Customer Lifetime Value Clv Definition Formula And Importance

Understand Calculate And Increase Your Customer Lifetime Value Clv Customer lifetime value (clv) is a business metric used to determine the amount of money customers will spend on your products or service over time. for example, if someone is loyal to an auto. The customer lifetime value formula is customer lifetime value = customer value x average customer lifespan. the clv result is the revenue you expect an average customer to generate during their relationship with your business. typically, lifetime value (ltv) calculates the overall value of all customers.

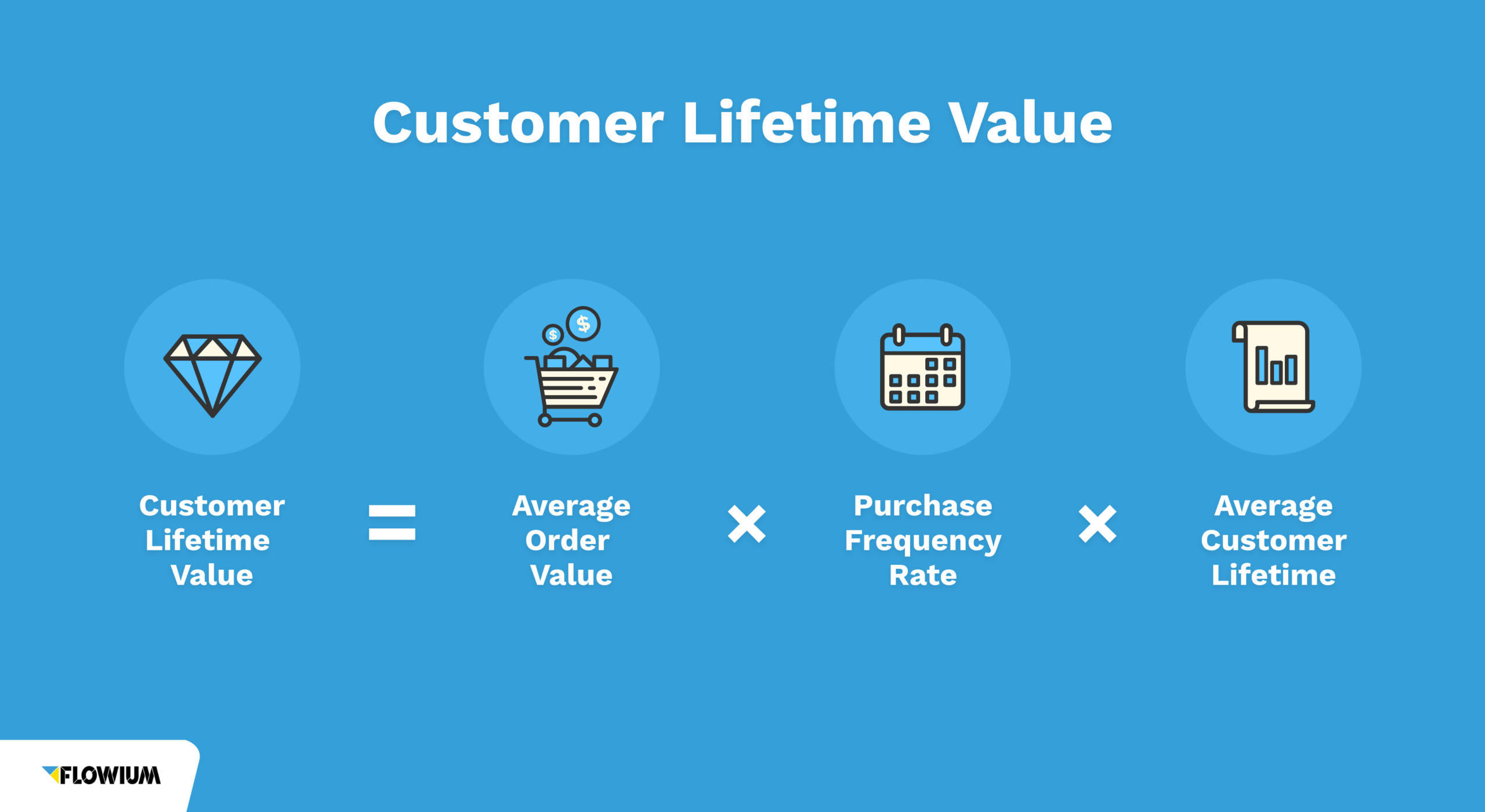

Customer Lifetime Value Clv Definition Formula And Importance Customer lifetime value (clv) is the total worth of or profit from a customer to a business over the entirety of their relationship. it is one of the most important metrics for tracking customer experience and value. as the name suggests, clv looks at how valuable a customer is to the organization as a whole, not just during a single. Customer lifetime value (clv) is defined as the present value of a customer has for a brand or an organization because of the purchases they have made in the past or the predictive value a customer might add during his her association with a business or company. read more about customer lifetime value definition, formula and what is the importance of clv. The simple formula for calculating customer lifetime value is given by: [number of purchases x value of purchase (in revenue or profit) x average customer lifespan] = customer lifetime value. one key factor to consider when deciding how to measure clv is choosing between revenue (top line) or profit (bottom line) to calculate the value of purchase. 3. customer lifetime value calculation (clv) in our next step, we divide the gross contribution per customer by the monthly churn rate, which is assumed to be 2.5% here. customer lifetime value (clv) = $16k gross contribution per customer ÷ 2.5% monthly churn = $640k. the takeaway is that for this hypothetical company, one customer is expected.

Understand Calculate And Increase Your Customer Lifetime Value Clv The simple formula for calculating customer lifetime value is given by: [number of purchases x value of purchase (in revenue or profit) x average customer lifespan] = customer lifetime value. one key factor to consider when deciding how to measure clv is choosing between revenue (top line) or profit (bottom line) to calculate the value of purchase. 3. customer lifetime value calculation (clv) in our next step, we divide the gross contribution per customer by the monthly churn rate, which is assumed to be 2.5% here. customer lifetime value (clv) = $16k gross contribution per customer ÷ 2.5% monthly churn = $640k. the takeaway is that for this hypothetical company, one customer is expected. Key takeaways. customer lifetime value (clv) is the measurement of how a customer’s worth for as long as they do business with a company. measuring clv helps fuel marketing efforts, enhance audience targeting, and reduce churn. personalization and friction reduction measures can improve clv. In the big picture, customer lifetime value is a gauge of the profit associated with a particular customer relationship, which should guide how much you’re willing to invest to maintain that relationship. that is, if you estimate one customer’s clv to be $500, you wouldn’t spend more than that to try and keep the relationship.

What Is Customer Lifetime Value Clv And How To Calculate It Key takeaways. customer lifetime value (clv) is the measurement of how a customer’s worth for as long as they do business with a company. measuring clv helps fuel marketing efforts, enhance audience targeting, and reduce churn. personalization and friction reduction measures can improve clv. In the big picture, customer lifetime value is a gauge of the profit associated with a particular customer relationship, which should guide how much you’re willing to invest to maintain that relationship. that is, if you estimate one customer’s clv to be $500, you wouldn’t spend more than that to try and keep the relationship.

Comments are closed.