Definition Of Consumer In Law

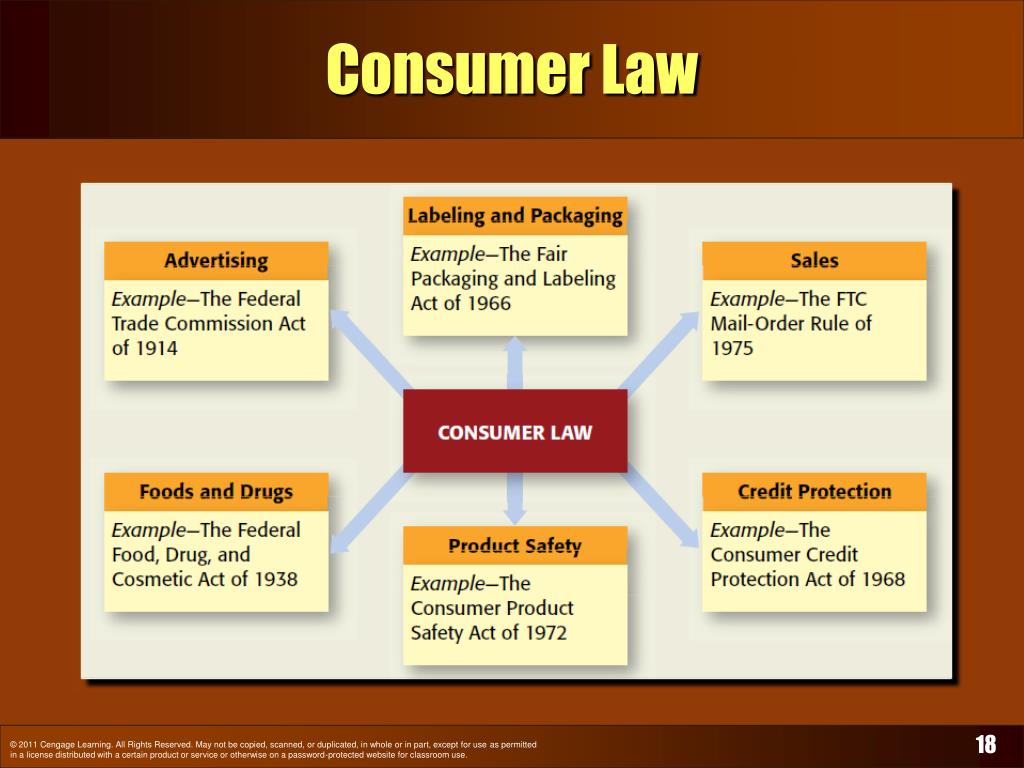

Ppt I Consumer Law Powerpoint Presentation Free Download Id 2062380 15 u.s. code § 2301 definitions. the term “ consumer product ” means any tangible personal property which is distributed in commerce and which is normally used for personal, family, or household purposes (including any such property intended to be attached to or installed in any real property without regard to whether it is so attached. Consumer law involves the regulations and statutes that create a balance between buyers and sellers. it also prevents sellers from using dishonest tactics. a consumer buys goods or services from manufacturers, wholesalers, or retailers. state and federal laws play a role in regulating consumer law. consumer laws include:.

Ppt Warranties Product Liability And Consumer Law Powerpoint Consumer protection laws. consumer protection laws safeguard purchasers of goods and services against defective products and deceptive, fraudulent business practices. historically, under the common law doctrine of caveat emptor, consumers had very little protection from misleading sales, requiring consumers to inspect all transactions themselves. Consumer rights and the law. the united states’ large and complex economy offers perhaps the broadest potential for products and services in history, but with such opportunities come the risk of scams, fraud, and outright theft. the principle of caveat emptor or “buyer beware” in modern parlance, still applies as much as it has since the. Consumer protection laws help keep businesses honest by shielding consumers against companies that operate with unfair, deceptive and fraudulent business practices. these laws have also created a. The fdcpa is a consumer protection law that prohibits unfair, abusive, deceptive, personal, family, or household debt collection methods. to achieve this, the act mainly prohibits certain kinds of communication practices. for instance, debt collectors should not contact debtors before 8 a.m. or after 9 p.m.

Comments are closed.