Difference Between Use Tax And Sales Tax In The Us

Difference Between Use Tax And Sales Tax In The Us Youtube The differences. sales tax and use tax are both types of taxes that are imposed on the sale of goods and services. the main difference between the two is that sales tax is a tax on the sale of tangible personal property, while use tax is a tax on the use of that property within a state. Florida sales and use tax rates typically range from 6% to 8%; illinois sales and use tax rates range from 6.25% to 11%. if you buy something taxable for $10 and the seller doesn’t collect sales tax, you would owe the state 50 cents in consumer use tax. united states ecommerce retail sales and use tax.

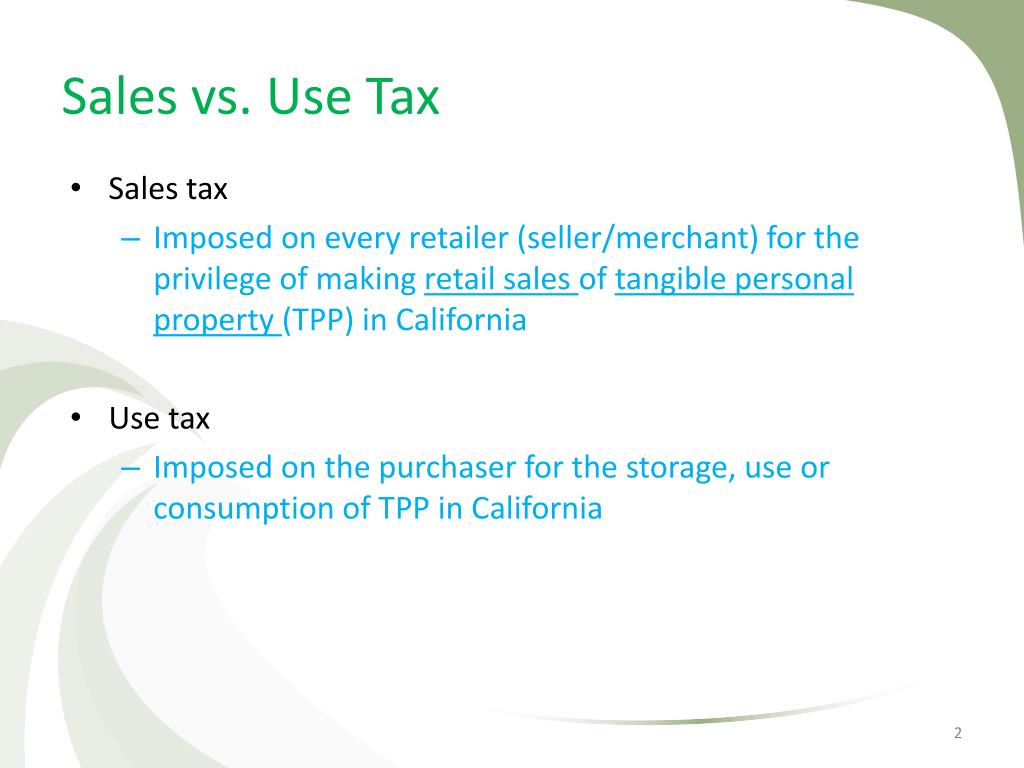

Sales Tax Vs Use Tax How They Work Who Pays More Use tax vs. sales tax. understanding the distinction between use tax and sales tax is crucial. sales tax is collected by the seller at the point of sale and is remitted to the state by the seller. use tax, on the other hand, is the responsibility of the buyer. it is self assessed and paid directly to the state by the consumer when sales tax was. Before diving into sales tax, consumer use tax, and seller use tax, we need to define the concept of nexus. whether sales or use tax applies to a transaction depends primarily on sales tax nexus, the connection between a seller and a state that permits the state to impose a tax collection obligation on the seller. Use tax definition. the use tax acts as a complement to the sales tax and is imposed in a situation where no sales tax was collected by the vendor and paid by the purchaser. use tax is generally imposed on the use, storage, consumption, or importation of tangible personal property or services in the state, where no sales tax was paid. Most of the states are considered consumer tax states. use tax is defined as a tax on the storage, use, or consumption of a taxable item or service on which no sales tax has been paid. use tax is a complementary or compensating tax to the sales tax and does not apply if the sales tax was charged. use tax applies to purchases made outside the.

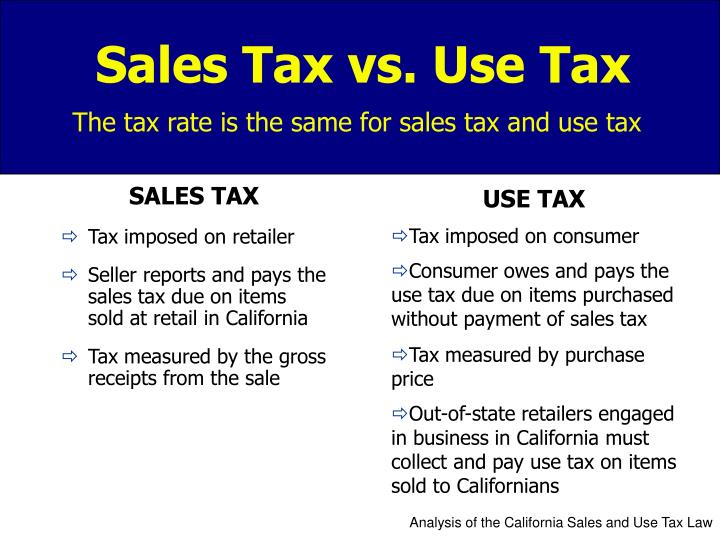

Ppt Sales Tax Vs Use Tax Powerpoint Presentation Free Download Id Use tax definition. the use tax acts as a complement to the sales tax and is imposed in a situation where no sales tax was collected by the vendor and paid by the purchaser. use tax is generally imposed on the use, storage, consumption, or importation of tangible personal property or services in the state, where no sales tax was paid. Most of the states are considered consumer tax states. use tax is defined as a tax on the storage, use, or consumption of a taxable item or service on which no sales tax has been paid. use tax is a complementary or compensating tax to the sales tax and does not apply if the sales tax was charged. use tax applies to purchases made outside the. The use tax rate is the same as the resident's local sales tax rate, which includes both state and local sales taxes. it is up to consumers to calculate and pay use taxes on any applicable. Differences between sales and use tax. the seller calculates sales tax. consumers rarely verify the calculation of the sales tax by the store. however, consumers are responsible for calculating and remitting use tax to the government. use tax is difficult to regulate because it relies on consumers to self report and pay.

Ppt Sales And Use Tax Powerpoint Presentation Free Download Id 3385831 The use tax rate is the same as the resident's local sales tax rate, which includes both state and local sales taxes. it is up to consumers to calculate and pay use taxes on any applicable. Differences between sales and use tax. the seller calculates sales tax. consumers rarely verify the calculation of the sales tax by the store. however, consumers are responsible for calculating and remitting use tax to the government. use tax is difficult to regulate because it relies on consumers to self report and pay.

The Difference Between Us Use Tax And Sales Tax By Quadern

Comments are closed.