Credit Cards Should You Use Credit Cards Pros Cons Of Creditо

Credit Cards Pros And Cons Should You Use Them Decent Fina Credit cards have notoriously high interest rates. right now, the average credit card interest rate is just over 20 percent, though some cardholders carry aprs even higher. most credit cards have. Convenience. one of the biggest advantages of using a credit card for spending is the ease of use. it’s a lot simpler to keep a card in your wallet than a wad of cash, and you don’t have to.

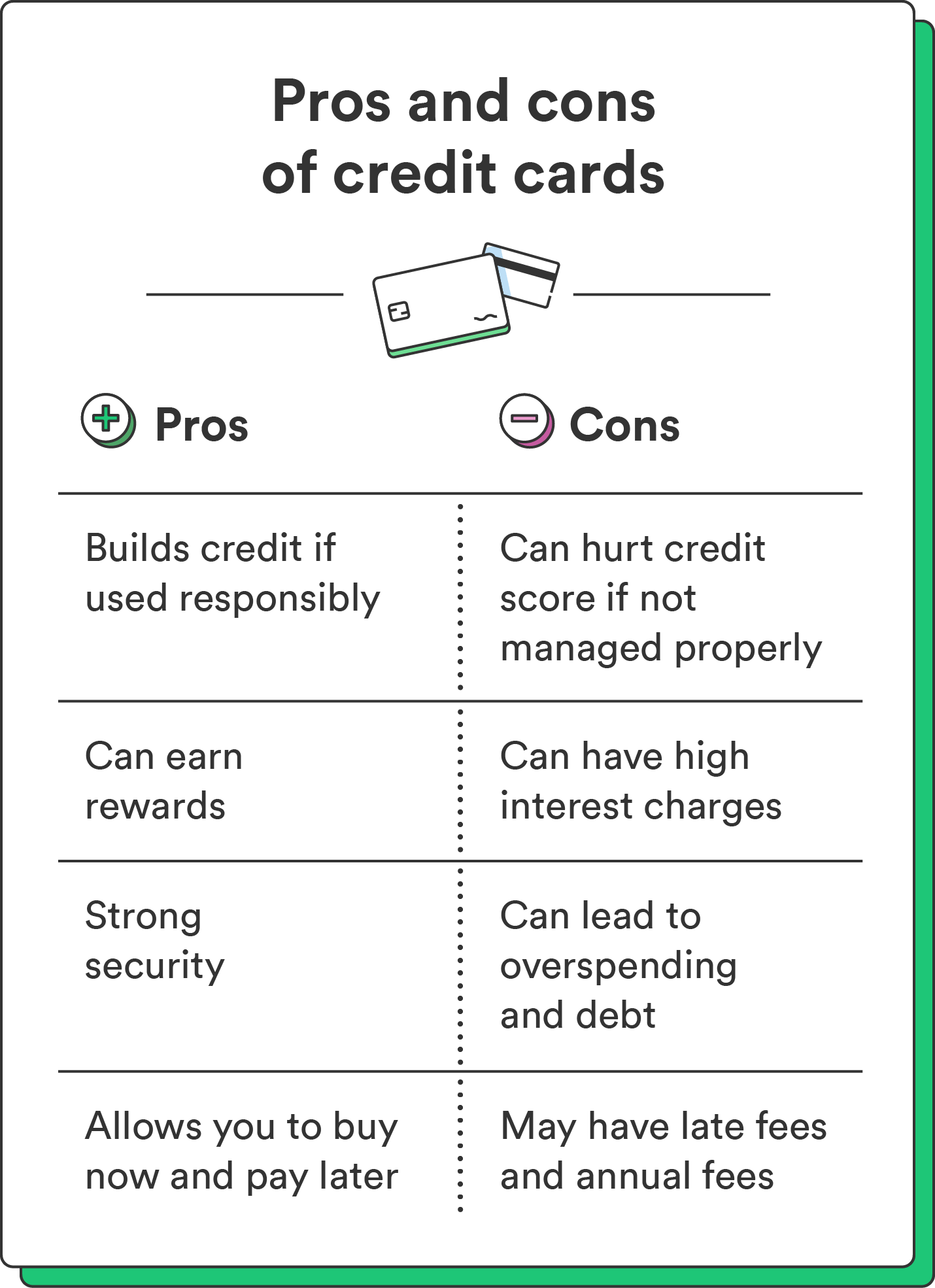

How Do Credit Cards Work The Beginners Guide Chime Pros of using a credit card for everyday purchases. earn as many rewards as you can by charging your card on everything — from a morning coffee to concert tickets. build your credit score steadily by spending on small, everyday items and paying them off in full. consumer protections, like purchase protection and extended warranty, come in. Credit cards can be a convenient way to manage your finances, but they can also be expensive and risky. compare the pros and cons of credit cards to decide whether you should get one. 13 benefits of using a credit card. some of the pros that come with paying on plastic include: a credit card is safer than carrying cash. Pros include: building credit, convenience, rewards and incentives, freedom to shop online, and cover for emergencies. cons include: potentially harming credit, overspending and going into debt, high interest, and fees. the key things to consider are responsible use and spending within your budget. credit cards are a convenient financial tool. Pros of credit cards. cons of credit cards. educational categories. credit cards are a great way to purchase the things you need now but want to pay for later. while it is possible for credit cards to be used to your advantage, irresponsible usage can negatively impact cardholders in a number of ways. whether you are a credit cardholder or plan.

Credit Card Advantages And Disadvantages Benefits Pros And Co Pros include: building credit, convenience, rewards and incentives, freedom to shop online, and cover for emergencies. cons include: potentially harming credit, overspending and going into debt, high interest, and fees. the key things to consider are responsible use and spending within your budget. credit cards are a convenient financial tool. Pros of credit cards. cons of credit cards. educational categories. credit cards are a great way to purchase the things you need now but want to pay for later. while it is possible for credit cards to be used to your advantage, irresponsible usage can negatively impact cardholders in a number of ways. whether you are a credit cardholder or plan. Credit cards have both pros and cons, though with responsible use, the benefits far outweigh the downsides. the pros of credit cards range from convenience and credit building to 0% financing, rewards and cheap currency conversion. the cons of credit cards include the potential to overspend easily, which leads to expensive debt if you don’t. Credit card pros. credit card cons. can help you build credit if you’re careful about the way you use the card. access to credit could lead to debt and spending beyond your means. may earn rewards. typically need to pay interest if you carry a balance month to month. protection against unauthorized charges.

Comments are closed.