Credit Unions And Banks The Differences

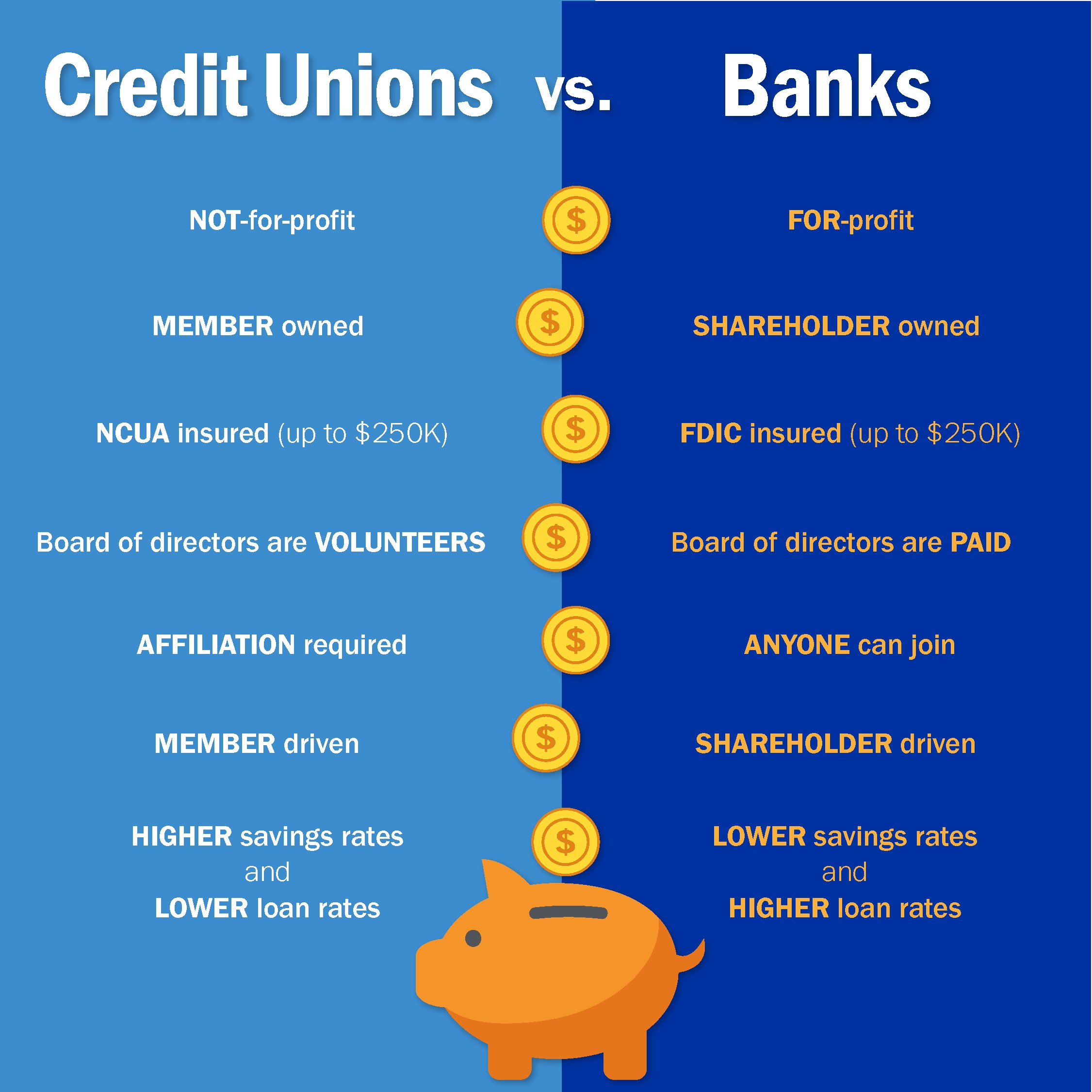

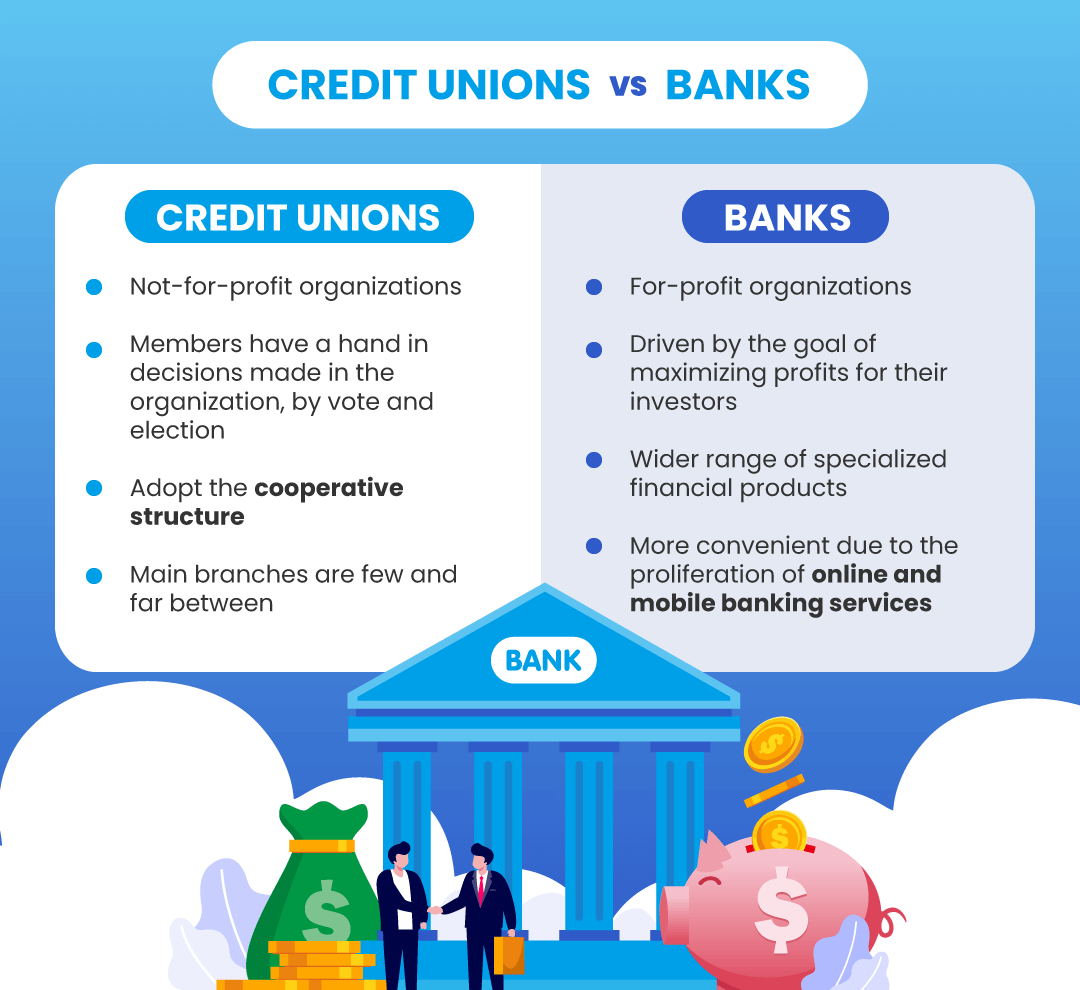

Credit Unions And Banks The Differences Understanding the difference between banks and credit unions can help you make the best decisions for your household. for profit vs. nonprofit what makes banks and credit unions different from. The main difference between a credit union and a bank is that credit unions are not for profit, whereas banks are for profit enterprises. knowing about the other differences will affect which home.

Credit Union Vs Bank What Are The Differences Azeus Convene Average credit union vs. bank fees ; credit union: bank average share draft checking nsf fee $23.86: $31.24: average credit card late fee: $24.56: $34.18: average mortgage closing costs: $1,151. Alliant credit union, ally bank and capital one are just a few of the financial institutions that have been at the forefront of this trend. the average overdraft fee decreased 11 percent from 2022. Key differences between banks & credit unions. banks and credit unions differ in terms of the following criteria: ownership and membership. banks are for profit institutions owned by shareholders interested in making a profit. anyone can be a bank's customer regardless of geographic location or affiliation. Banks are for profit and credit unions are not for profit, meaning different things for customers. published sat, oct 28 2023 andreina rodriguez @ in andreina rodriguez 33b505134 @andreina rodrgz.

Credit Unions Vs Banks вђ Us Community Credit Union Key differences between banks & credit unions. banks and credit unions differ in terms of the following criteria: ownership and membership. banks are for profit institutions owned by shareholders interested in making a profit. anyone can be a bank's customer regardless of geographic location or affiliation. Banks are for profit and credit unions are not for profit, meaning different things for customers. published sat, oct 28 2023 andreina rodriguez @ in andreina rodriguez 33b505134 @andreina rodrgz. Key differences between credit unions and traditional banks although banks and credit unions offer similar products and services, there are some major differences between the two. ownership. Key differences between credit unions and banks. both banks and credit unions offer basic financial products and services, including: savings products, such as savings accounts and certificates of deposit (cds). checking products, such as regular checking and interest bearing accounts. loan products, such as auto loans, mortgages, and credit cards.

:max_bytes(150000):strip_icc()/dotdash-credit-unions-vs-banks-4590218-v2-70e5fa7049df4b8992ea4e0513e671ff.jpg)

Credit Unions Vs Banks What S The Difference Key differences between credit unions and traditional banks although banks and credit unions offer similar products and services, there are some major differences between the two. ownership. Key differences between credit unions and banks. both banks and credit unions offer basic financial products and services, including: savings products, such as savings accounts and certificates of deposit (cds). checking products, such as regular checking and interest bearing accounts. loan products, such as auto loans, mortgages, and credit cards.

Comments are closed.