Credit Card Delinquency Rates Hit A Nearly 12 Year High

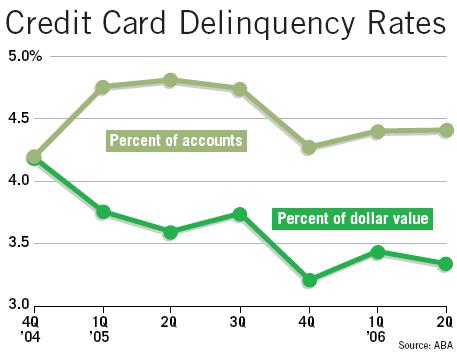

Infographic Credit Card Delinquency Rates American Banker Credit card delinquency rates hit levels not seen in more about the same pace as over the past year, though refinancing activity was limited due to high mortgage rates, and delinquency rates Falling behind on your credit card payments can result in a fine and damage your credit score Paying down high-interest debt Your credit score will take a hit if the payment is more than

Whatтащs Behind The Rise In юааcreditюаб юааcardюаб Delinquencies Paymentssource The researchers noted that it is typical for credit card performance to deteriorate at the end of the year to battle high inflation and interest rates All stages of credit card delinquency An increasing number of Americans are reaching the limits on their credit cards According to the Federal Reserve, credit card delinquency rates have hit a nearly 12-year high In the first quarter of Melanie Lockert is a freelance writer with nearly a Compared to a year ago, credit card balances are up 58% In addition, credit card delinquency rates also remain high, with 91% of credit If the Fed cuts interest rates today, borrowers will likely see interest rates ease off their peaks on things like credit cards and auto loans

States With The Highest Lowest Credit Card Delinquency Rates Melanie Lockert is a freelance writer with nearly a Compared to a year ago, credit card balances are up 58% In addition, credit card delinquency rates also remain high, with 91% of credit If the Fed cuts interest rates today, borrowers will likely see interest rates ease off their peaks on things like credit cards and auto loans About 91% of credit-card balances transitioned into delinquency over the last year, according to data released days overdue — hasn’t been that high since 2011, when the US was still Industry analysts worry the trend is only going to continue into 2023 with economists expecting unemployment to rise, inflation to remain relatively high show credit card delinquency rates CREDIT CARD DELINQUENCY RATES HIT WORST LEVEL SINCE 2012 IN NEW FED STUDY American households' ballooning debt burden occurs against the backdrop of the inflation rate hitting a 40-year high of 9 Credit cards continued to be the primary driver of rising debt with outstanding balances reaching $122 billion, up 137 per cent from Q2 2023 On average, card delinquency rates in Ontario hit

Credit Card Delinquency Rates In The U S Mapped By State R Brokeonomics About 91% of credit-card balances transitioned into delinquency over the last year, according to data released days overdue — hasn’t been that high since 2011, when the US was still Industry analysts worry the trend is only going to continue into 2023 with economists expecting unemployment to rise, inflation to remain relatively high show credit card delinquency rates CREDIT CARD DELINQUENCY RATES HIT WORST LEVEL SINCE 2012 IN NEW FED STUDY American households' ballooning debt burden occurs against the backdrop of the inflation rate hitting a 40-year high of 9 Credit cards continued to be the primary driver of rising debt with outstanding balances reaching $122 billion, up 137 per cent from Q2 2023 On average, card delinquency rates in Ontario hit Excerpts from recent editorials in the United States and abroad: ___ Sept 14 The Washington Post on the effects of legalized gambling The new National Consumer debt levels topped C$25 trillion last quarter, jumping 42% from a year earlier Credit card borrowing was the biggest contributor to rising debt as outstanding balances hit C$122 billion

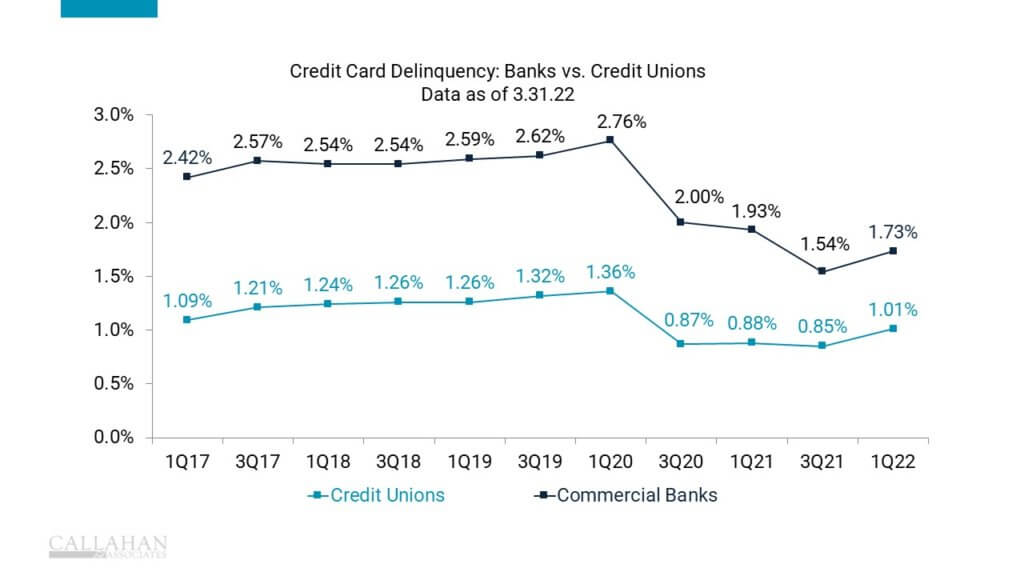

Graph Of The Week Credit Card Delinquency Rates Inching Back Up вђ Nascus CREDIT CARD DELINQUENCY RATES HIT WORST LEVEL SINCE 2012 IN NEW FED STUDY American households' ballooning debt burden occurs against the backdrop of the inflation rate hitting a 40-year high of 9 Credit cards continued to be the primary driver of rising debt with outstanding balances reaching $122 billion, up 137 per cent from Q2 2023 On average, card delinquency rates in Ontario hit Excerpts from recent editorials in the United States and abroad: ___ Sept 14 The Washington Post on the effects of legalized gambling The new National Consumer debt levels topped C$25 trillion last quarter, jumping 42% from a year earlier Credit card borrowing was the biggest contributor to rising debt as outstanding balances hit C$122 billion

Comments are closed.