Don T Know How To Start Budgeting Do You Need To Know How To Make A

Pin On Budget Help Let’s do this.) subtract all your expenses from your income. this number should equal zero, meaning you just made a zero based budget. this is key: a zero based budget doesn’t mean you let your bank account reach zero. (leave a little buffer in there of about $100–300.) it also doesn’t mean you blow all your money. See full bio. step 1. figure out your after tax income step 2. choose a budgeting system step 3. track your progress step 4. automate your savings step 5. practice budget management.

How To Start Budgeting For Beginners Sweet Frugal Life Step 3: track your spending. now it’s time to track your spending and see where all of your money is going every month. this takes some time but you must know what you’re spending your money on. you should track your spending for at least a month but three months will give you a more accurate picture of your habits. Step 1. embrace the ongoing process of budgeting. we often tend to think of budgeting as a one and done kind of chore. you sit down with your accounts and receipts. you figure out how much you. The 50 30 20 budget requires you to allocate money to just three separate categories, like so: 50% of your income for necessities. 30% of your income for discretionary spending. 20% of your income for saving. although this is super simple, it will only work if 50% of your income will cover your essential bills. 50 30 20 budget. the 50 30 20 approach is a very popular budgeting strategy. this method is based on the idea that you can separate your monthly income into three categories: needs: essential.

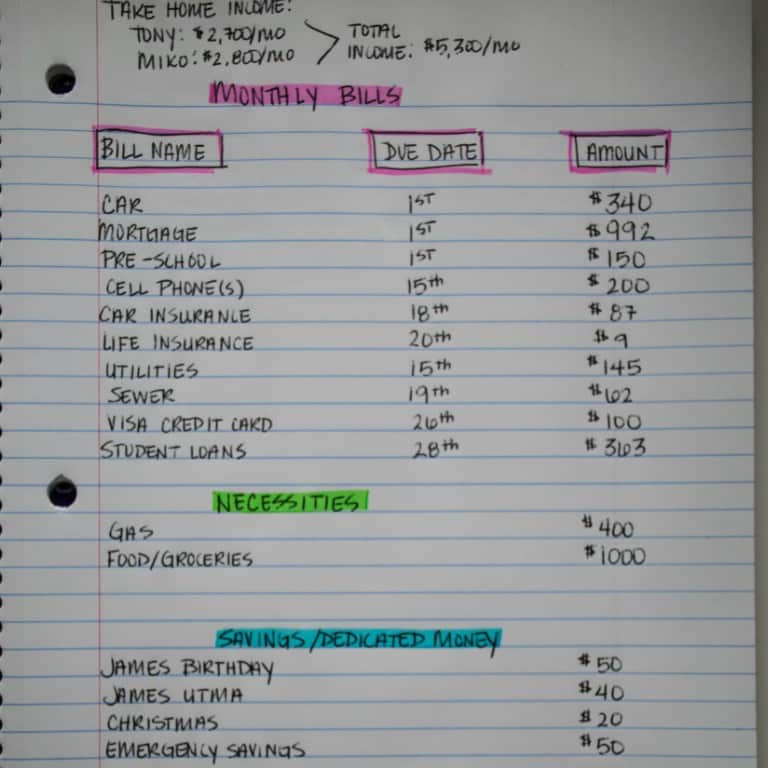

10 Tips For Better Budgeting Of Personal Finances The 50 30 20 budget requires you to allocate money to just three separate categories, like so: 50% of your income for necessities. 30% of your income for discretionary spending. 20% of your income for saving. although this is super simple, it will only work if 50% of your income will cover your essential bills. 50 30 20 budget. the 50 30 20 approach is a very popular budgeting strategy. this method is based on the idea that you can separate your monthly income into three categories: needs: essential. Step 4: make a plan. this is where everything comes together: what you’re actually spending vs. what you want to spend. use the variable and fixed expenses you compiled to get a sense of what you’ll spend in the coming months. then compare that to your net income and priorities. consider setting specific—and realistic—spending limits. To do zero based budgeting, start with a number representing your monthly take home. then make a list of your expense categories. these will be things like rent or mortgage, groceries, health.

How To Create A Budget When You Really Don T Want To The Budget Step 4: make a plan. this is where everything comes together: what you’re actually spending vs. what you want to spend. use the variable and fixed expenses you compiled to get a sense of what you’ll spend in the coming months. then compare that to your net income and priorities. consider setting specific—and realistic—spending limits. To do zero based budgeting, start with a number representing your monthly take home. then make a list of your expense categories. these will be things like rent or mortgage, groceries, health.

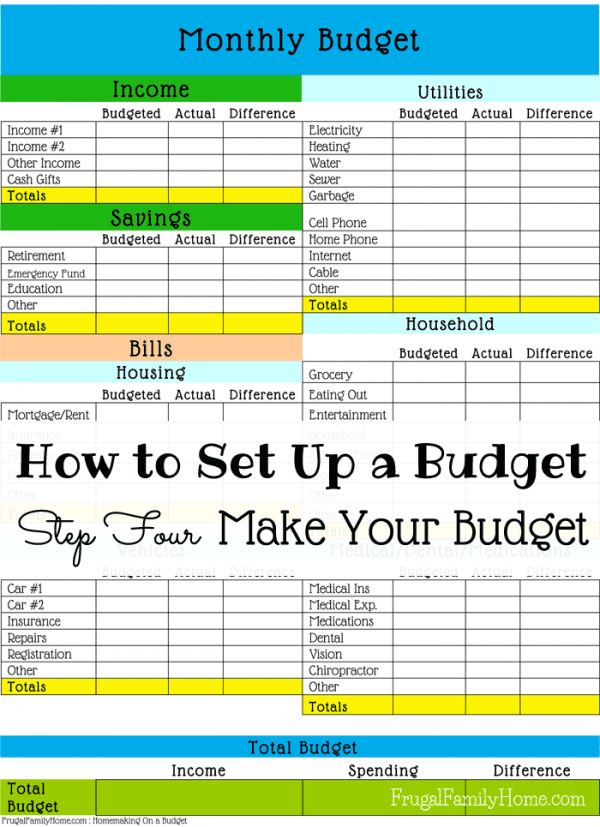

How To Set Up A Budget Make Your Budget Frugal Family Home

Comments are closed.