Dscr Loan Interest Rates Today November 2023

Dscr Loan Interest Rates Today November 2023 Typically, dscr loan rates are 1% 1.5% higher than conventional mortgage rates due to the unique nature of dscr loans and the associated increased risk for the lender. in october 2023, interest rates were at record highs in the last decade but started to fall after november 2023. The current dscr loan interest rate as of august 2nd, 2024 is 6.375% (apr: 6.616%) 8.000% (apr: 8.263%). these rates are typically higher than conventional mortgage rates by about 1 2%. keep in mind that fixed interest rates for dscr loans remain the same throughout the loan term, while adjustable rates can fluctuate based on market conditions.

Dscr Loan Interest Rates Dscr loan interest rate = 4,712% 4,1% = 8,812% [crevc calculator downpayment=20 price=200000 rate=7 term=30 noi=21600] main types of dscr loan interest rates. there are 3 different types of dscr loan interest rates that you need to take into account when considering the pros and cons of dscr loans. they are as follows: 1. fixed dscr loan. New silver lending is a hard money fintech company that offers fix and flip, rent (dscr), and ground up loans. their interest rates range from 10 13.25%, but the interest rates on their dscr product are a bit lower. other terms include: minimum loan amount of $150,000; maximum loan amount of $3,000,000; minimum fico of 660; up to 80% of ltv. Generally, properties with a higher dscr are considered lower risk, and lenders may offer more favorable interest rates to compensate for this reduced risk. for example, a property with a dscr of 1.25 may qualify for an interest rate of 5.5%, while a property with a lower dscr of 1.0 might be offered an interest rate of 6.5% or higher. Between 2018 and february 2023, approximately half of the 201,000 non qm loans were dscr loans, making them a popular choice amongst real estate investors and those in commercial real estate. the appeal of dscr loans is largely due to rental income contributing significantly to the property’s ability to pay off the debt.

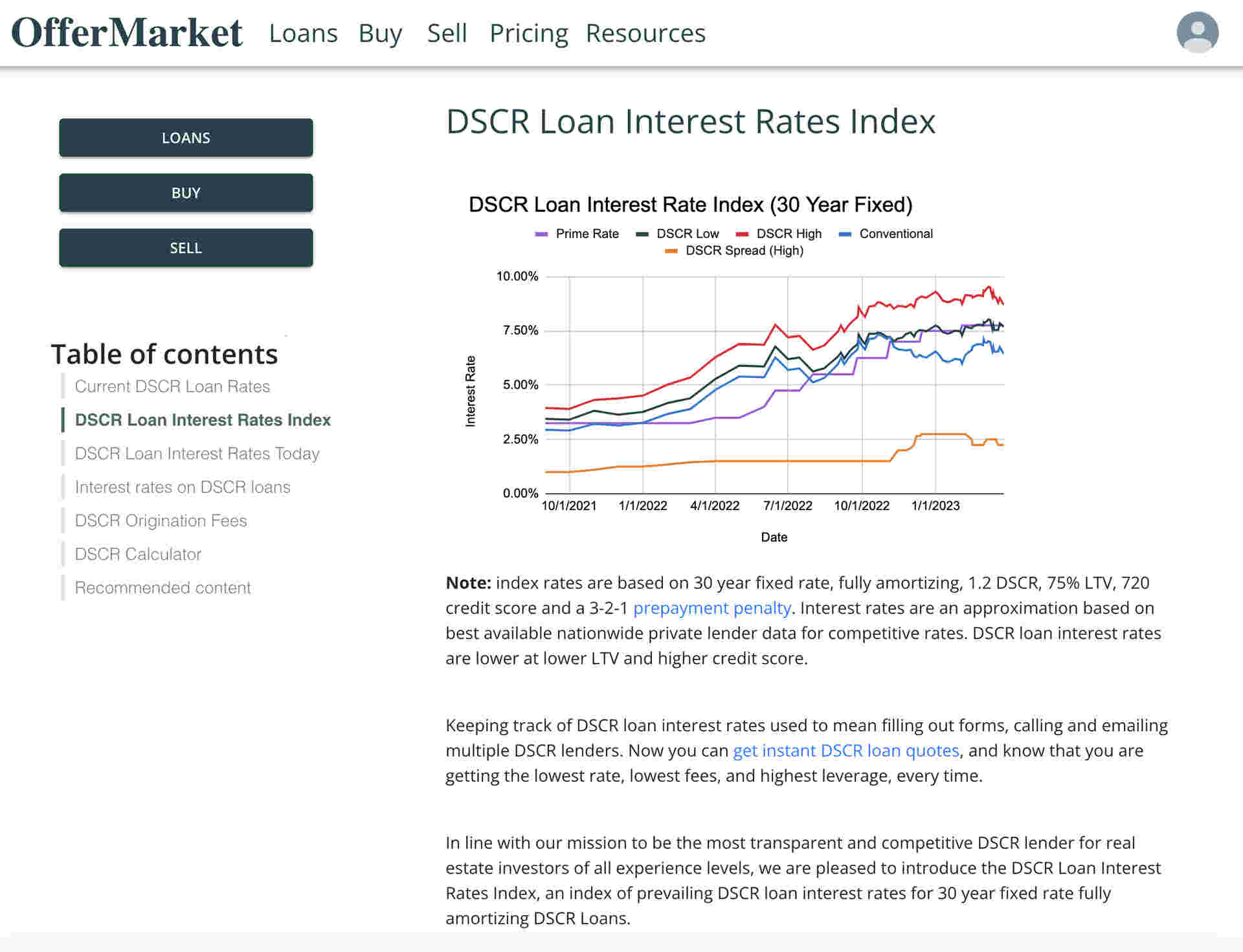

Debt Service Coverage Ratio Dscr Loan How To Qualify Generally, properties with a higher dscr are considered lower risk, and lenders may offer more favorable interest rates to compensate for this reduced risk. for example, a property with a dscr of 1.25 may qualify for an interest rate of 5.5%, while a property with a lower dscr of 1.0 might be offered an interest rate of 6.5% or higher. Between 2018 and february 2023, approximately half of the 201,000 non qm loans were dscr loans, making them a popular choice amongst real estate investors and those in commercial real estate. the appeal of dscr loans is largely due to rental income contributing significantly to the property’s ability to pay off the debt. How to calculate dscr loan interest rate. dscr loan interest rate= 5 year us treasury borrower credit spread. 5 year us treasury ("risk free rate")= 4.43% (as of the 'last updated' date at the top of the page) borrower credit spread ("risk premium")= 2.65% to 4.5% (depends on credit score, ltv, property type, experience and pre payment. Since spring 2022, when the federal reserve embarked on its latest rate hiking cycle, interest rates on the most popular loans for real estate investors, dscr loans (part of the non qm loans category), have moved at unprecedented rates. many months of rates moving at most a few basis points a week morphed into dramatic, massive movements—with bigger changes sometimes happening in one day.

What Are Interest Rates For Dscr Loans In 2023 Investor Financing How to calculate dscr loan interest rate. dscr loan interest rate= 5 year us treasury borrower credit spread. 5 year us treasury ("risk free rate")= 4.43% (as of the 'last updated' date at the top of the page) borrower credit spread ("risk premium")= 2.65% to 4.5% (depends on credit score, ltv, property type, experience and pre payment. Since spring 2022, when the federal reserve embarked on its latest rate hiking cycle, interest rates on the most popular loans for real estate investors, dscr loans (part of the non qm loans category), have moved at unprecedented rates. many months of rates moving at most a few basis points a week morphed into dramatic, massive movements—with bigger changes sometimes happening in one day.

Comments are closed.