Cpa Vs Cma Vs Cfa Top 10 Differences Infographics

Cpa Vs Cma Vs Cfa Top 10 Differences Infographics The primary difference in professionals with a cpa, cma, or cfa certification lies in their area of expertise. while a cpa specializes in general accounting and finance, a cma is an expert in management accounting and a cfa in finance and investment services. in the context of cpa vs cma vs cfa, although these professionals function in the. The average annual salary range of a licensed cpa professional is $82,000 to $129,000. in comparison, a us cma earns an average of $73,000 to $133,000, and a cfa professional earns around $126,000 to $177,000 in the usa. now that you know about the salary particulars of cpa vs cma vs cfa, let's take a look at the side by side comparison.

Cpa Vs Cma Vs Cfa Top 10 Differences Infographics 52 Off The major difference in professionals with a certified public accountant, certified management accountant, or chartered financial analyst certification lies in their expertise area. while a us cpa specializes in finance and general accounting, a us cma is excellent in management accounting and a cfa in investment and finance services. When looking to advance your career, in finance or accounting acquiring a certification can greatly improve your opportunities. some of the certifications in this field include the certified public accountant (cpa) chartered financial analyst (cfa) and certified management accountant (cma). And if your own bottom line is a concern, cma holders report a median annual compensation that is 67 percent higher than their non certified colleagues, according to the march 2016 ima global salary survey. the cma certification, like other accounting credentials, comes with a price tag—. the certified public accountant (cpa) credential is. Like a cpa, a cma salary also depends on geography, experience, and the role, but cmas report a 19 percent higher median salary than their non certified peers 3. the average salary is approximately $118,122, as they often specialize in financial leadership and drive business success through strategy.

Cpa Vs Cma Vs Cfa Top 10 Differences Infographics And if your own bottom line is a concern, cma holders report a median annual compensation that is 67 percent higher than their non certified colleagues, according to the march 2016 ima global salary survey. the cma certification, like other accounting credentials, comes with a price tag—. the certified public accountant (cpa) credential is. Like a cpa, a cma salary also depends on geography, experience, and the role, but cmas report a 19 percent higher median salary than their non certified peers 3. the average salary is approximately $118,122, as they often specialize in financial leadership and drive business success through strategy. The primary difference between cfa and cma is the skills you obtain. cfa is conducted by the cfa institute (usa) and focuses on enhancing investment management skills, including investment analysis, portfolio strategy, asset allocation, and corporate finance. whereas cma is conducted by the institute of management accountants, enabling you to. The main difference is that a cpa qualification (certified public accountant) is for those candidates who seek a career in the field of accounting, auditing and taxation, while a cfa designation (chartered financial analyst ) prepares candidates for investment portfolio management and corporate finance profiles.

Cpa Vs Cma Vs Cfa Top 10 Differences Infographics 52 Off The primary difference between cfa and cma is the skills you obtain. cfa is conducted by the cfa institute (usa) and focuses on enhancing investment management skills, including investment analysis, portfolio strategy, asset allocation, and corporate finance. whereas cma is conducted by the institute of management accountants, enabling you to. The main difference is that a cpa qualification (certified public accountant) is for those candidates who seek a career in the field of accounting, auditing and taxation, while a cfa designation (chartered financial analyst ) prepares candidates for investment portfolio management and corporate finance profiles.

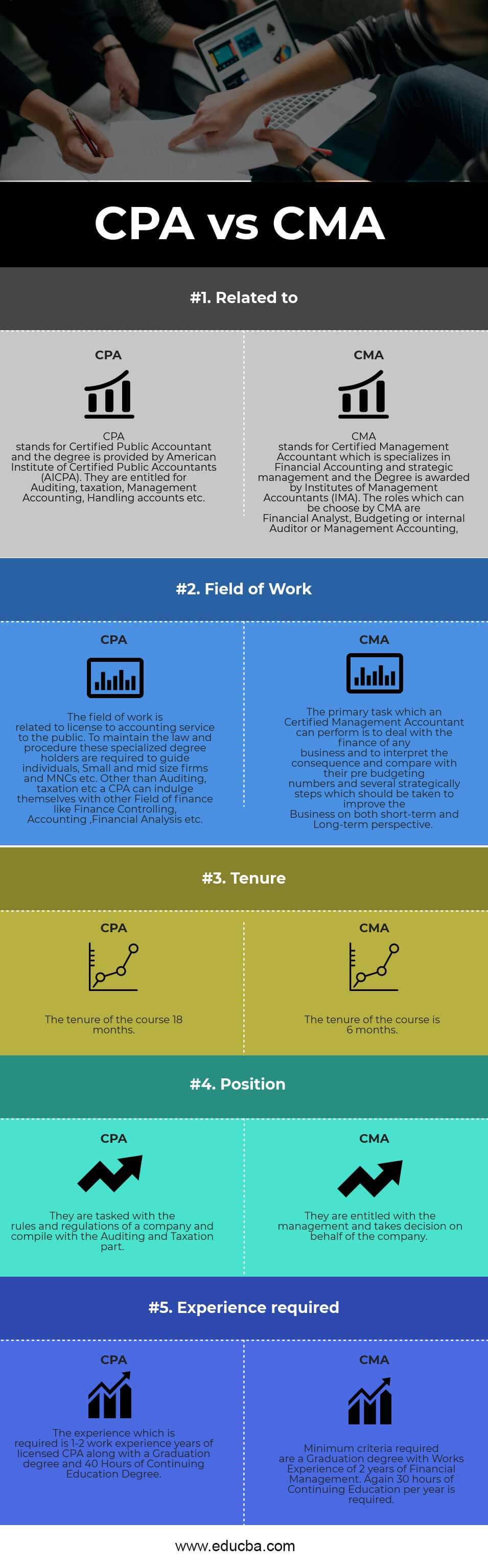

Cpa Vs Cma Top 5 Best Differences With Infographics

Comments are closed.