Dscr Loan For Multifamily Property 2023 How To Qualify

Dscr Loan For Multifamily Property 2023 How To Qualify A credit score of 620 or above. it’s true that dscr loans mainly focus on your property’s cash flow. however, you need to have a credit score of 620 or above to qualify for the loan. this is because if your property can’t generate sufficient cash flow to cover the debt obligations, lenders may require you to step in. You will have to know a property’s cash flow and the monthly mortgage payments on the total debt service. the total debt service reflects how much you owe in debt for a property in a given year. here’s the formula for the ratio: dscr = net operating income total debt service. if a property’s net operating income is $100,000 per year and.

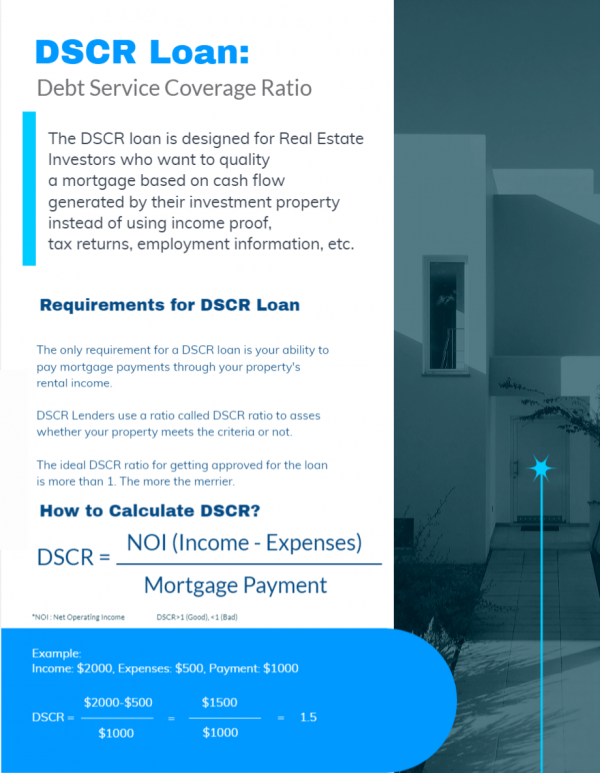

Dscr Loan For Multifamily Property 2024 How To Qualify Debt service coverage ratio (dscr) is a figure that’s used by lenders to determine whether an investment property is generating enough income to cover its debt payments. for dscr loans, the dscr figure is used in lieu of the borrower’s income, which is typically used for conventional loans. dscr is calculated by dividing the property’s. A dscr loan allows real estate investors to secure financing based on the rental income of a property rather than their personal income. if you cannot qualify for a conventional loan, dscr loans are a great option. without having to submit tax returns and w 2s, you can secure capital to invest in rental properties with a dscr loan. To prove this capacity, lenders typically require rent rolls or tenant lease agreements as part of the loan application process. meeting these criteria is essential for obtaining a multifamily dscr loan approval. property eligibility. multifamily dscr loans are available to borrowers who meet certain eligibility criteria. Some final notes on prepayment penalties for dscr loans. one is that several states have restrictions on prepayment penalties, even for business purpose investment properties. these typically only apply to dscr loans used for 1–4 unit properties, and don’t apply if using a multifamily dscr loan for a 5 10 unit or mixed use property. states.

Dscr Loans 2023 The Pros Requirements And How To Qualify To prove this capacity, lenders typically require rent rolls or tenant lease agreements as part of the loan application process. meeting these criteria is essential for obtaining a multifamily dscr loan approval. property eligibility. multifamily dscr loans are available to borrowers who meet certain eligibility criteria. Some final notes on prepayment penalties for dscr loans. one is that several states have restrictions on prepayment penalties, even for business purpose investment properties. these typically only apply to dscr loans used for 1–4 unit properties, and don’t apply if using a multifamily dscr loan for a 5 10 unit or mixed use property. states. Debt service coverage ratio (dscr): this is the heart of a dscr loan. it’s a simple calculation that divides the property’s gross monthly rental income by the monthly mortgage payment. a dscr of 1.2, for instance, means the rental income is 1.2 times greater than the mortgage payment, indicating a 20% buffer to cover expenses and vacancies. Lenders typically require a minimum dscr ratio to qualify for a loan. this ratio is calculated by dividing the property’s annual net operating income by its total yearly debt service. most lenders look for a dscr of at least 1.25, indicating that the property generates 25% more revenue annually than necessary to cover the debt.

Comments are closed.