Etf Vs Index Fund вђ The Hell Yeah Group

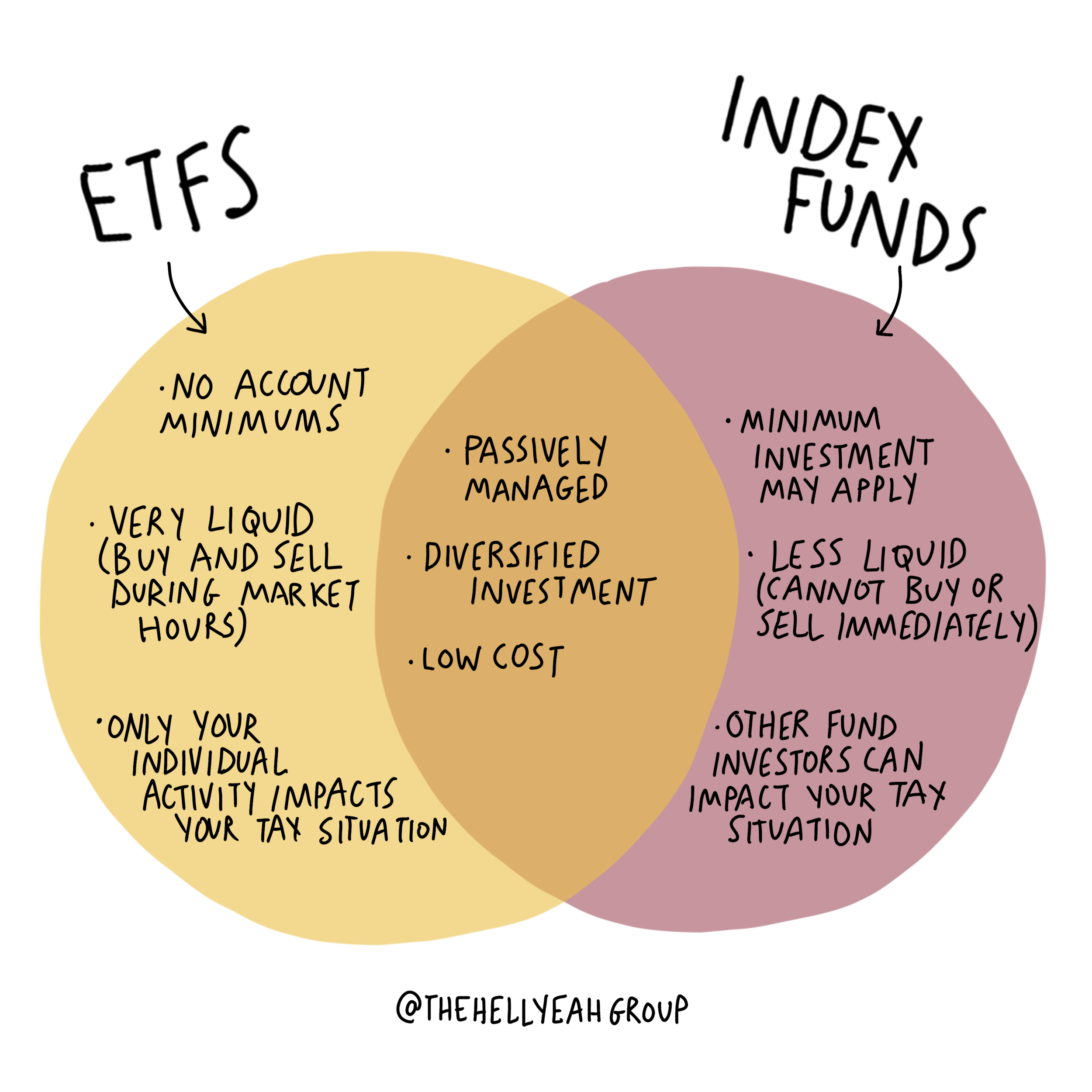

Etf Vs Index Fund вђ The Hell Yeah Group Taxes: etf vs index fund. when you decide you're ready to cash out on an etf, the process is simple. you sell your shares on the open market just as you would individual shares of stock. of course, you'll have to pay capital gains taxes on any profit you make, but the taxation ends there. index fund taxation is a little more complicated. 1. fees and expenses. the primary difference between etfs and index funds is how they're bought and sold. etfs trade on an exchange just like stocks, and you buy or sell them through a broker.

Etf Vs Index Fund вђ The Hell Yeah Group Often you can buy a single share, or even a fraction of one. more tax efficient. etfs are slightly more tax efficient than index funds. if you’re investing a substantial amount of money, then an. The investment company institute ® found index mutual funds' expense ratios were 0.05% per year on average in 2023, a rate that's been declining for years. 1 index equity etfs' asset weighted average expense ratio for 2023 was higher, at 0.15%. 2 but there are multiple s&p 500 ® etfs that charge 0.03% per year. 3 be sure to check expense ratios before investing because the less you pay in. Actively managed equity mutual funds charged an average of around 0.74%. equity index funds charged an average expense ratio of 0.07%. equity index etfs charged an average expense ratio of 0.18%. Index fund vs. etf. the biggest difference between etfs and index funds is that etfs can be traded throughout the day like stocks, whereas index funds can be bought and sold only for the price set.

Index Funds Vs Etfs What Is The Difference And Which Is Better Actively managed equity mutual funds charged an average of around 0.74%. equity index funds charged an average expense ratio of 0.07%. equity index etfs charged an average expense ratio of 0.18%. Index fund vs. etf. the biggest difference between etfs and index funds is that etfs can be traded throughout the day like stocks, whereas index funds can be bought and sold only for the price set. The ongoing management fee, or mer, for index mutual funds, can be considerably more expensive than a similar portfolio of index etfs. think of it this way: a $100,000 portfolio of index funds may. In 2022, the average expense ratio for index equity mutual funds was 0.05 percent, according to the investment company institute’s latest report. for equity etfs, it was 0.16 percent. on the.

Etf Vs Index Funds Learn The 6 Best Differences With Infographics The ongoing management fee, or mer, for index mutual funds, can be considerably more expensive than a similar portfolio of index etfs. think of it this way: a $100,000 portfolio of index funds may. In 2022, the average expense ratio for index equity mutual funds was 0.05 percent, according to the investment company institute’s latest report. for equity etfs, it was 0.16 percent. on the.

Comments are closed.