Different Types Of Divergence Share Market Learning

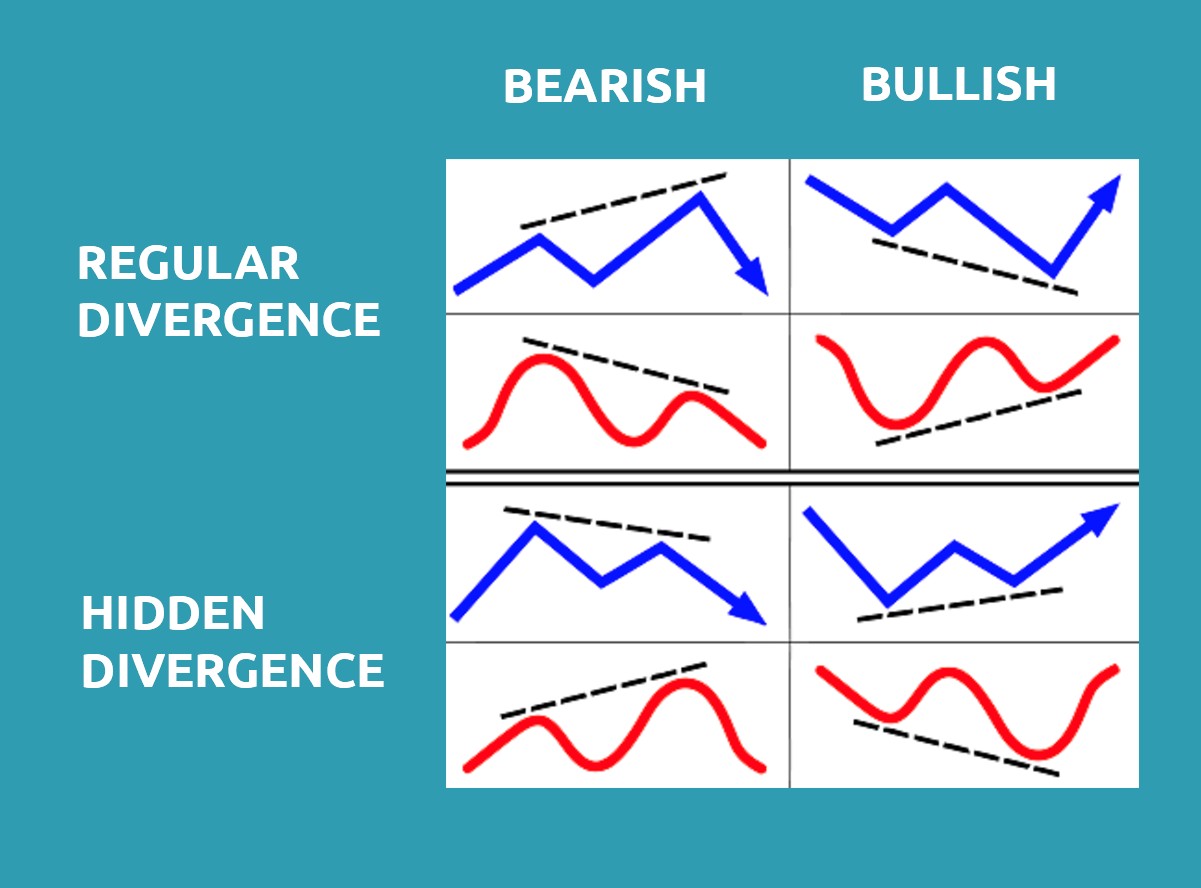

Divergences In Trading Types Meanings Strategies Divergence is a popular concept in technical analysis that describes when the price is moving in the opposite direction of a technical indicator. there are two types of divergences: regular divergence. hidden divergence. each type of divergence will contain either a bullish bias or a bearish bias. since you’ve all be studying hard and not. Divergence refers to a powerful trading signal that can provide valuable insights into market trends and potential reversals. in this comprehensive guide, i will walk you through the basics of divergence, its different types, and how to identify and trade it effectively. understanding the concept of divergence the basics of divergence.

The Ultimate Divergence Cheat Sheet A Comprehensive Guide For Traders Versatility: divergence can be applied to various asset classes, timeframes, and trading strategies. whether you're a day trader or a long term investor, divergence analysis can be adapted to your trading style. avoiding false signals: divergence can help filter out false signals and noise in the market. Below are different types of trading divergences: 1. bullish. a bullish divergence is the first thing we will notice. for this example, the oscillator will be the relative strength index. you’ll notice that there are recurring, similar patterns that are associated with divergences when you trade with them. Rsi has fixed boundaries with values ranging from 0 to 100. momentum can be calculated by using the formula: m = cp cpx. where cp is the closing price and cpx is the closing price "x" number of. Divergence is a technical analysis concept that compares the movement of an asset’s price to a related indicator, such as the relative strength index (rsi) or moving average convergence divergence (macd). when the price and the indicator move in opposite directions, it signals a divergence. there are two types of divergence: regular and hidden.

Comments are closed.