Dscr Loan Pros And Cons

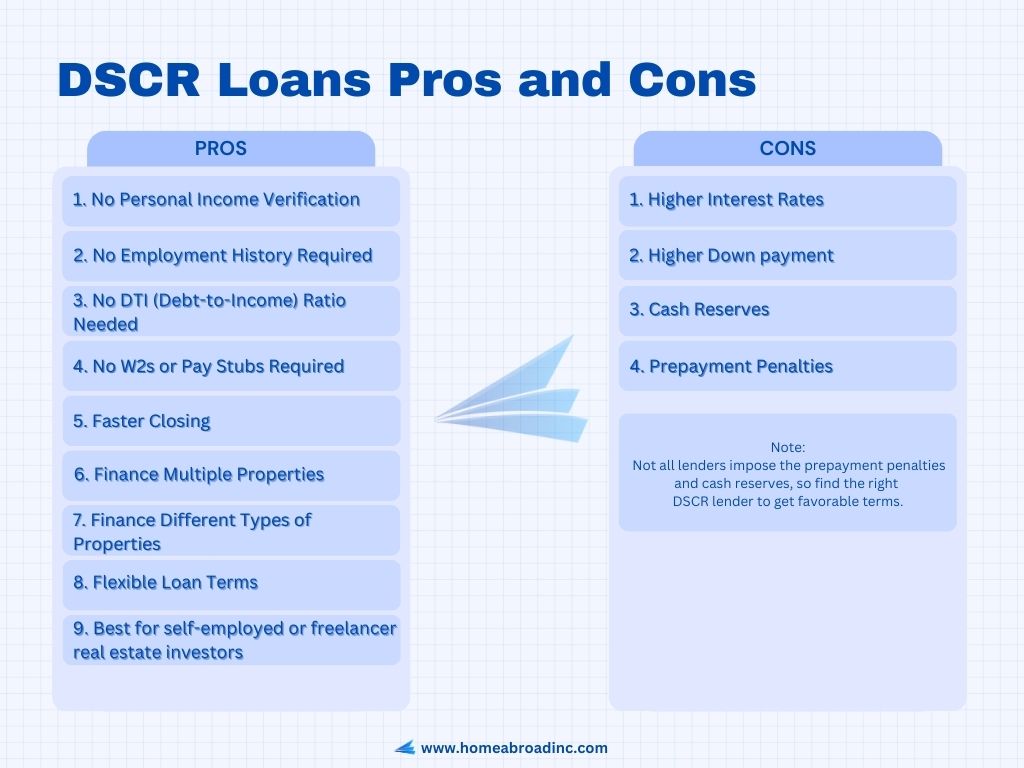

Dscr Loans Pros And Cons 2023 9 Pros 4 Cons Learn what a dscr loan is, how it works, and its advantages and disadvantages for real estate investors. compare dscr loan requirements, interest rates, down payments, and other factors with traditional mortgages. Dscr loans are non qm loans that use the property's income as collateral instead of personal income documents. learn the benefits and drawbacks of dscr loans, who should consider them, and what's needed to qualify.

Pros And Cons Of A Dscr Loan What Is A Dscr Loan Dscr loans focus on the rental property’s income rather than the borrower’s income, making them ideal for self employed investors or those with multiple properties. learn how dscr loans work, their advantages and disadvantages, and how to apply for them. Learn what dscr loans are, how they work, and their pros and cons for real estate investors. dscr loans use the property's income to cover its debt payments, but have higher down payment and credit score requirements. A dscr loan is a non qm loan that lets investors qualify based on rental property cash flow, not income. learn how it works, what it takes to qualify, and the advantages and disadvantages of this loan type. Learn what a dscr loan is, how it works, and its advantages and disadvantages for real estate investors. a dscr loan is based on the property's income generating ability, not the investor's personal income, but it may have higher interest rates, larger down payments, and prepayment penalties.

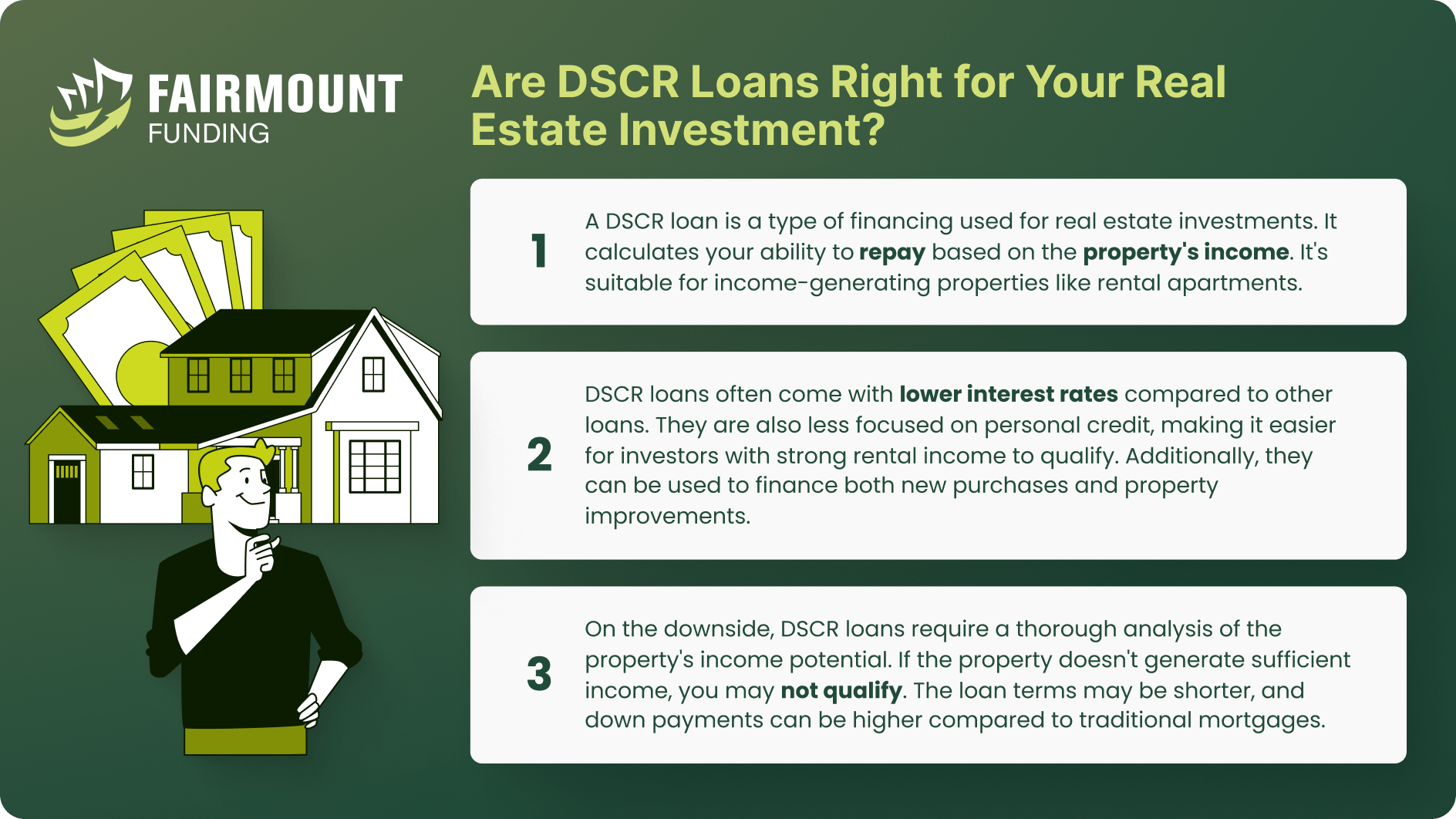

Dscr Loan Pros And Cons A Comprehensive Review Loanclark A dscr loan is a non qm loan that lets investors qualify based on rental property cash flow, not income. learn how it works, what it takes to qualify, and the advantages and disadvantages of this loan type. Learn what a dscr loan is, how it works, and its advantages and disadvantages for real estate investors. a dscr loan is based on the property's income generating ability, not the investor's personal income, but it may have higher interest rates, larger down payments, and prepayment penalties. Cons of dscr loans. unfortunately, like all types of loans, dscr loans have some risks and drawbacks that may not make them suitable for every borrower. the cons of dscr loans include the following: large down payments: most lenders require a large down payment of 20 40%, which may be higher than some conventional mortgages. Dscr loans are based on a property's cash flow, not your personal income. learn how they work, what are the requirements, and the advantages and disadvantages of using them to buy rental properties.

Dscr Loan Pros And Cons Fairmount Funding Cons of dscr loans. unfortunately, like all types of loans, dscr loans have some risks and drawbacks that may not make them suitable for every borrower. the cons of dscr loans include the following: large down payments: most lenders require a large down payment of 20 40%, which may be higher than some conventional mortgages. Dscr loans are based on a property's cash flow, not your personal income. learn how they work, what are the requirements, and the advantages and disadvantages of using them to buy rental properties.

Dscr Loan Pros And Cons Everything You Need To Know Cup Loan Program

Comments are closed.