Difference Between Credit Card And Debit Card Paisabazaar

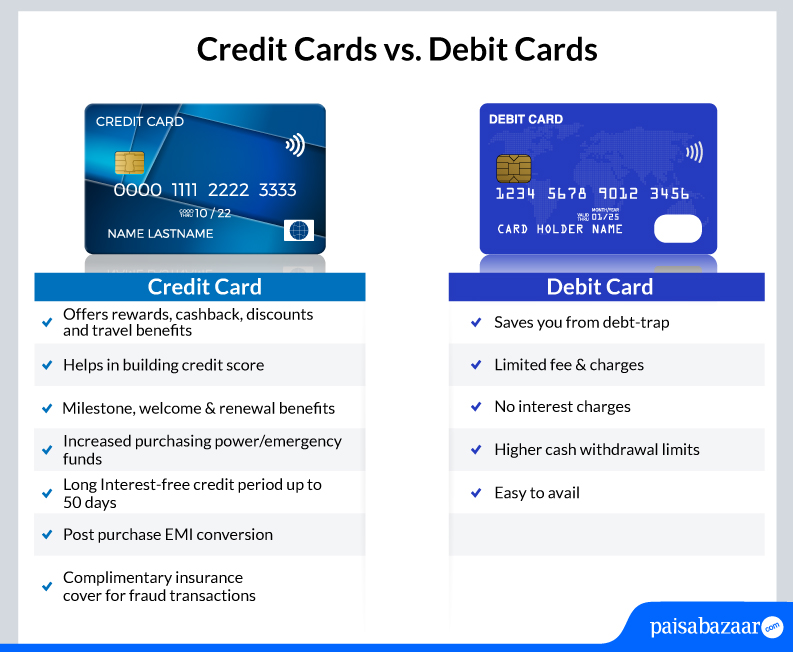

Difference Between Credit Card And Debit Card Paisabazaar 31 In terms of the card application, it is easier to avail of a debit card, in comparison to a credit card as you are required to fulfill provider specific credit card eligibility criteria. the primary difference between a debit card vs. a credit card is where the money comes from and how much money you can use. with a debit card, the money comes. 4. rewards or cashback benefits. although debit cards also offer rewards or cashback somehow credit cards are a more preferred way to earn such benefits. this is also because credit cards offer better benefits as compared to debit cards. but one thing which you should consider is that credit cards usually come with an annual fee, whereas debit.

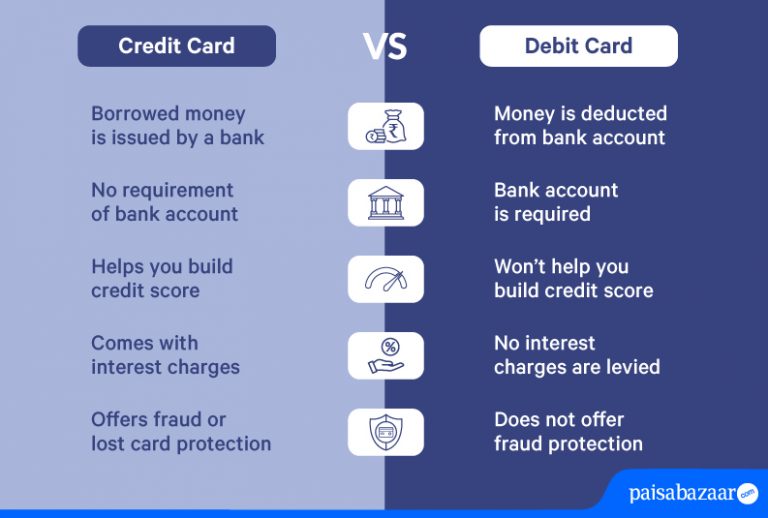

Why Are Credit Cards Better Than Debit Cards Paisabazaar 02 What is the difference between a debit card and a credit card? both debit cards and credit cards are plastic cards that look the same but function differently. with a debit card, you use the funds you have in your existing bank account, but with a credit card, you borrow funds from your card issuer and pay it back before the due date. you can. The key difference between the 2 types of cards is where the money is taken from after a purchase is made. when you use a debit card, the money comes directly from your checking account. when you use a credit card, the purchase is charged to a line of credit that you are billed for later. Wallethub senior researcher. the main difference between debit cards and credit cards is that debit cards are linked to a checking account and funds are pulled out immediately after a purchase, while credit cards are linked to a line of credit and purchases are paid off at a later date. a credit card is also far more likely to offer rewards. Credit card: it affects your credit score based on your usage and repayment period. debit card: it doesn’t involve borrowing, so it does not impact your credit score. security and fraud protection: credit card: provides better fraud prevention and often limits liability for unauthorized charges. debit card: offers basic fraud protection.

Comments are closed.