common shares. basic eps is always larger than diluted eps. diluted eps is always smaller than. Key takeaways. earnings per share is the portion of a company's income available to shareholders and allocated to each outstanding share of common stock. eps equals the difference between net. Diluted earnings per share (eps) = $250mm net earnings ÷ $251mm fully diluted common shares; diluted eps = $1.00; 3. diluted eps ratio analysis example. our diluted eps of $1.25 compares to the basic eps of $1.00 – with a net differential of $0.25 – due to the incorporation of the dilutive impact of options, warrants, mezzanine instruments.

Data Figure 03 Vector Vectors Graphic Art Designs In Editable Ai Eps Key takeaways. earnings per share is the portion of a company's income available to shareholders and allocated to each outstanding share of common stock. eps equals the difference between net. Diluted earnings per share (eps) = $250mm net earnings ÷ $251mm fully diluted common shares; diluted eps = $1.00; 3. diluted eps ratio analysis example. our diluted eps of $1.25 compares to the basic eps of $1.00 – with a net differential of $0.25 – due to the incorporation of the dilutive impact of options, warrants, mezzanine instruments.

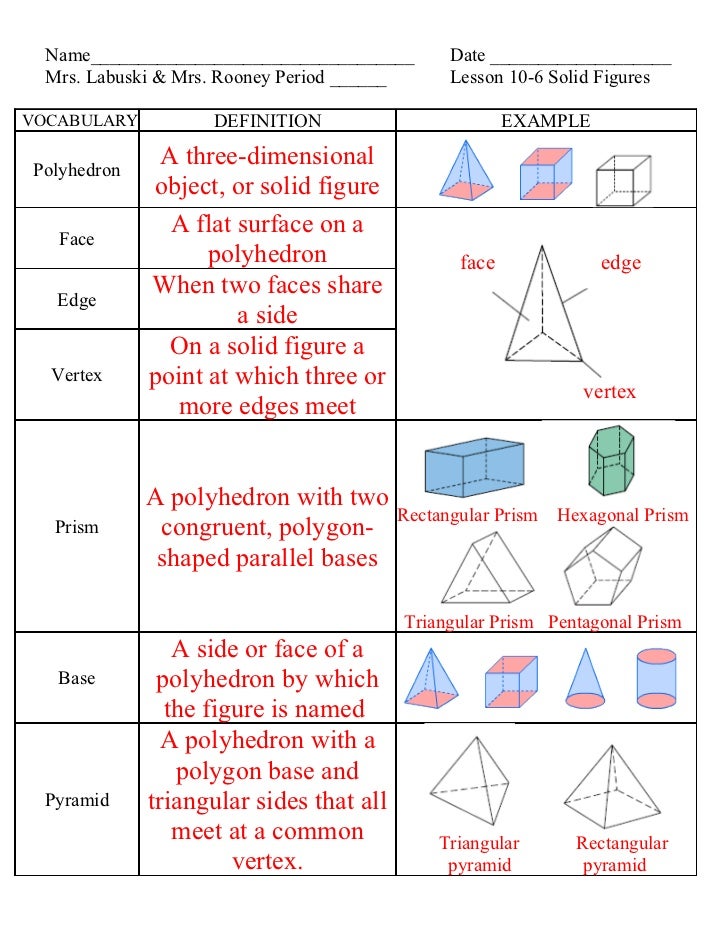

Lesson 10 6 Solid Figures

Comments are closed.