Divergence In Trading Definition Types Importance Trading Example

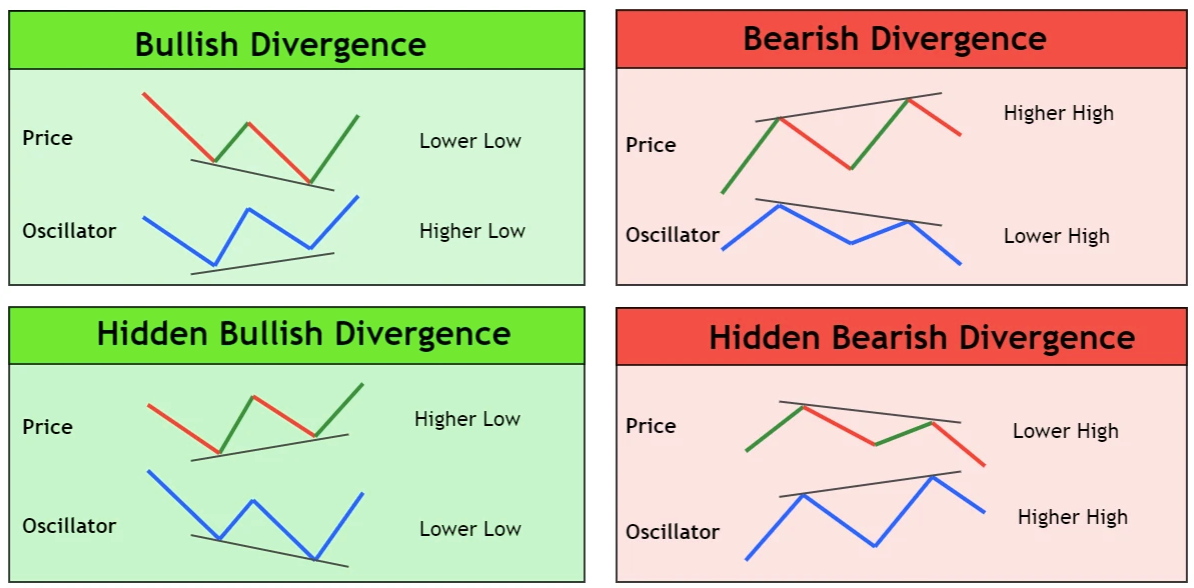

Divergence In Trading Definition Types Importance Trading Example Divergence in trading is a break between the price action of a security and an oscillator. divergence in trading refers to scenarios where the price of an asset and its momentum as measured by an indicator such as rsi or macd do not confirm each other’s direction. there are two main types of divergences seen in trading – hidden and reverse. Versatility: divergence can be applied to various asset classes, timeframes, and trading strategies. whether you're a day trader or a long term investor, divergence analysis can be adapted to your trading style. avoiding false signals: divergence can help filter out false signals and noise in the market.

Divergence In Trading Definition Types Importance Trading Example Divergence is when the price of an asset is moving in the opposite direction of a technical indicator, such as an oscillator, or is moving contrary to other data. divergence warns that the current. Divergence signals that the current price trend is weakening and that a reversal may ensue. a negative divergence occurs when an asset’s price is in an uptrend while the indicator is moving lower. conversely, positive divergence happens when the price is in a downtrend, but the oscillator is moving higher. Divergence comes from a latin word “divergere” which means “to detect a disagreement”. in trading, divergence refers to a disagreement in dynamics between a price chart and various price indicators. let’s consider an example from the euro futures chart, the data was taken from the cme exchange, timeframe = 5 minutes. Divergence based trading focuses primarily on price and indicator relationships, neglecting the influence of external factors such as news events, economic data, or geopolitical developments. these factors can override divergence signals and cause unexpected market movements, making it important to consider a comprehensive range of information.

Divergence Trading Guide 101 The Basics Technical Analysis Divergence comes from a latin word “divergere” which means “to detect a disagreement”. in trading, divergence refers to a disagreement in dynamics between a price chart and various price indicators. let’s consider an example from the euro futures chart, the data was taken from the cme exchange, timeframe = 5 minutes. Divergence based trading focuses primarily on price and indicator relationships, neglecting the influence of external factors such as news events, economic data, or geopolitical developments. these factors can override divergence signals and cause unexpected market movements, making it important to consider a comprehensive range of information. Divergence is important for trade management. taking profit or selling a call option were fine strategies in figure 5. the divergence between the price and the indicator led to a pullback then the. What is divergence. divergence in technical analysis refers to the relationship between two different data sets; the divergence can be between an instrument price and an oscillator, an indicator, sentiment, or another correlated instrument price or market. for many analysts, divergence analysis is considered a leading indicator and is commonly.

Divergence In Trading Definition Types Importance Trading Example Divergence is important for trade management. taking profit or selling a call option were fine strategies in figure 5. the divergence between the price and the indicator led to a pullback then the. What is divergence. divergence in technical analysis refers to the relationship between two different data sets; the divergence can be between an instrument price and an oscillator, an indicator, sentiment, or another correlated instrument price or market. for many analysts, divergence analysis is considered a leading indicator and is commonly.

Comments are closed.