Factors That Influence Your Credit Score Finlocker

Factors That Influence Your Credit Score Finlocker Your credit score is determined by several factors, including p ayment history, the amount of credit you are using, length of your credit history, new credit accounts, and the types of credit you have open. understanding the factors that affect your credit score will help you plan the most effective way to build and maintain your credit score. Your credit score is a number that ranges between 850 and 300, with a score of 850 reflecting perfect credit. lower scores equal greater risk to the lender loaning the money. each lender is responsible for determining risk and a low credit score can have an impact on your ability to qualify for a loan. most credit programs have a minimum credit.

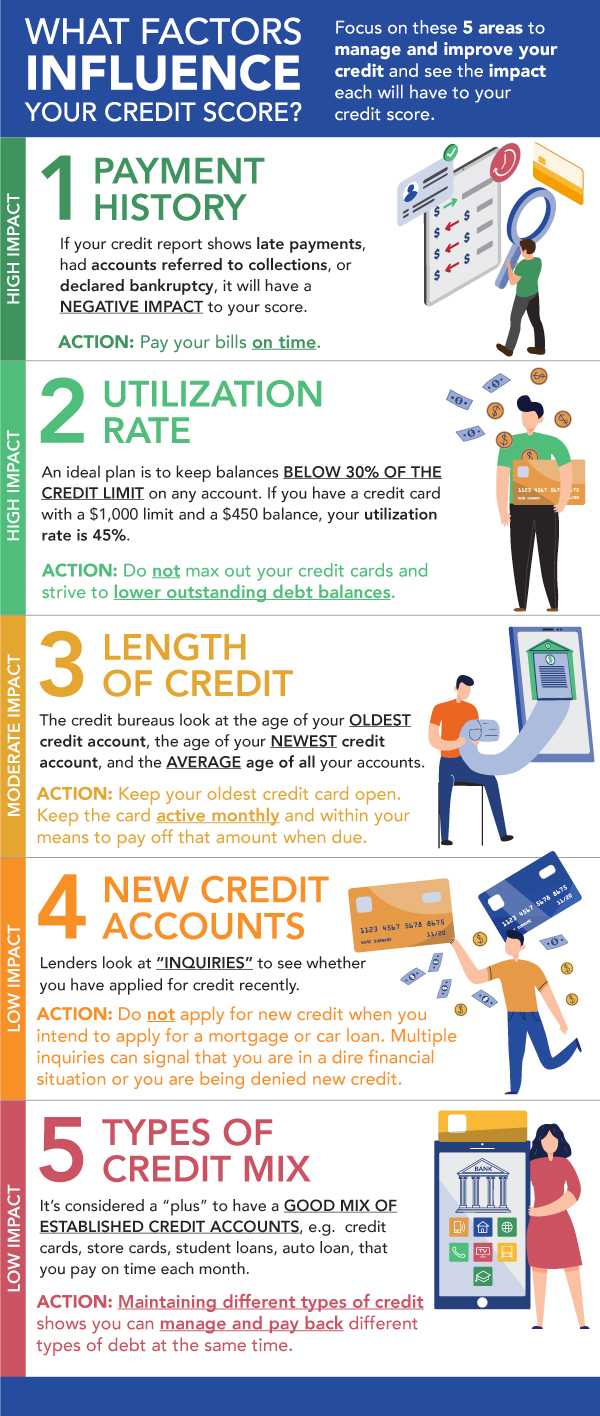

What Is The Average Credit Score 5. build your credit score by knowing the impact of the factors that influence your credit score. click here to obtain actions you can take to improve each factor. 6. automate your savings by setting up automatic transfers to separate savings accounts. many employer payroll systems allow you to deposit a portion of your paycheck into a. The factors that affect credit scores most. the two major scoring companies in the u.s., fico and vantagescore, differ a bit in their approaches, but they agree on the two factors that are most. Credit can be a confusing concept. but if you want to understand your credit scores, you can start by focusing on high impact factors like your credit card utilization, payment history and any derogatory marks on your reports. editorial note: intuit credit karma receives compensation from third party advertisers, but that doesn’t affect our. Payment history – 40%. lenders want to know you’re good about paying back your loans on time. so, naturally your payment history is an important credit score factor. consistently making on time payments for your accounts can help you build and maintain a healthy credit history. alternatively, missing payments can have a significant.

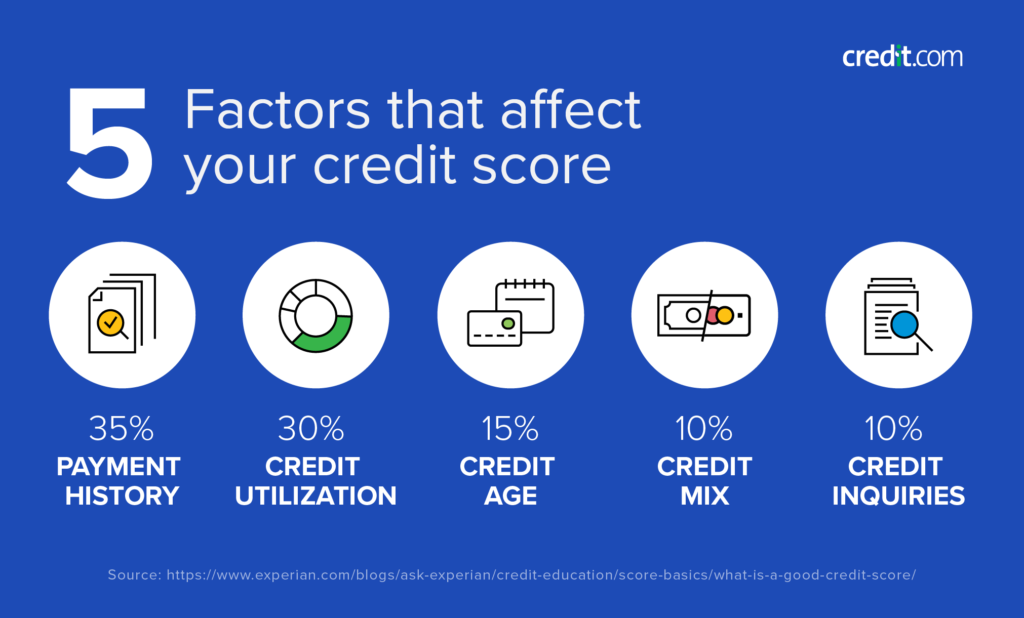

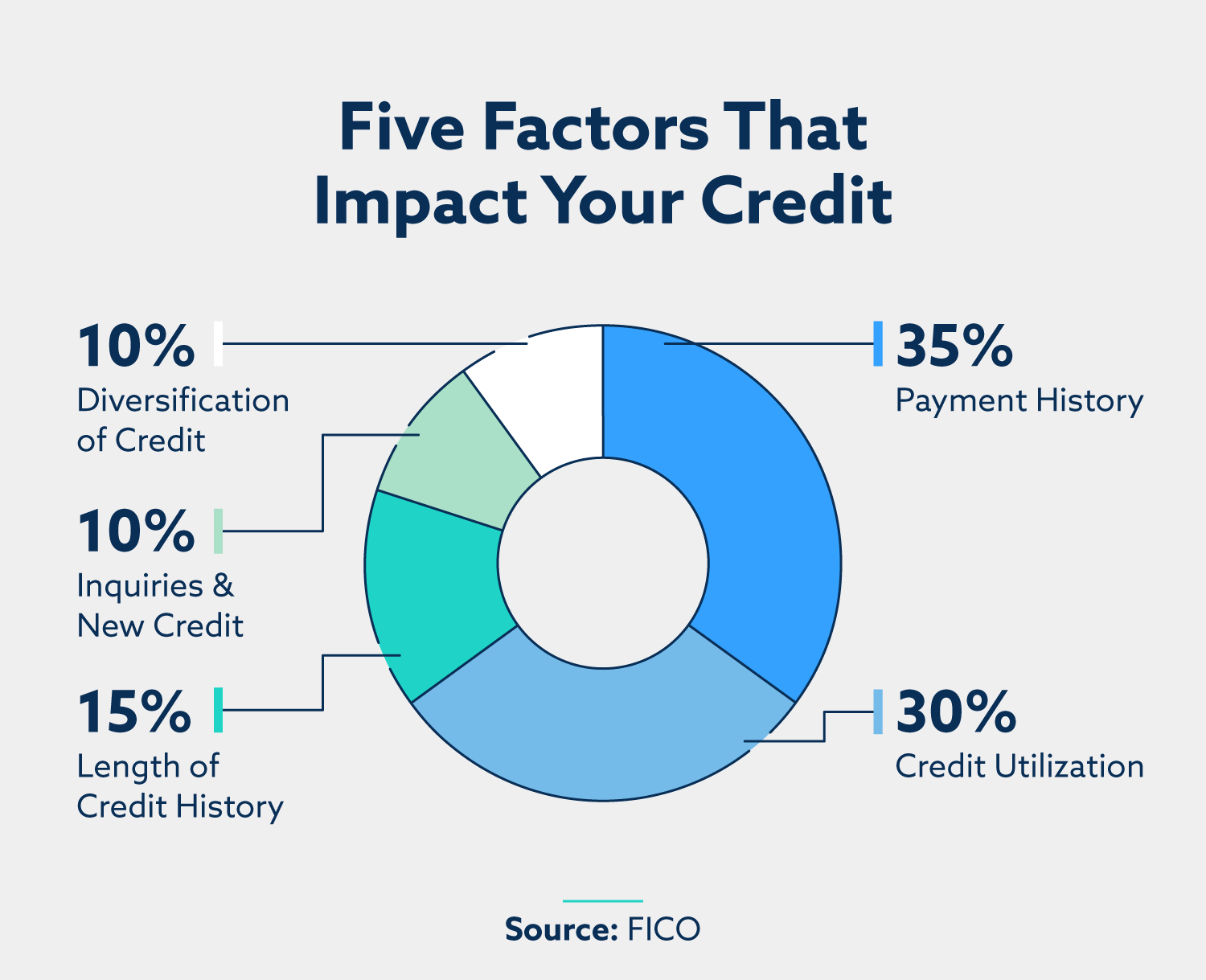

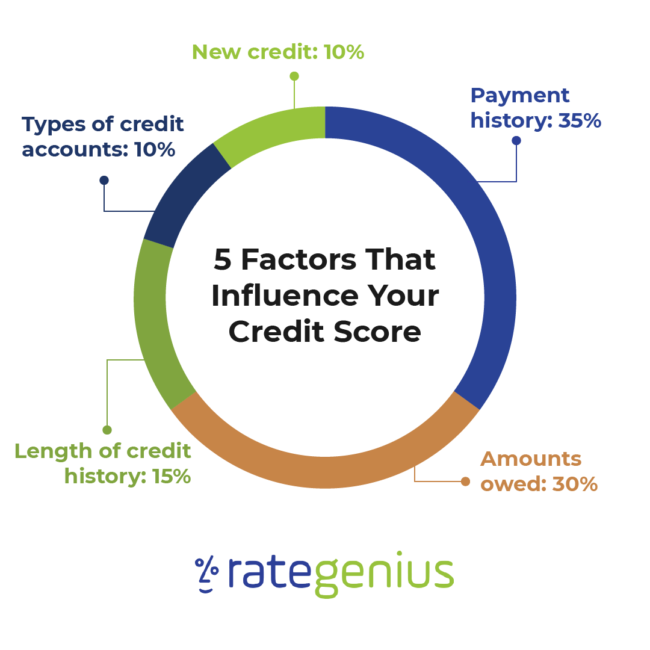

15 Credit Facts Everyone Needs To Know In 2021 Lexington Law Credit can be a confusing concept. but if you want to understand your credit scores, you can start by focusing on high impact factors like your credit card utilization, payment history and any derogatory marks on your reports. editorial note: intuit credit karma receives compensation from third party advertisers, but that doesn’t affect our. Payment history – 40%. lenders want to know you’re good about paying back your loans on time. so, naturally your payment history is an important credit score factor. consistently making on time payments for your accounts can help you build and maintain a healthy credit history. alternatively, missing payments can have a significant. 3. somewhat important: length of credit history. a variety of factors related to the length of your credit history can affect your credit, including the following: the age of your oldest account. the age of your newest account. the average age of your accounts. whether you’ve used an account recently. Fico scores are calculated using many different pieces of credit data in your credit report. this data is grouped into five categories: payment history (35%), amounts owed (30%), length of credit history (15%), new credit (10%) and credit mix (10%). your fico scores consider both positive and negative information in your credit report.

Your Comprehensive Guide To Understanding Credit Scores Rategenius 3. somewhat important: length of credit history. a variety of factors related to the length of your credit history can affect your credit, including the following: the age of your oldest account. the age of your newest account. the average age of your accounts. whether you’ve used an account recently. Fico scores are calculated using many different pieces of credit data in your credit report. this data is grouped into five categories: payment history (35%), amounts owed (30%), length of credit history (15%), new credit (10%) and credit mix (10%). your fico scores consider both positive and negative information in your credit report.

Comments are closed.