Divergence Explains Cheat Sheet In 2023

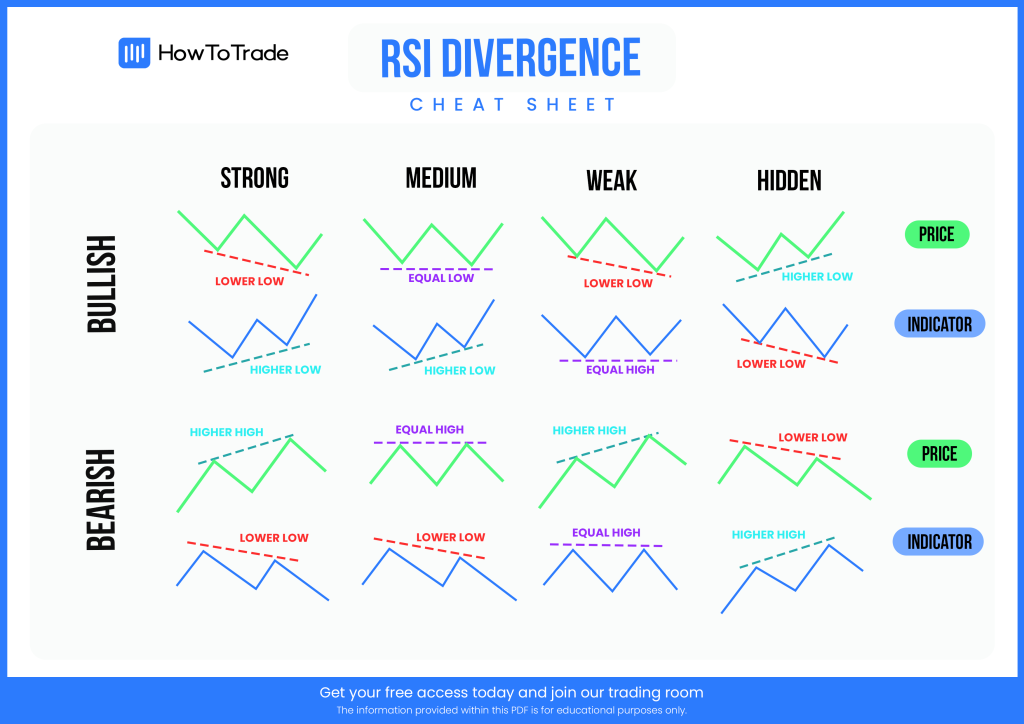

This Is The Anamous Divergence Of Rsi You Can Get More And More Profit Understanding divergence: a key concept in trading. divergence occurs when the price of an asset and an indicator, such as the relative strength index (rsi), move in opposite directions. this pattern provides valuable insights into potential price reversals or changes in trends. the divergence cheat sheet. Divergence cheat sheet and free pdf. one of the basic tenets of technical analysis is that momentum precedes price. however, prices never move in a smooth line, and momentum will often be out of sync with the price. this mismatch between momentum and the actual price is referred to as a divergence. traders can exploit these price discrepancies.

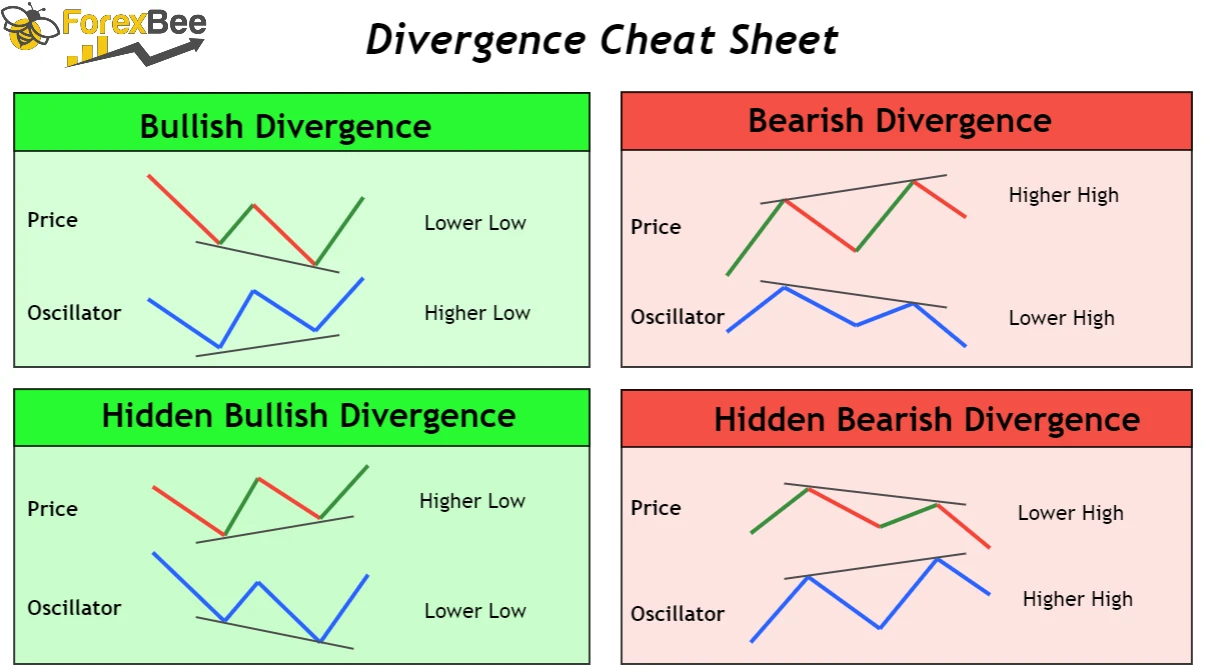

The Ultimate Divergence Cheat Sheet Forexbee Divergence cheat sheet (free download) trading divergences is a common strategy focusing on finding a miscorrelation between the asset’s price and a technical indicator. with this strategy, divergence traders are looking for price reversals or trend continuation signals to capture long price movements. and, if used properly, it can turn out. In technical analysis, divergence refers to the phenomenon when the price and a technical indicator (like the rsi) display conflicting signals. for instance, if price forms a higher high while the rsi forms a lower high, it indicates bearish divergence. price and the rsi, which should typically move in tandem, end up showing contradictory signals. Hidden divergence. hidden divergences signal a possible trend continuation. indicates underlying strength. good entry or re entry. this occurs during retracements in an uptrend. nice to see during the price retest of previous lows. “buy the dips.”. indicates underlying weakness. found during retracements in a downtrend. A bearish divergence occurs when the indicator does not reach a higher high, while the price does. recall that uptrends don’t only have higher highs. they also have higher lows. so, you must also compare the lows of the price to the lows of the indicator. this will reveal any hidden bullish divergences.

Rsi Divergence Cheat Sheet Pdf Free Download Hidden divergence. hidden divergences signal a possible trend continuation. indicates underlying strength. good entry or re entry. this occurs during retracements in an uptrend. nice to see during the price retest of previous lows. “buy the dips.”. indicates underlying weakness. found during retracements in a downtrend. A bearish divergence occurs when the indicator does not reach a higher high, while the price does. recall that uptrends don’t only have higher highs. they also have higher lows. so, you must also compare the lows of the price to the lows of the indicator. this will reveal any hidden bullish divergences. Trading the divergence cheatsheet comes only with three simple steps: spot a reversal divergence. go into the lower timeframe. wait and trade the flag pattern. go back into the higher timeframe and use the indicator to manage your trade. spotting a divergence can be tricky enough at times. Rule #1: it only exists in four different price scenarios. rule #2: for bearish divergence, only connect highs. rule #3: for bullish divergence, only connect lows. rule #4: the line slope hints to the strength of the divergence. rule #5: don’t chase divergence. your cheat sheet on the divergence trading strategy.

What Is Divergence Cheat Sheet Education Trading the divergence cheatsheet comes only with three simple steps: spot a reversal divergence. go into the lower timeframe. wait and trade the flag pattern. go back into the higher timeframe and use the indicator to manage your trade. spotting a divergence can be tricky enough at times. Rule #1: it only exists in four different price scenarios. rule #2: for bearish divergence, only connect highs. rule #3: for bullish divergence, only connect lows. rule #4: the line slope hints to the strength of the divergence. rule #5: don’t chase divergence. your cheat sheet on the divergence trading strategy.

Comments are closed.