Fair And Accurate Credit Transactions Act Of 2003 Ppt

Fair And Accurate Credit Transactions Act Of 2003 Ppt The document summarizes the fair and accurate credit transactions act of 2003 (fact act) red flag provisions, which require financial institutions and creditors to develop and implement an identity theft prevention program. Links. this act, amending the fair credit reporting act (fcra), adds provisions designed to improve the accuracy of consumers' credit related records. it gives consumers the right to one free credit report a year from the credit reporting agencies, and consumers may also purchase, for a reasonable fee, a credit score along with information.

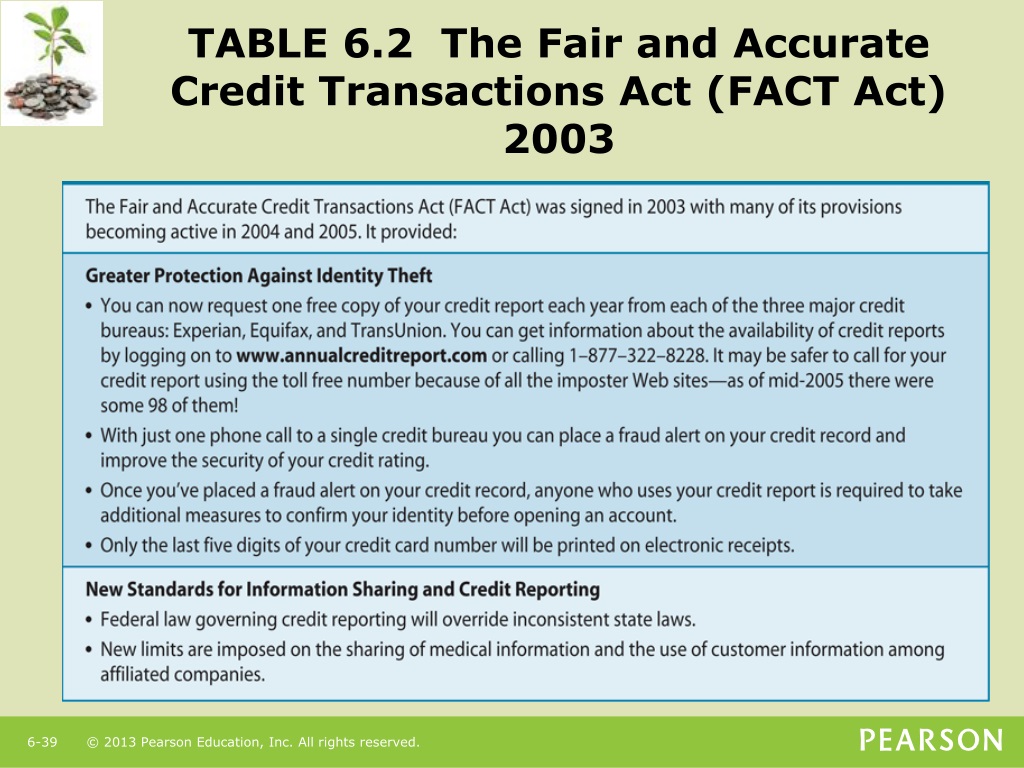

Ppt Chapter 6 Powerpoint Presentation Free Download Id 1520675 Public law 108–159 108th congress an act. to amend the fair credit reporting act, to prevent identity theft, improve resolution of consumer disputes, improve the accuracy of consumer records, make improve ments in the use of, and consumer access to, credit information, and for other purposes. fair and accurate credit transactions act of 2003. The fair and accurate credit transactions act (facta), also known as the fact act, is a federal law enacted by the u.s. congress in 2003 to amend the fair credit reporting act passed in 1970. its. The fair and accurate credit transactions act of 2003 (fact act or facta, pub. l. 108–159 (text) (pdf)) is a u.s. federal law, passed by the united states congress on november 22, 2003, [1] and signed by president george w. bush on december 4, 2003, [2] as an amendment to the fair credit reporting act. the act allows consumers to request and. Shown here: public law no: 108 159 (12 04 2003) fair and accurate credit transactions act of 2003 (sec. 3) requires the board of governors of the federal reserve system (board) and the federal trade commission (ftc) to jointly prescribe final regulations that establish effective dates for this act before the end of the two month period beginning on the date of the enactment of this act.

Comments are closed.