Etf 107 Passive Vs Active Etfs Explained Vaneck

Etf 107 Passive Vs Active Etfs Explained Vaneck Mexico Hello! This is MarketWatch reporter Isabel Wang, bringing you this week’s ETF Wrap In this week’s edition, we look at actively managed bond ETFs and what has been driving investor interest in On or around June 1, 2023, the iShares MSCI Frontier & Select EM ETF (FM low cost index-based ETFs for the long-term buy-and-hold core of most portfolios, I do think active makes sense

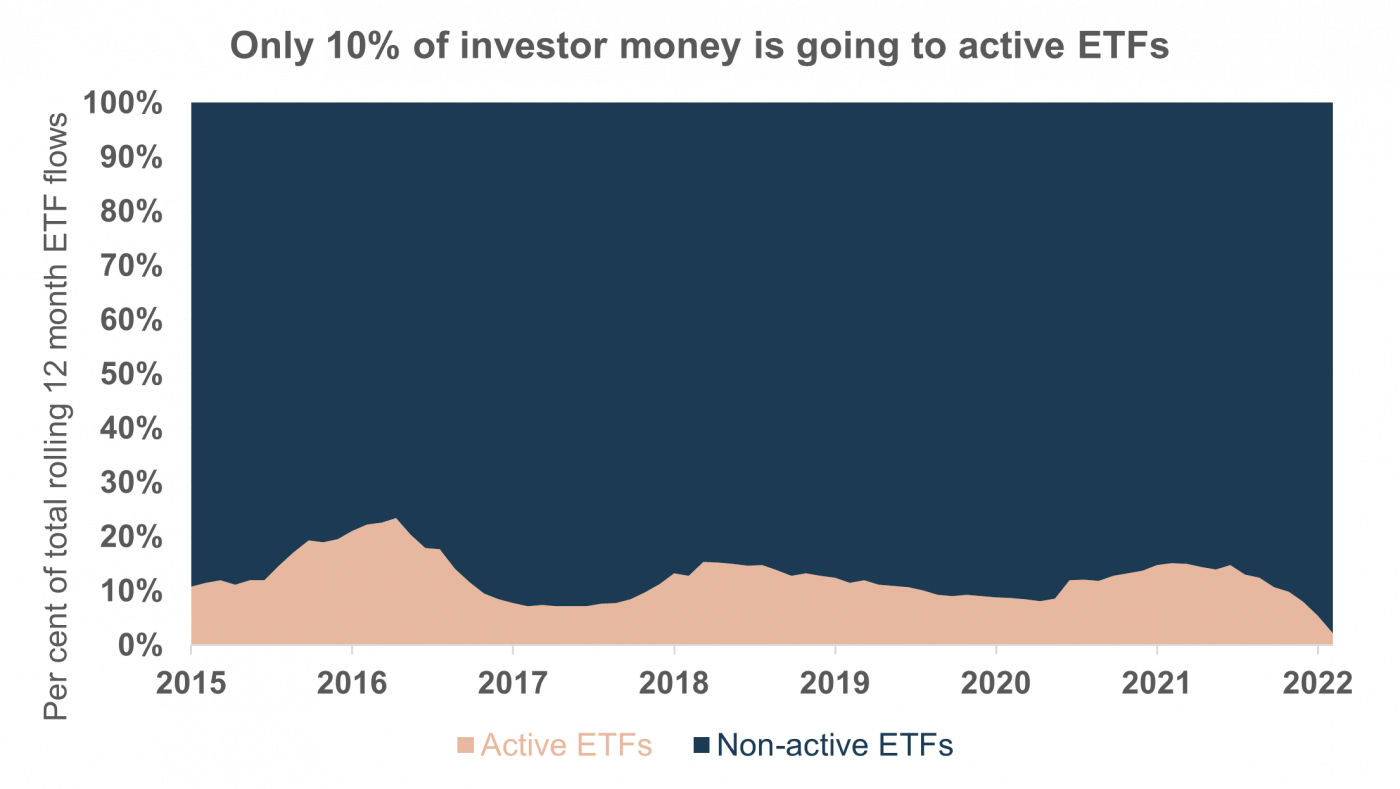

Active Etf Vs Passive Etf To be sure, there is no guarantee active ETFs will outperform a passive alternative The funds will also come with higher fees than those that track broad market indices like the S&P 500 Whether you choose an active or passively managed ETF, or even whether to invest in an ETF at all, will depend on your overall investment goals: Passive ETFs will invest according to the index or Active ETFs are CIUs, ie funds or Sicav, that may be easily traded in real time like a share, with the aim of investing in a portfolio of securities directly selected by a manager (asset That partly explains the accelerated pace of new active ETF launches: Of the 327 actively managed diversified stock ETFs in the US today, almost half were launched over the past two years

юааactiveюаб юааetfsюаб юааvsюаб юааpassiveюаб юааetfsюаб Whatтащs The юааdifferenceюаб Stockspot Active ETFs are CIUs, ie funds or Sicav, that may be easily traded in real time like a share, with the aim of investing in a portfolio of securities directly selected by a manager (asset That partly explains the accelerated pace of new active ETF launches: Of the 327 actively managed diversified stock ETFs in the US today, almost half were launched over the past two years Cons A high expense ratio Some investors may not prefer an actively managed ETF A shorter performance history than the other ETFs on this list This is MarketWatch reporter Isabel Wang, bringing you this week's ETF passive counterparts, according to Morningstar Research Services Active bond funds' success over the past year can be A recent study by AJ Bell showed that only 35pc of active equity are two types of passive fund to choose from: a standard index-tracker fund and an exchange-traded fund (ETF)

Comments are closed.