Economics Of Inflation Deflation Indian Economy Upscfever

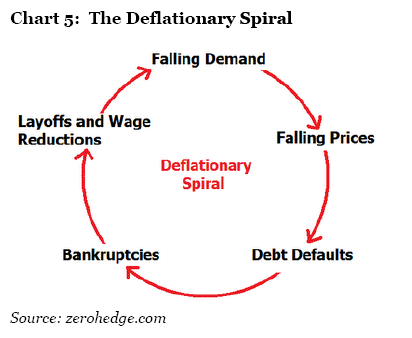

Economics Of Inflation Deflation Indian Economy Upscfever The reasons for deflationary gap are decreased money supply, reduced government expenditure, increased propensity to save i.e. part of income saved by households, increase imports. inflationary spiral is a chain of events that worsen inflation and deflationary spiral are chain of events that worsen deflation. fig 1: deflationary spiral. Advanced economy theory for entrance exams. topics covered in economy part ii. indian economic and social development; infrastructure development, energy infrastructure, government policy. economy of agriculture ; international bodies, important international events affecting indian economy ; inflation, deflation and recession.

Reflation Vs Disinflation Vs Deflation Vs Inflation Indian Economy Indian economy test 1. read instructions for the test. negative marks are 0.33 per wrong answer. right answer is 1 mark. no time limit but finish in 30 mins. solution can be found at below chapters: test series is based on following chapters. indian economy chapter 1: state of the indian economy pre independence. indian economy chapter 2. Food inflation for july 2024 is the lowest since june 2023. the y o y inflation rate based on the all india consumer food price index (cfpi) is 5.42 percent (provisional) for july. the. Demand side inflation is caused by high demand and low production which creates a demand supply gap and it leads to a hike in prices due to increase in consumption. cost pull inflation. cost pull inflation is caused by shortage of factors of production like labour, land, capital etc. and also due to artificial scarcity created due to hoarding. The projected gdp (gross domestic product) growth for 2023 24 is 6.5%, while the benchmark sensex index stands currently at 65,000 points. however, if inflation remains high, it could affect returns on stock market investments. gold and bank deposit rates, on the other hand, are expected to remain stable in the coming months. the reserve bank.

Reflation Vs Disinflation Vs Deflation Vs Inflation Indian Economy Demand side inflation is caused by high demand and low production which creates a demand supply gap and it leads to a hike in prices due to increase in consumption. cost pull inflation. cost pull inflation is caused by shortage of factors of production like labour, land, capital etc. and also due to artificial scarcity created due to hoarding. The projected gdp (gross domestic product) growth for 2023 24 is 6.5%, while the benchmark sensex index stands currently at 65,000 points. however, if inflation remains high, it could affect returns on stock market investments. gold and bank deposit rates, on the other hand, are expected to remain stable in the coming months. the reserve bank. This paper revisits the threshold level of inflation for india. the empirical analysis follows spline regression for the period 1996–97q1 to 2019–20q4. the results suggest the existence of a statistically significant threshold level of inflation at 5 to 5.5% in terms of both cpi and wpi. below this level, the impact of inflation on growth is generally positive whereas it is negative above. Inflation is a situation in an economy where prices of goods and services increase and the purchasing power of people decreases. whereas, in deflation, there is a downward movement of the general.

Inflation And Deflation Economics Basics Indian Economy Youtube This paper revisits the threshold level of inflation for india. the empirical analysis follows spline regression for the period 1996–97q1 to 2019–20q4. the results suggest the existence of a statistically significant threshold level of inflation at 5 to 5.5% in terms of both cpi and wpi. below this level, the impact of inflation on growth is generally positive whereas it is negative above. Inflation is a situation in an economy where prices of goods and services increase and the purchasing power of people decreases. whereas, in deflation, there is a downward movement of the general.

Comments are closed.