Dscr Loan Program How To Qualify Requirements Benefits

Dscr Loans 2023 The Pros Requirements And How To Qualify The dscr includes a property’s annual net operating income and mortgage debt (principal and interest). it’s used to gauge cash flow from a property and how much of the income can be allocated towards the monthly loan payment. a higher dscr helps you qualify for loans and get lower interest rates. Dscr loan qualifications. dscr loans are a lot easier to qualify for than other real estate financing options. here are all the dscr loan requirements you need to meet: interest rate: from 7.5%. origination fee: 2 3%. loan to purchase price: up to 80%. loan to value: up to 80%.

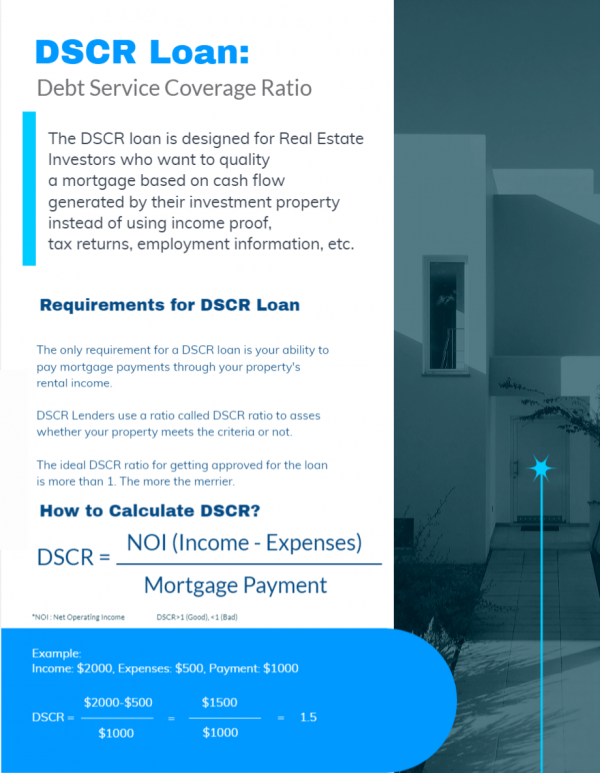

Dscr Loan Program How To Qualify Requirements Benefits A dscr loan allows real estate investors to secure financing based on the rental income of a property rather than their personal income. if you cannot qualify for a conventional loan, dscr loans are a great option. without having to submit tax returns and w 2s, you can secure capital to invest in rental properties with a dscr loan. A dscr (debt service coverage ratio) loan, or investor cash flow loan, is a non qm loan that allows you to qualify for a home loan without relying on personal income dscr loans are perfect for real estate investors who can secure a real estate loan based on their rental property’s cash flow, not their income tax returns or other financial paperwork. Debt service coverage ratio (dscr): this is the heart of a dscr loan. it’s a simple calculation that divides the property’s gross monthly rental income by the monthly mortgage payment. a dscr of 1.2, for instance, means the rental income is 1.2 times greater than the mortgage payment, indicating a 20% buffer to cover expenses and vacancies. The minimum dscr ratio typically required for most loans is 1.25. this means that the net operating income (noi) from the property should be at least 1.25 times the annual debt obligations. however, this can vary depending on the lender and the risk assessment of the specific investment.

Comments are closed.