Fed Rate Cuts 2024 Moll Teresa

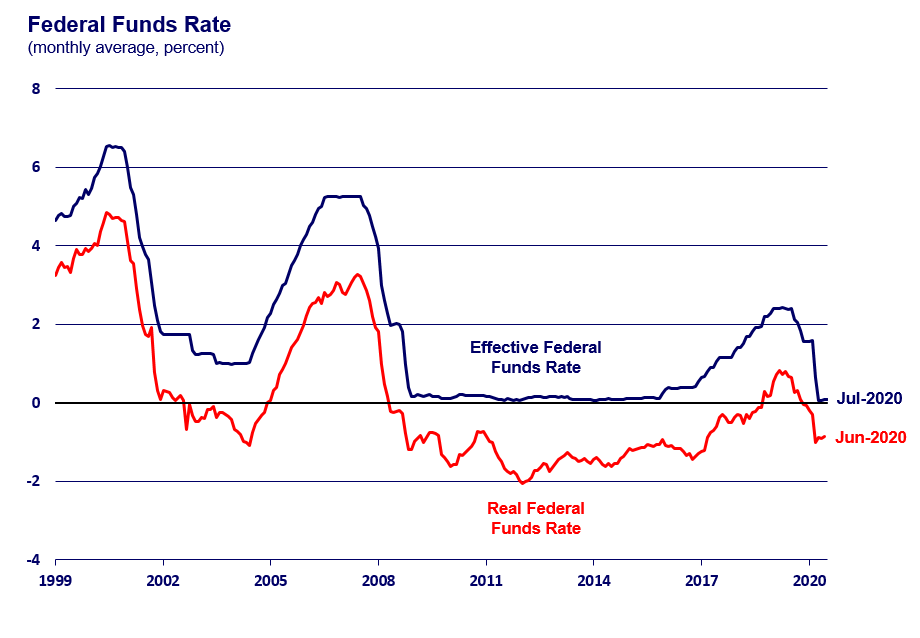

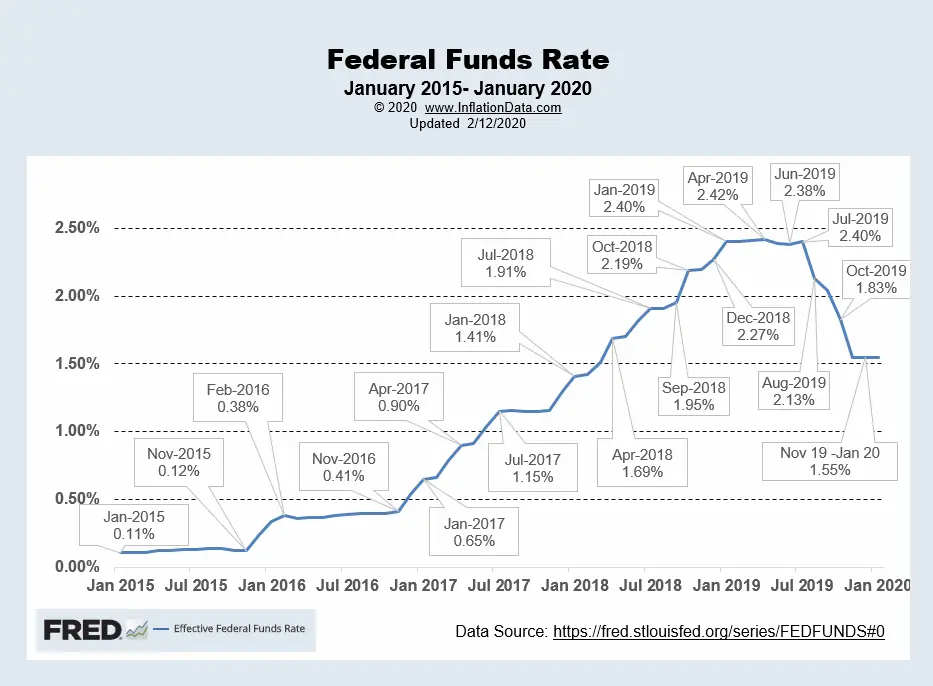

Fed Rate Cuts 2024 Moll Teresa The message from the fed’s projected dot plot is that while the fed will remain data dependent, the path of the fed funds rate will be fairly profound over the rest of 2024, 2025 and 2026 – taking the federal funds rate midpoint from the 5.38% prior to today’s meeting to 2.9% at the end of 2026. Financial experts expect that the federal reserve will cut the federal funds rate in september, the first rate cut of 2024. the impact of the fed rate on mortgage rates may not be immediate, as.

Us Fed Rate Cut 2024 Calendar Moll Teresa The federal reserve will lower interest rates by 25 basis points at each of the u.s. central bank's three remaining policy meetings in 2024, according to a majority of economists in a reuters poll. Home loan rates have already started to come down in recent weeks, slightly induced in part by favorable economic data and indications the fed could cut rates. as of thursday, sept. 12, the. Dec. 13, 2023, 3:04 p.m. et. ben casselman. the projections that the fed released at 2 p.m. were surprisingly “dovish” with their projection of three rate cuts in 2024. the question coming. Updated 2:51 pm pdt, march 20, 2024. washington (ap) — federal reserve officials signaled wednesday that they still expect to cut their key interest rate three times in 2024, fueling a rally on wall street, despite signs that inflation remained elevated at the start of the year. for now, the officials kept their benchmark rate unchanged for a.

Fed Rate Cuts 2024 Moll Teresa Dec. 13, 2023, 3:04 p.m. et. ben casselman. the projections that the fed released at 2 p.m. were surprisingly “dovish” with their projection of three rate cuts in 2024. the question coming. Updated 2:51 pm pdt, march 20, 2024. washington (ap) — federal reserve officials signaled wednesday that they still expect to cut their key interest rate three times in 2024, fueling a rally on wall street, despite signs that inflation remained elevated at the start of the year. for now, the officials kept their benchmark rate unchanged for a. Rate cuts would signal a new stage in the fed’s inflation fight. fed officials had lifted rates rapidly from march 2022 to mid 2023 in a bid to hit the brakes on the economy. but they stopped. For example, she believes if the fed cuts rates by 0.25%, mortgage rates would likely drop by at least 0.25%. predicting how mortgage rates would respond isn't a perfect science, though, experts say.

Comments are closed.