Extensions Of Var Cfa Frm And Actuarial Exams Study Notes

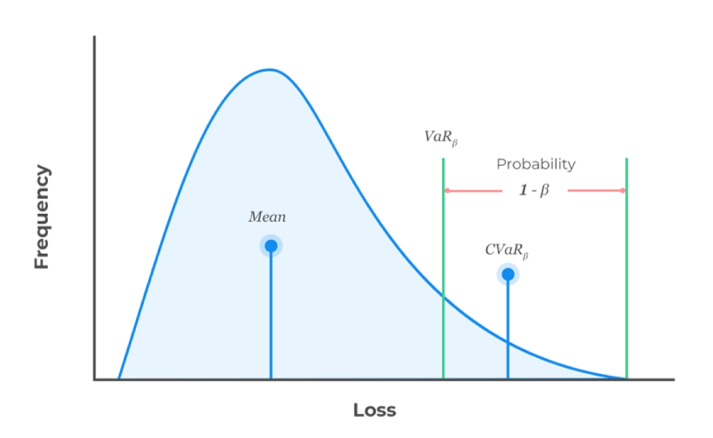

Extensions Of Var Cfa Frm And Actuarial Exams Study Notes Cvar is a tail risk metric that quantifies the amount of the expected losses beyond the var cutoff point at a specific confidence level. it is also known as the expected shortfall (es), average value at risk (avar), or expected tail loss (etl). cvar is a weighted average of the losses in the tail of the return’s distribution beyond the var level. © 2014 2023 analystprep. 4 6. human agency and conflicts of interest 7. typology of risks and risk interactions 8. risk aggregation 9. balancing risk and reward.

Extensions Of Var Cfa Frm And Actuarial Exams Study Notes Notes. this repository contains the notes i created when preparing frm & cfa. they were originally written using microsoft word in mac. a lot of latex math formulae were used extensively, which unfortunately cannot be correctly recognized in windows. hence, their pdf versions are shared here. Examens d’actuariat. partenariats. cfa® niveau 1. cfa® niveau 2. cfa® niveau 3. frm partie 1. frm partie 2. register today to get free access to our cfa level 1 question bank. analystprep also features qbanks and study notes for cfa level 2&3 and frm part 1&2. Since the skills sets for the cfa and frm complement each other very well, many cfa holders are also frms. for many finance professionals, it is not a case of frm vs cfa, but instead frm and cfa! demonstrating your competencies in financial risk via the frm designation is a win win for cfa charterholders, especially given the prominent role. Cfa institute does not endorse, promote or warrant the accuracy or quality of analystprep. cfa® and chartered financial analyst® are registered trademarks owned by cfa institute.

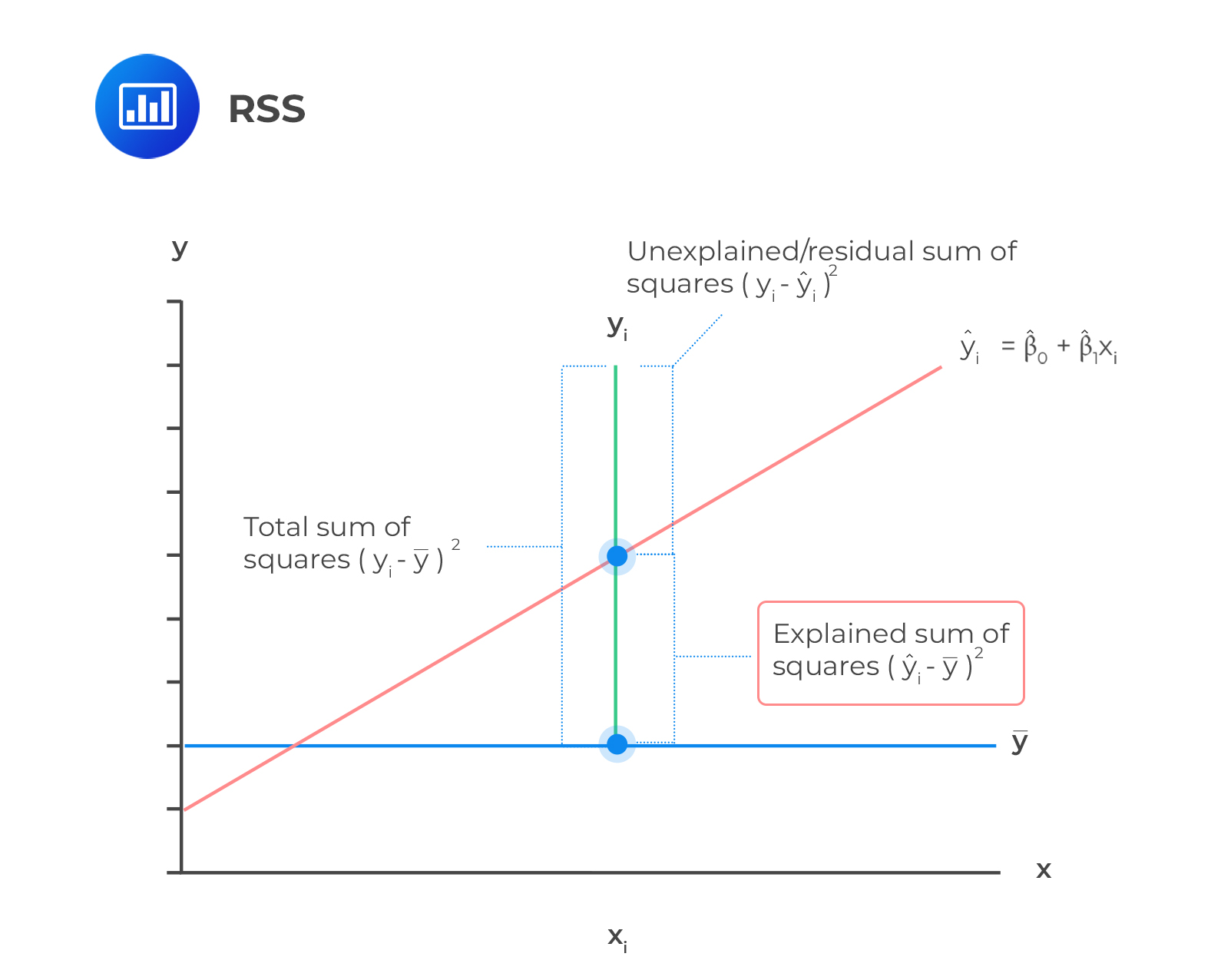

Analysis Of Variance Cfa Frm And Actuarial Exams Study Notes My Since the skills sets for the cfa and frm complement each other very well, many cfa holders are also frms. for many finance professionals, it is not a case of frm vs cfa, but instead frm and cfa! demonstrating your competencies in financial risk via the frm designation is a win win for cfa charterholders, especially given the prominent role. Cfa institute does not endorse, promote or warrant the accuracy or quality of analystprep. cfa® and chartered financial analyst® are registered trademarks owned by cfa institute. Cfa vs frm salary. but to be constructive, let’s compare a “typical” cfa charterholder and frm certified manager’s salary. on average, a cfa charterholder in portfolio management makes us$126,000 base salary, with a total compensation of us$177,000. a financial risk manager’s average salary is us$102,000, with a total compensation of. 01 aug 2021. value at risk (var) measures the probability of underperformance by providing a statistical measure of downside risk. in the case of a continuous random variable, var can be computed as follows: v ar(x) = −t where p (x <t) = p v a r (x) = − t where p (x <t) = p. var represents the maximum possible loss on a portfolio over a.

Comments are closed.