Erc Tax Credit Application Erc Refund

Erc Tax Credit Application Erc Refund Employee retention credit. the employee retention credit (erc) – sometimes called the employee retention tax credit or ertc – is a refundable tax credit for certain eligible businesses and tax exempt organizations that had employees and were affected during the covid 19 pandemic. the requirements are different depending on the time period. Ir 2024 203, aug. 8, 2024 — the internal revenue service announced today additional actions to help small businesses and prevent improper payments in the employee retention credit (erc) program, including accelerating more payments and continuing compliance work on the complex pandemic era credit that was flooded with claims following misleading marketing.

Irs Form 941 X Erc Erc Refund The employee retention credit (erc) – sometimes called the employee retention tax credit or ertc – is a refundable tax credit for certain eligible businesses and tax exempt organizations. the requirements are different depending on the time period for which you claim the credit. Irs erc audits. although the irs is processing low risk erc claims, it is still on watch for phony ones. the tax agency has sent 58,000 rejection letters to businesses, amounting to $6 billion in. Here's the cost breakdown: you can apply for 50% of up to $10,000 of an employee’s qualified wages paid between march 2020 and december 2020. additionally, you can apply for 70% of up to $10,000 per employee for each of the first three quarters of 2021. in other words, the maximum possible credit for 2020 is $5,000 for employee, and the. The employee retention credit (erc) continues to provide a wide variety of employers with lucrative refundable payroll tax credits for qualified wages paid to employees in 2020 and 2021. businesses can still apply for the erc by filing an amended form 941x (quarterly federal payroll tax return) for the quarters during which the company was an.

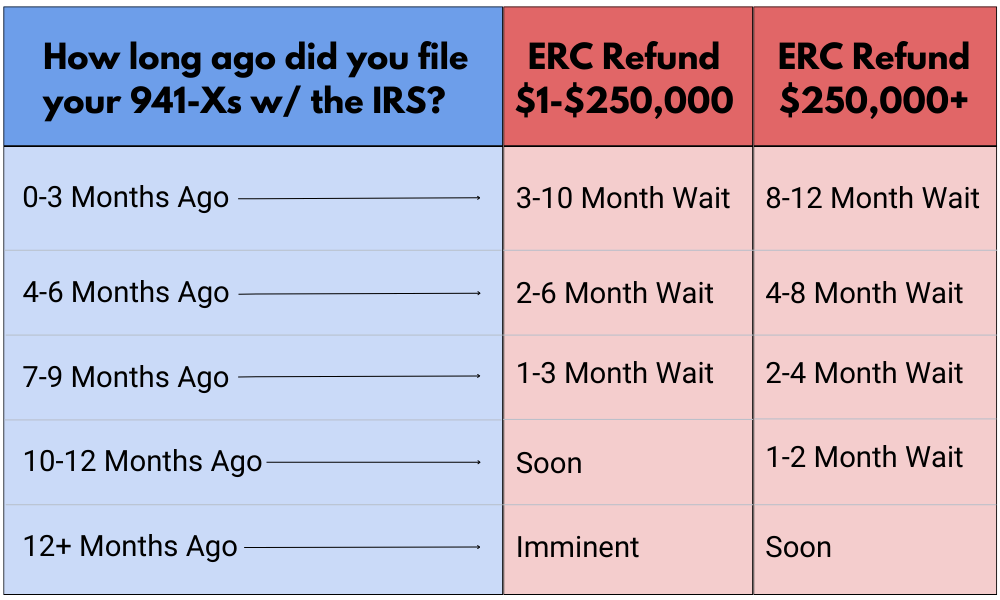

Where Is My юааercюаб юааrefundюаб ёясйcheck Status Of Your Ertc Claim Here's the cost breakdown: you can apply for 50% of up to $10,000 of an employee’s qualified wages paid between march 2020 and december 2020. additionally, you can apply for 70% of up to $10,000 per employee for each of the first three quarters of 2021. in other words, the maximum possible credit for 2020 is $5,000 for employee, and the. The employee retention credit (erc) continues to provide a wide variety of employers with lucrative refundable payroll tax credits for qualified wages paid to employees in 2020 and 2021. businesses can still apply for the erc by filing an amended form 941x (quarterly federal payroll tax return) for the quarters during which the company was an. The employee retention credit (erc) was a refundable payroll tax credit for "qualified wages" paid to retained employees, originally from march 13, 2020, to dec. 31, 2020. Erc refund is a specialty cpa tax service dedicated to filing the employee retention credit (erc) for qualified businesses affected by covid 19. your business has up to three years to amend previously filed payroll taxes for 2020 and 2021 in order to claim your erc refund. you may qualify to receive up to $26,000 per w 2 employee!.

Comments are closed.