Everything You Need To Know About Sales And Use Tax In Maryland

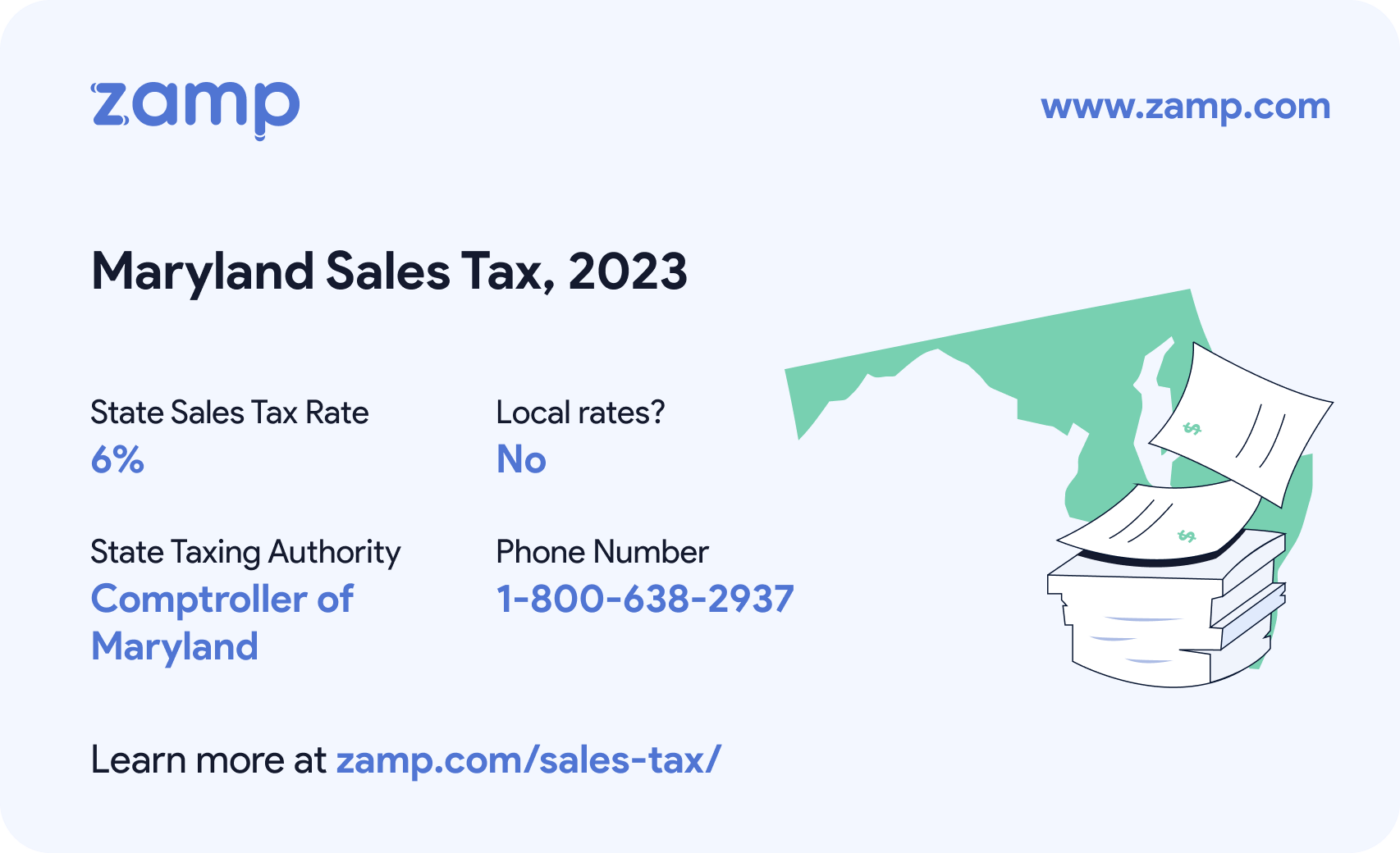

Everything You Need To Know About Sales And Use Tax In Maryland Every time you purchase taxable tangible goods, whether in person, over the phone, or on the internet, the purchase is subject to maryland's 6 percent sales and use tax if you use the merchandise in maryland. if you make a tax free purchase out of state and need to pay maryland's 6 percent use tax, you should file the consumer use tax return. You can file your sales and use tax returns . if you would like to continue receiving paper coupons you can request them by e mailing comptroller of maryland revenue administration division p.o. box 1829 annapolis, md, 21404. effective january 3, 2008, the maryland sales and use tax rate is 6 percent, as follows: sales and use tax alert.

Ultimate Maryland Sales Tax Guide вђ Zamp Filing late should be avoided, especially in maryland, because two penalties can occur. the first is a 10% penalty added to the taxes due, and the second is an interest penalty of 1.08% per month. filing early or on time is best practice – and also earns you a discount on your sales tax due. and there you have it!. For use tax, you have a few other requirements to know. if you make an applicable purchase outside the state and need to pay the use tax, you need to file a consumer use tax return with payment by the applicable deadline. failing to do so could lead to penalties. this form and payment should be sent to this address: revenue administration division. Sales tax 101. sales tax is a tax paid to a governing body (state or local) on the sale of certain goods and services. maryland first adopted a general state sales tax in 1947, and since that time, the rate has risen to 6 percent. in many states, localities are able to impose local sales taxes on top of the state sales tax. This is true whether you purchase these goods in person, online, or over the phone. here, the use tax rate is the same as the maryland sales tax rate: 6% for regular sales of tangible goods and 9% for alcoholic beverages (with some variance for specific items). 2.

Guide To Maryland Sales Use Tax Compliance And Penalties Sales tax 101. sales tax is a tax paid to a governing body (state or local) on the sale of certain goods and services. maryland first adopted a general state sales tax in 1947, and since that time, the rate has risen to 6 percent. in many states, localities are able to impose local sales taxes on top of the state sales tax. This is true whether you purchase these goods in person, online, or over the phone. here, the use tax rate is the same as the maryland sales tax rate: 6% for regular sales of tangible goods and 9% for alcoholic beverages (with some variance for specific items). 2. Step 7: going forward, apply the 6% maryland sales tax rate to taxable goods services and file periodic returns even for no taxes collected. the pay balance is due upon filing to remain compliant. step 8: contact the comptroller's helpline at 410 260 7980 if you need assistance with the online registration system. Maryland has a statewide sales tax rate of 6%, which has been in place since 1947. municipal governments in maryland are also allowed to collect a local option sales tax that ranges from 0% to 0% across the state, with an average local tax of n a (for a total of 6% when combined with the state sales tax). the maximum local tax rate allowed by.

Maryland Sales Tax Guide Step 7: going forward, apply the 6% maryland sales tax rate to taxable goods services and file periodic returns even for no taxes collected. the pay balance is due upon filing to remain compliant. step 8: contact the comptroller's helpline at 410 260 7980 if you need assistance with the online registration system. Maryland has a statewide sales tax rate of 6%, which has been in place since 1947. municipal governments in maryland are also allowed to collect a local option sales tax that ranges from 0% to 0% across the state, with an average local tax of n a (for a total of 6% when combined with the state sales tax). the maximum local tax rate allowed by.

Comments are closed.