Credit Score Ranges Explained Lexington Law

Credit Score Ranges Explained Lexington Law Good credit score range: 670 – 739. the benefits of having a good credit score are that you have an easier time being approved for loans and often get better interest rates. these scores won’t get you the very best interest rates, but you’re less likely to pay high fees and interest, which is a big plus. June 29, 2022. a credit score is a number used to provide an overview of your financial health and responsibility. it pulls information from your credit reports and uses an algorithm to come up with a number, generally somewhere between 300 and 850. the information provided on this website does not, and is not intended to, act as legal.

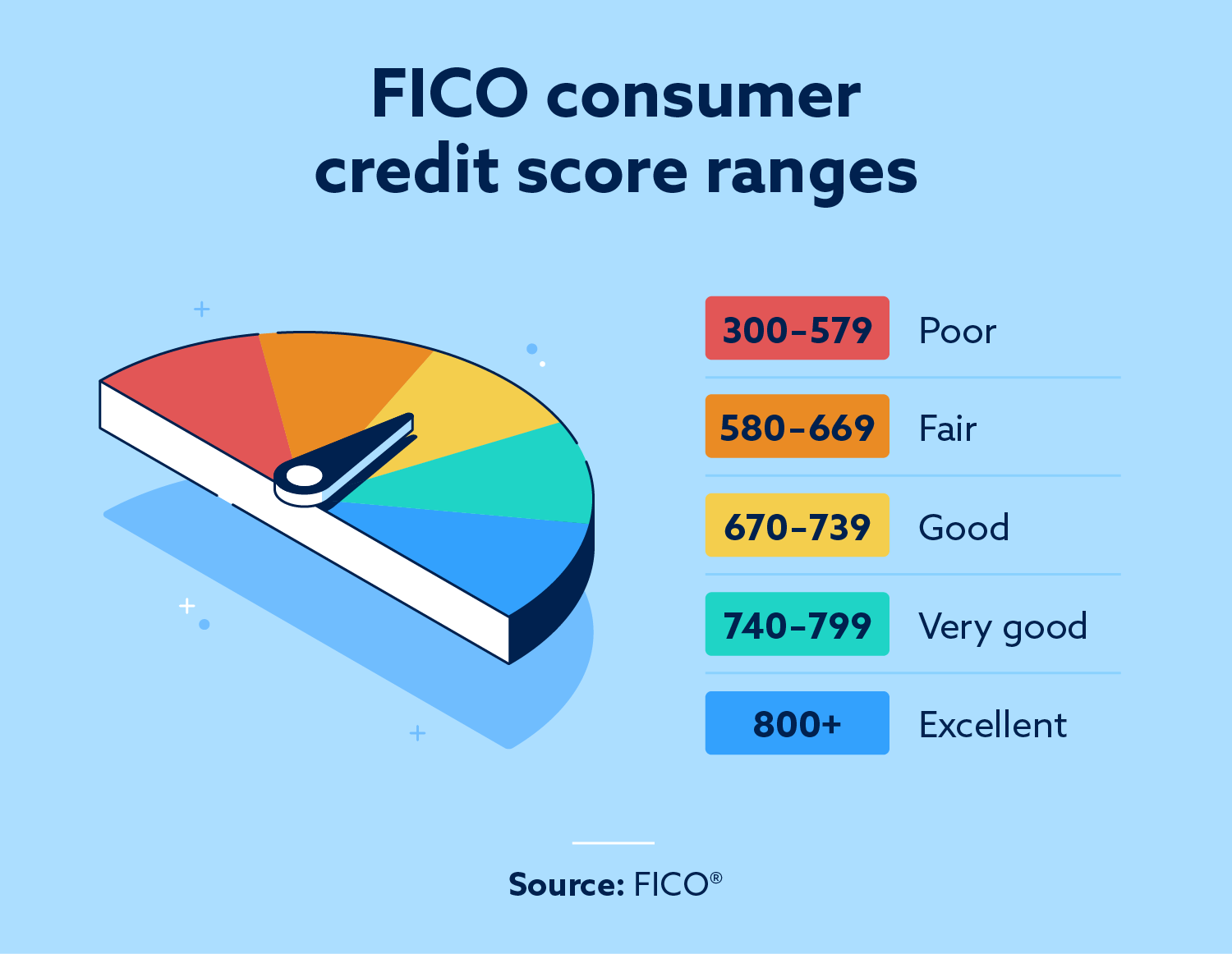

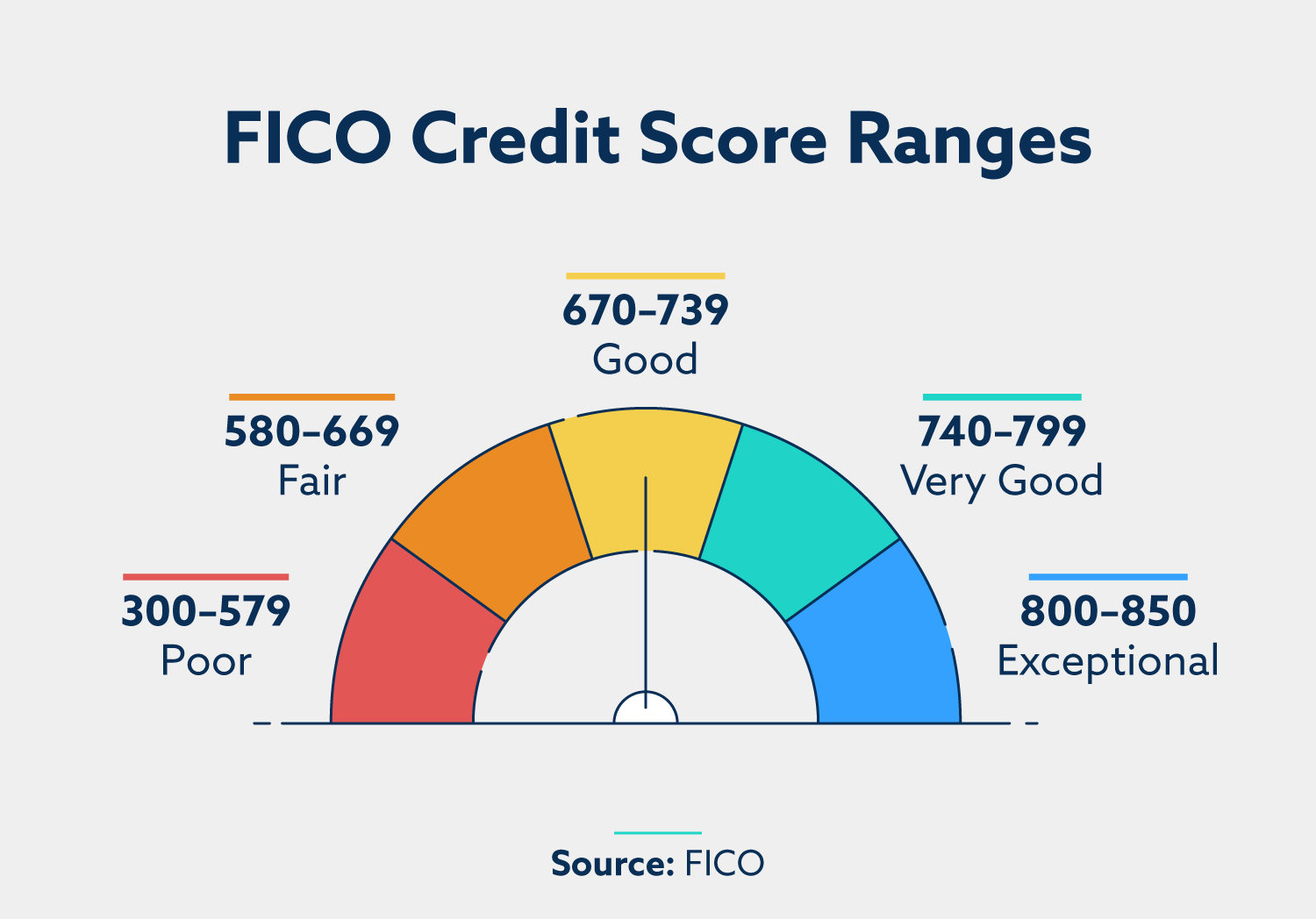

Credit Score Ranges Explained Lexington Law As your score increases, you go up in credit score ranges. the ranges include very poor, fair, good, very good and exceptional, and fortunately, a score of 746 lands you in the “very good” credit range of 740 to 799. this means that you’re likely to be approved for most loans and you’ll receive some of the best interest rates available. But both use a credit score range of 300 to 850. these are the general guidelines: a score of 720 or higher is generally considered excellent credit. a score of 690 to 719 is considered good. Credit score ranges vary across creditors and score types. for base fico scores, the credit score ranges are: poor credit: 300 to 579. fair credit: 580 to 669. good credit: 670 to 739. very good credit: 740 to 799. excellent credit: 800 to 850. 740 to 799: very good credit score. individuals in this range have demonstrated a history of positive credit behavior and may have an easier time being approved for additional credit. 670 to 739: good credit score. lenders generally view those with credit scores of 670 and up as acceptable or lower risk borrowers.

Credit Score Ranges Explained Lexington Law Credit score ranges vary across creditors and score types. for base fico scores, the credit score ranges are: poor credit: 300 to 579. fair credit: 580 to 669. good credit: 670 to 739. very good credit: 740 to 799. excellent credit: 800 to 850. 740 to 799: very good credit score. individuals in this range have demonstrated a history of positive credit behavior and may have an easier time being approved for additional credit. 670 to 739: good credit score. lenders generally view those with credit scores of 670 and up as acceptable or lower risk borrowers. That means the same credit score could represent something different depending on which credit model a lender uses. a vantagescore 3.0 score of 661 could put you in the good range for example, while a 661 fico score may be considered fair. and lenders create or use their own standards when making credit based decisions. To calculate your credit utilization ratio, divide your outstanding balance by your total credit limit. for example, if you have a credit card with a $3,000 balance and a $5,000 credit limit, you have a 60% ratio. in this case, lowering that percentage by paying down your credit card debt could potentially improve your score.

The Credit Score Range Explained Lexington Law That means the same credit score could represent something different depending on which credit model a lender uses. a vantagescore 3.0 score of 661 could put you in the good range for example, while a 661 fico score may be considered fair. and lenders create or use their own standards when making credit based decisions. To calculate your credit utilization ratio, divide your outstanding balance by your total credit limit. for example, if you have a credit card with a $3,000 balance and a $5,000 credit limit, you have a 60% ratio. in this case, lowering that percentage by paying down your credit card debt could potentially improve your score.

15 Credit Facts Everyone Needs To Know In 2021 Lexington Law

Comments are closed.