Credit Cards Vs Lines Of Credit Vs Personal Loans ођ

юааcreditюаб юааcardюаб юааvsюаб юааpersonalюаб юааloanюаб Whatтащs The юааdifferenceюаб A personal loan is a type of installment loan, and a personal line of credit is a type of revolving credit. with a personal loan, you receive funds as a lump sum and make payments in even. A personal line of credit is more similar to a credit card than a personal loan. when you apply for a line of credit, the lender approves you for a certain amount, typically up to $100,000 with.

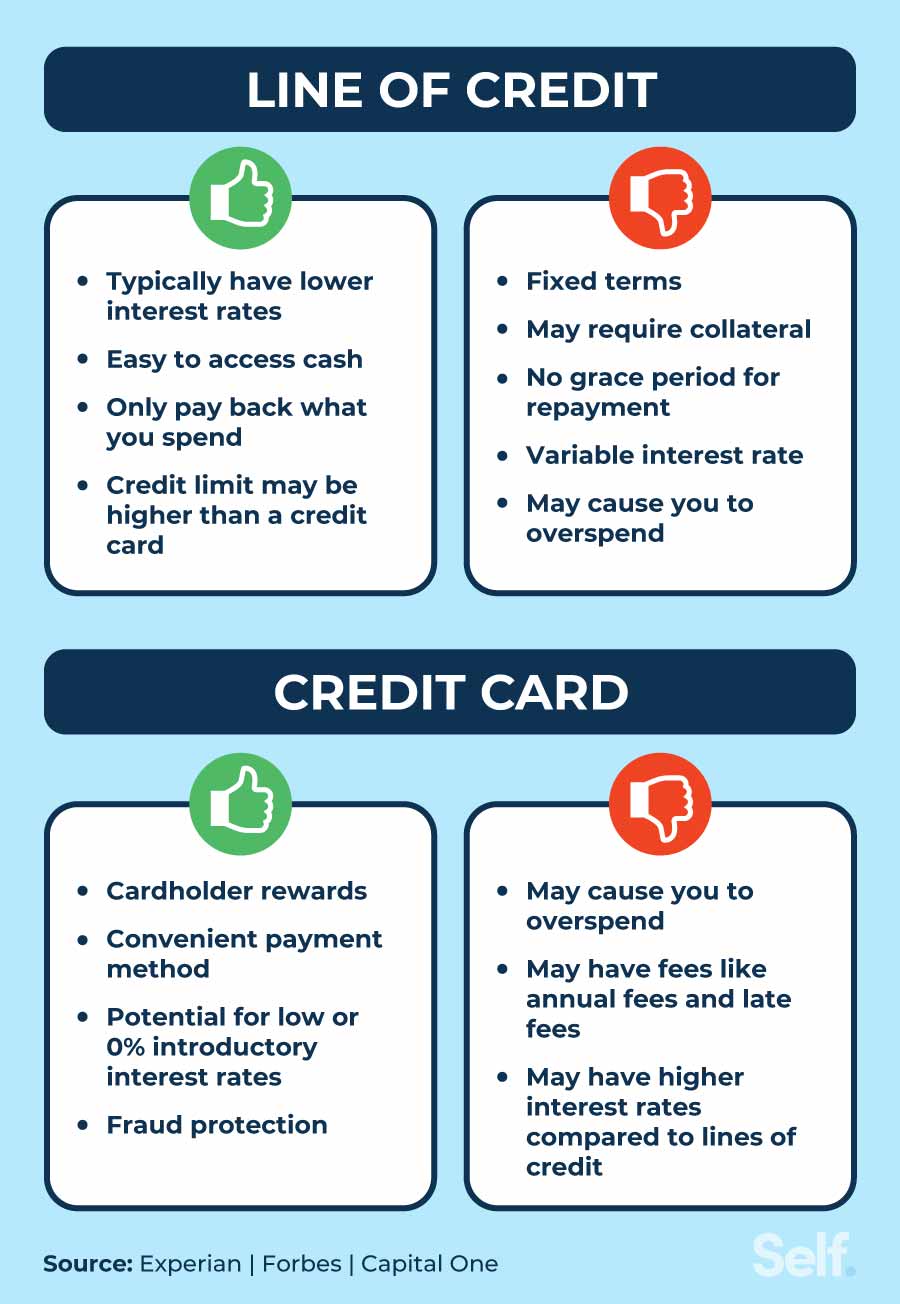

Line Of Credit Vs Credit Card The Key Differences Self Credit Bu The difference comes in how you receive your funds. borrowing a personal loan means receiving a lump sum when you are approved, while a personal line of credit functions similarly to a credit card. Personal loans usually are best for when you have large, one off expenses like car repairs or home improvement projects or if you’re consolidating high interest debt into a single loan with a. A personal line of credit gives you more flexibility than a one time personal loan, and the terms may be more favorable than a credit card when it comes to carrying a large balance you need to pay. Personal loans come in lump sums with fixed interest rates and are repaid in equal installments over time. credit cards have a revolving line of credit that you can repeatedly draw from and repay.

Personal Loan Vs Line Of Credit Finance Strategists A personal line of credit gives you more flexibility than a one time personal loan, and the terms may be more favorable than a credit card when it comes to carrying a large balance you need to pay. Personal loans come in lump sums with fixed interest rates and are repaid in equal installments over time. credit cards have a revolving line of credit that you can repeatedly draw from and repay. In contrast, a personal loan is often the better option if you only need to borrow funds once and don’t have an ongoing need for credit. 3. account for your preferences. whether you take out a. A personal loan provides a lump sum of cash. a line of credit provides funds that you can draw from continuously for a certain period, up to a certain limit. personal loans have fixed interest rates. personal lines of credit have variable ones. but there’s more to both than that.

Personal Loans Vs Line Of Credit вђ What S The Difference In contrast, a personal loan is often the better option if you only need to borrow funds once and don’t have an ongoing need for credit. 3. account for your preferences. whether you take out a. A personal loan provides a lump sum of cash. a line of credit provides funds that you can draw from continuously for a certain period, up to a certain limit. personal loans have fixed interest rates. personal lines of credit have variable ones. but there’s more to both than that.

Comments are closed.