Evaluating Venture Capital Performance 3 Venture Capital In The 21st Century

Evaluating Venture Capital Performance 3 Venture Capital I Janeway reviews the performance of venture capital firms and recent changes in the venture capital market. he starts by summarizing the stylized facts of ven. Lecture 1 investing at the technological frontier. in this first lecture in the institute for new economic thinking’s series “venture capital in the 21st century”, prof. bill janeway explains how economic growth and development can be conceived as an evolutionary process, punctuated and driven by technological innovations.

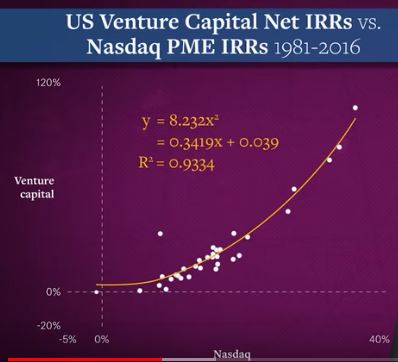

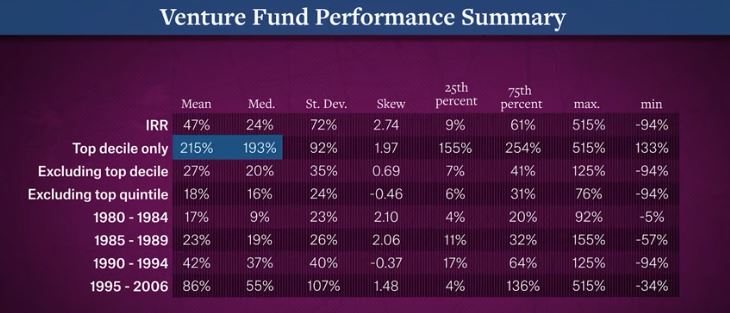

Evaluating Venture Capital Performance By Bill Janeway Start Up State of the us vc industry. “the us venture capital (vc) industry ended the decade on a high note in 2019. for the second consecutive year, high growth startups raised more than $130 billion, and 2019 represented the second year on record (after 2015) where more than 10,000 venture backed companies received an investment. His recent contribution was mentioned by many including nicolas colin and on a personal note, friends from imf. they just mentioned to me 8 videos which seem absolutely brilliant: venture capital in the 21st century. i just watched the third: evaluating venture capital performance | #3 | innovation in the 21st century. here are the slides. He starts by summarizing the stylized facts of venture capital returns (highly skewed, very persistent, and correlated with the stock market). vc capital increased rapidly in the late 1990s, peaking in 2000. vc returns have since settled down, with longer holdings and fewer ipos. but with the climate of zero real interest rates since 2008, new. Chasing the next unicorn? you might want to watch this first. janeway reviews the performance of venture capital firms and recent changes in the venture.

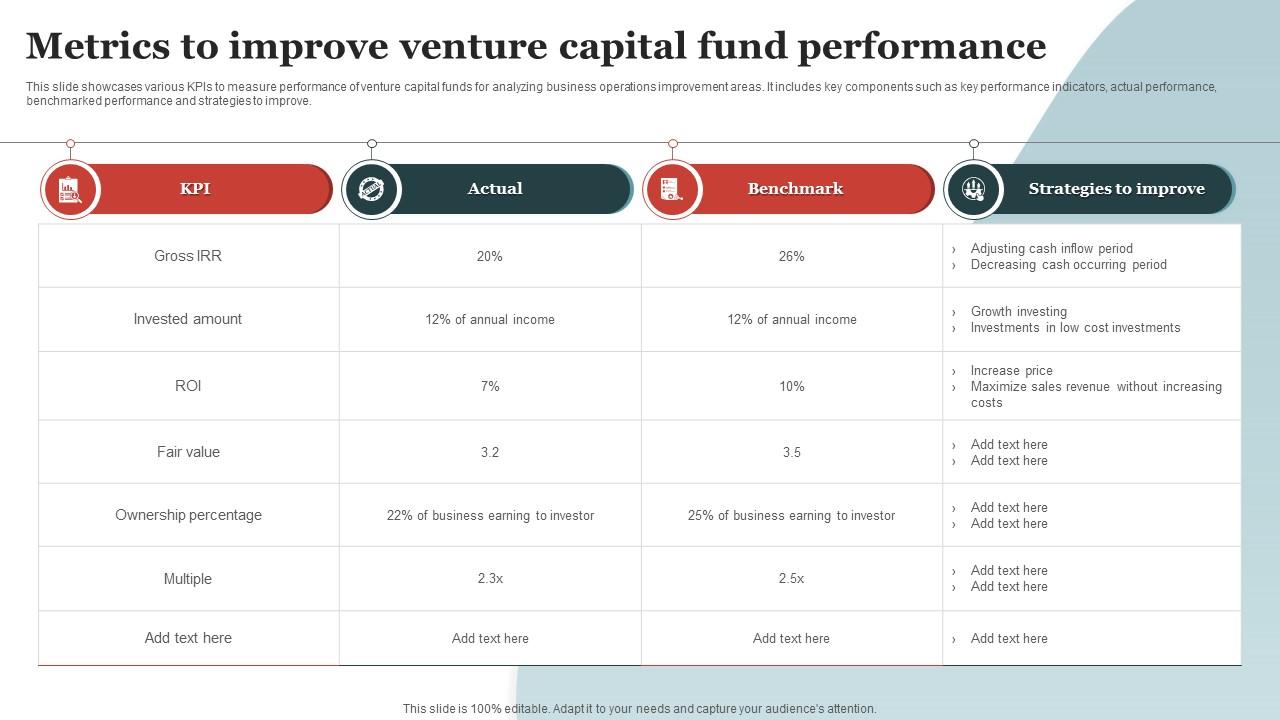

Evaluating Venture Capital Performance By Bill Janeway Start Up He starts by summarizing the stylized facts of venture capital returns (highly skewed, very persistent, and correlated with the stock market). vc capital increased rapidly in the late 1990s, peaking in 2000. vc returns have since settled down, with longer holdings and fewer ipos. but with the climate of zero real interest rates since 2008, new. Chasing the next unicorn? you might want to watch this first. janeway reviews the performance of venture capital firms and recent changes in the venture. Here are 14 critical venture capital metrics that every investor should focus on: 1. internal rate of return (irr) irr measures the annualized rate of return on an investment. it helps determine the profitability of a venture capital investment by considering the timing and amount of cash flows. 2. 9 venture capital metrics every vc should know [explained] venture capitalists use a variety of metrics to measure the potential success of a startup. in this article, we explain how vc metrics are calculated, used, and read for more profitable investment decisions. venture capital funds finance high growth potential companies, and to do so.

Metrics To Improve Venture Capital Fund Performance Here are 14 critical venture capital metrics that every investor should focus on: 1. internal rate of return (irr) irr measures the annualized rate of return on an investment. it helps determine the profitability of a venture capital investment by considering the timing and amount of cash flows. 2. 9 venture capital metrics every vc should know [explained] venture capitalists use a variety of metrics to measure the potential success of a startup. in this article, we explain how vc metrics are calculated, used, and read for more profitable investment decisions. venture capital funds finance high growth potential companies, and to do so.

How Venture Capital Can Identify And Evaluate Promising Web3 Projects

Comments are closed.