Divergence Trading Guide 101 The Basics Technical Analysis

Divergence Trading Guide 101 The Basics Technical Analysis Divergence is a technical analysis pattern that can be seen on price charts when the price of a crypto asset is going against the trend of other data or in the opposite direction of a technical indicator. it is a signal that the trend may be weakening and shifting. it occurs when a price and an oscillating indicator, like the macd or rsi, disagree. An rsi divergence. #1 revisiting the rsi. divergences work on all indicators, but my favorite by far is the rsi (relative strength index). the rsi compares the average gain and the average loss over a certain period. so for example, if your rsi is set to 14, it compares the bullish candles and the bearish candles over the past 14 candles.

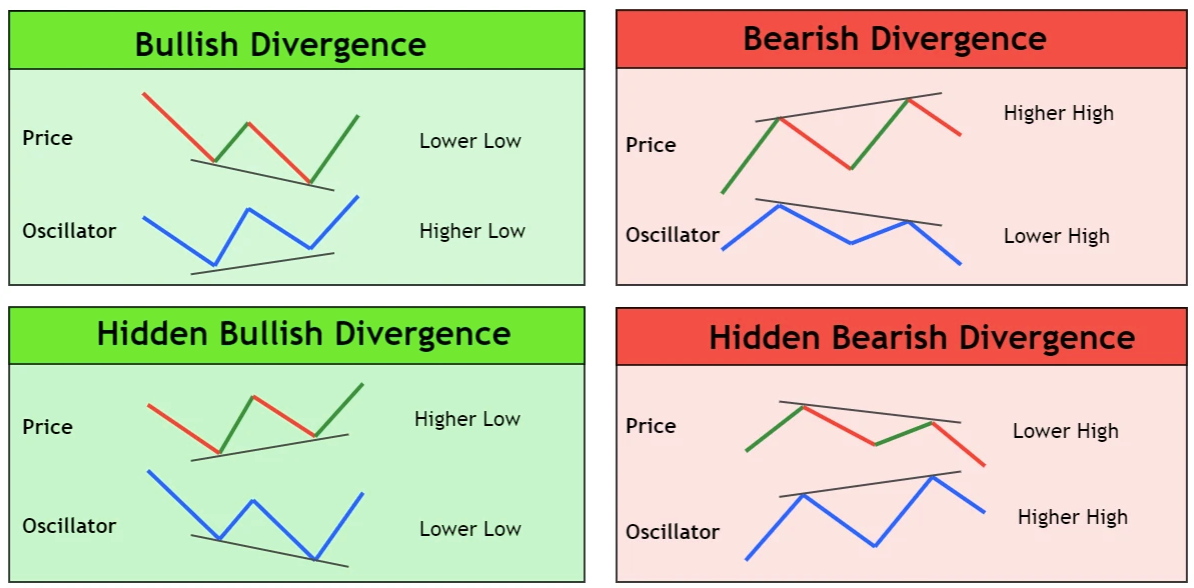

Divergence Trading Guide 101 The Basics Technical Analysis Versatility: divergence can be applied to various asset classes, timeframes, and trading strategies. whether you're a day trader or a long term investor, divergence analysis can be adapted to your trading style. avoiding false signals: divergence can help filter out false signals and noise in the market. The purpose of the divergence cheat sheet is to help traders identify these patterns and make informed decisions about their trades. a cheat sheet on hand saves time and reduces the risk of missing key signals in fast paced trading. using a cheat sheet in trading offers several advantages. firstly, it helps traders stay organized and focused. Divergence is a popular concept in technical analysis that describes when the price is moving in the opposite direction of a technical indicator. there are two types of divergences: regular divergence. hidden divergence. each type of divergence will contain either a bullish bias or a bearish bias. since you’ve all be studying hard and not. The ultimate divergence cheat sheet. anes bukhdir 2 7 2024. if you’re looking to elevate your trading game and achieve success in the financial markets, understanding the concept of divergence is an essential skill to master. divergence refers to a powerful trading signal that can provide valuable insights into market trends and potential.

Divergence Trading Guide 101 The Basics Technical Analysis Divergence is a popular concept in technical analysis that describes when the price is moving in the opposite direction of a technical indicator. there are two types of divergences: regular divergence. hidden divergence. each type of divergence will contain either a bullish bias or a bearish bias. since you’ve all be studying hard and not. The ultimate divergence cheat sheet. anes bukhdir 2 7 2024. if you’re looking to elevate your trading game and achieve success in the financial markets, understanding the concept of divergence is an essential skill to master. divergence refers to a powerful trading signal that can provide valuable insights into market trends and potential. Divergence in forex occurs when the price action of a currency pair and a related indicator move in opposite directions. this phenomenon signals underlying strength or weakness in the market that may not be immediately apparent from price alone. this guide aims to demystify divergence in forex trading, offering traders at all levels a thorough. In this guide, we will delve into the concept of divergence and its significance in technical analysis, specifically focusing on its application in the cryptocurrency market, particularly bitcoin. understanding divergence: a key concept in trading divergence occurs when the price of an asset and an indicator, such as the relative strength index (rsi), move in opposite directions.

Comments are closed.