Defining Internal Controls In Accounts Payable Teams Eftsure

Defining Internal Controls In Accounts Payable Teams Eftsure According to cpa australia, there are seven objectives when it comes to internal controls: help align objectives of the business: to ensure thorough reporting procedures and that the activities carried out by the business are in line with the business’s objectives. safeguard assets: ensuring the business’s physical and monetary assets are. Pressure testing in accounting is a process that evaluates the effectiveness of internal controls. it involves subjecting financial procedures and processes to simulated scenarios and testing their ability to withstand risks like fraud or cyber attacks. pressure testing was widely introduced into the banking sector following the 2008 global.

Defining Internal Controls In Accounts Payable Teams Eftsure The accounts payable team for filing under the supplier’s name in the vendor master file. back to top. step 3: vendor master file. maintaining an accurate and up to date vendor master file is critical. data anomalies increase the risk of payment errors. furthermore, lax internal controls can result in cases of internal fraud. Relay pro is one accounts payable solution that can help your small business implement best practices and put internal controls on autopilot. with relay pro, your ap process is built directly into banking and comes with role based permissions for users, automated single and multi step approval workflows, same day ach payments, and automatic. Internal controls in ap are required to help ensure the safety and security of your organization’s payments and mitigate fraud. according to j.p. morgan’s 2022 afp payments fraud and control survey, 71% of organizations were victims of payment fraud attacks or attempts in 2021. with security threats on the rise, companies of all industries. Accounts payable internal controls are broken down into three sequential categories: your obligation to pay. data entry into the system. payment of the debt. ap controls help to streamline operations, mitigate the risk of losses, and organize the labor force.

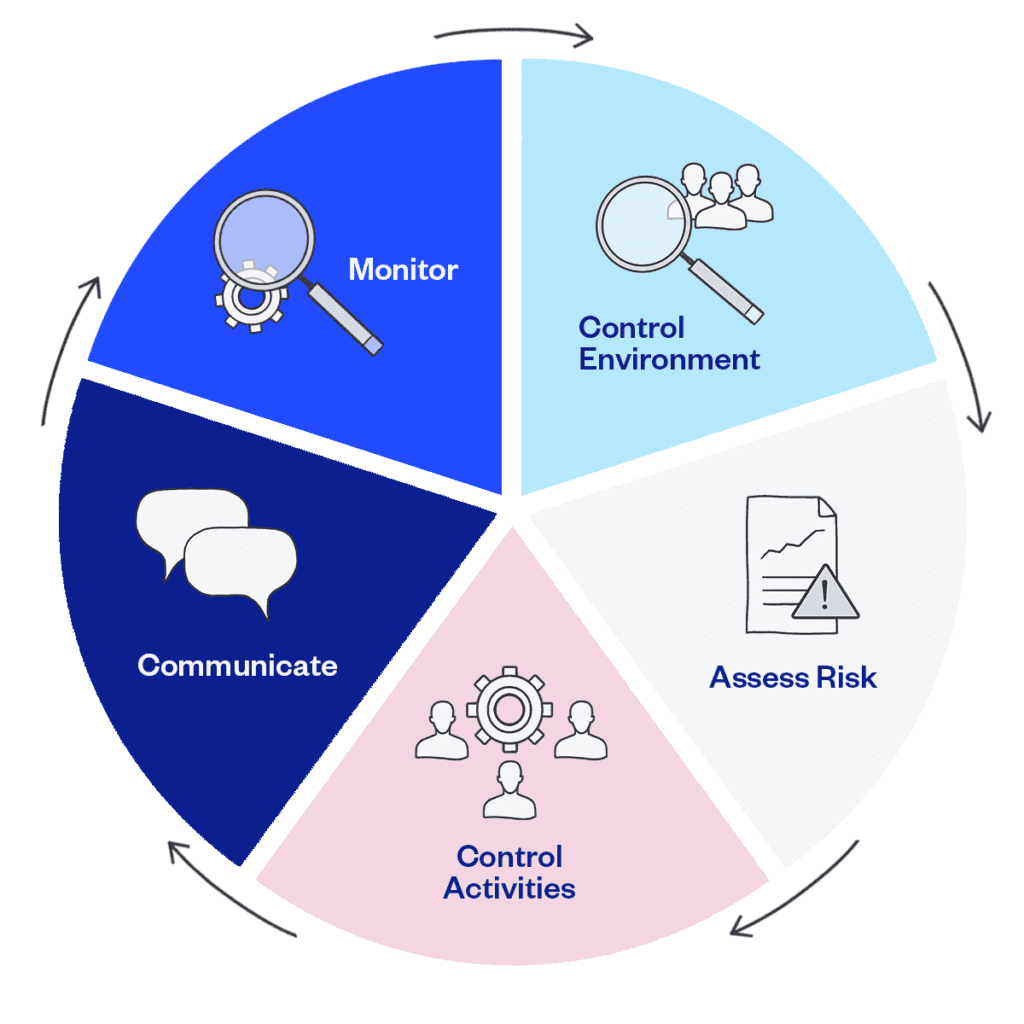

Defining Internal Controls In Accounts Payable Teams Eftsure Internal controls in ap are required to help ensure the safety and security of your organization’s payments and mitigate fraud. according to j.p. morgan’s 2022 afp payments fraud and control survey, 71% of organizations were victims of payment fraud attacks or attempts in 2021. with security threats on the rise, companies of all industries. Accounts payable internal controls are broken down into three sequential categories: your obligation to pay. data entry into the system. payment of the debt. ap controls help to streamline operations, mitigate the risk of losses, and organize the labor force. Ultimate guide to accounts payable internal controls for 2024. all businesses must expertly manage the payments they owe to other people or entities. this function, referred to as accounts payable, is critical to business operations, financial management, and long term relationship building in every industry. Accounts payable internal controls are rules and checks that businesses set up to manage their outgoing payments effectively. this helps businesses avoid mistakes like paying too much, paying the wrong person, or paying twice. a good accounts payable workflow will have three main steps where internal controls will verify that everything is.

Best Internal Controls For Accounts Payable Eftsure Ultimate guide to accounts payable internal controls for 2024. all businesses must expertly manage the payments they owe to other people or entities. this function, referred to as accounts payable, is critical to business operations, financial management, and long term relationship building in every industry. Accounts payable internal controls are rules and checks that businesses set up to manage their outgoing payments effectively. this helps businesses avoid mistakes like paying too much, paying the wrong person, or paying twice. a good accounts payable workflow will have three main steps where internal controls will verify that everything is.

Comments are closed.