Evaluating Venture Capital Performance By Bill Janeway Start Up

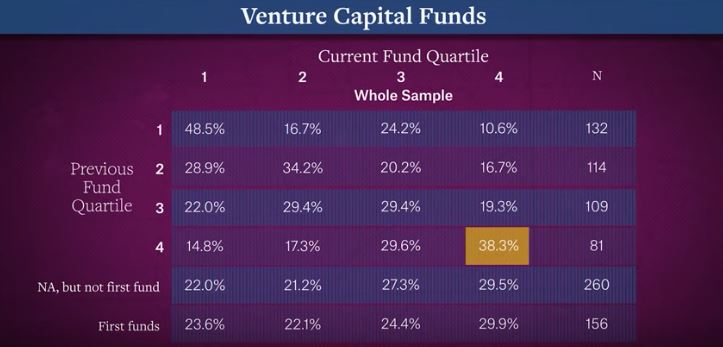

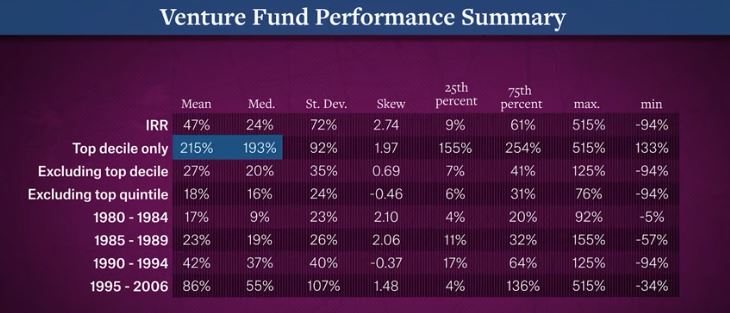

Evaluating Venture Capital Performance By Bill Janeway Start Up Janeway reviews the performance of venture capital firms and recent changes in the venture capital market. he starts by summarizing the stylized facts of venture capital returns (highly skewed, very persistent, and correlated with the stock market). vc capital increased rapidly in the late 1990s, peaking in 2000. State of the us vc industry. “the us venture capital (vc) industry ended the decade on a high note in 2019. for the second consecutive year, high growth startups raised more than $130 billion, and 2019 represented the second year on record (after 2015) where more than 10,000 venture backed companies received an investment.

Evaluating Venture Capital Performance By Bill Janeway Start Up Authors’ contact details are: [email protected], [email protected] and [email protected]. 1. introduction. venture capital is associated with some of the most innovative and high growth companies in the economy. scores of startups commercializing transformational technologies have been backed by venture capital. Janeway reviews the performance of venture capital firms and recent changes in the venture capital market. he starts by summarizing the stylized facts of venture capital returns (highly skewed, very persistent, and correlated with the stock market). vc capital increased rapidly in the late 1990s, peaking in 2000. Janeway reviews the performance of venture capital firms and recent changes in the venture capital market. he starts by summarizing the stylized facts of venture capital returns (highly skewed, very persistent, and correlated with the stock market). vc capital increased rapidly in the late 1990s, peaking in 2000. In the second lecture of inet's “venture capital in the 21st century” series, prof. bill janeway explores the relationship between entrepreneurial firms and venture capital. in providing start up financing, venture capital investment may earn high payoffs if a new technology succeeds, but also risks large losses if it does not. prof.

Evaluating Venture Capital Performance By Bill Janeway Start Up Janeway reviews the performance of venture capital firms and recent changes in the venture capital market. he starts by summarizing the stylized facts of venture capital returns (highly skewed, very persistent, and correlated with the stock market). vc capital increased rapidly in the late 1990s, peaking in 2000. In the second lecture of inet's “venture capital in the 21st century” series, prof. bill janeway explores the relationship between entrepreneurial firms and venture capital. in providing start up financing, venture capital investment may earn high payoffs if a new technology succeeds, but also risks large losses if it does not. prof. Credits: matthew kulvicki, nick alpha, gonçalo fonseca, athullya roytman, kurt semm. in this eight part series, bill janeway investigates the relationship between venture capital and technological innovation, and the interdependent roles of entrepreneurial firms, the mission driven state and financial speculation in the overall innovation system. 11. we review the growing literature on the relationship between venture capital (vc) booms and start up financing, focusing on three broad areas. first, we discuss the drivers of large inflows into the vc asset class, particularly in recent years, which are related to but also distinct from macroeconomic business cycles and stock market.

Comments are closed.