Consumercredittransaction

Ppt Chapter 5 Introduction To Consumer Credit Powerpoint Presentation Consumer credit law & practice in the u.s.1. 1. introduction. consumer credit is an important element of the united states economy. a consumer’s ability to borrow money easily allows a well managed economy to function more efficiently and stimulates economic growth. Key takeaways. consumer credit is credit issued to individuals that is not collateralized. installment credit is provided in a lump sum and then repaid in regular installments over a set period of.

Business Law 51 Consumer Credit Transactions Youtube Consumer credit refers to the ability of a consumer to access a loan. the most common form of credit used by consumers is a credit card account issued by a financial institution. merchants may also provide direct financing for products which they sell. banks may directly finance purchases through loans and mortgages. The amendments essentially lower the rate of interest for money judgments entered against a natural person in consumer debt cases from 9% to 2% beginning on april 30, 2022. legislation: consumer credit fairness act — s153. rate of interest applicable to money judgments for consumer debt — s5724 a. court rules:. Consumer credit transaction. the term “consumer credit transaction” means any transaction in which credit is offered or extended to an individual for personal, family, or household purposes. Libretexts. the amount of consumer debt, or household debt, owed by americans to mortgage lenders, stores, automobile dealers, and other merchants who sell on credit is difficult to ascertain. one reads that the average household credit card debt (not including mortgages, auto loans, and student loans) in 2009 was almost $16,000.

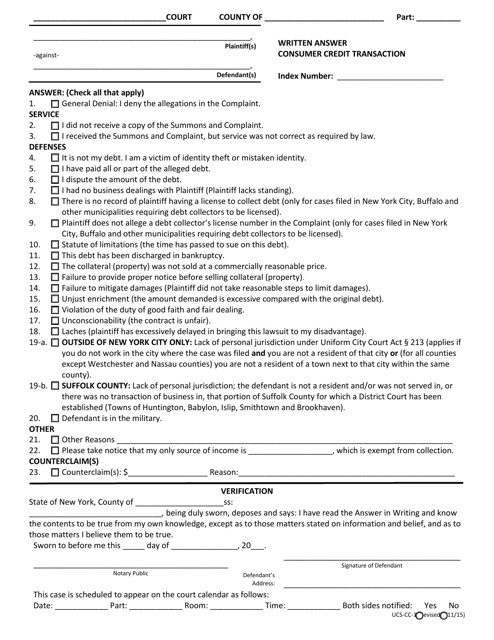

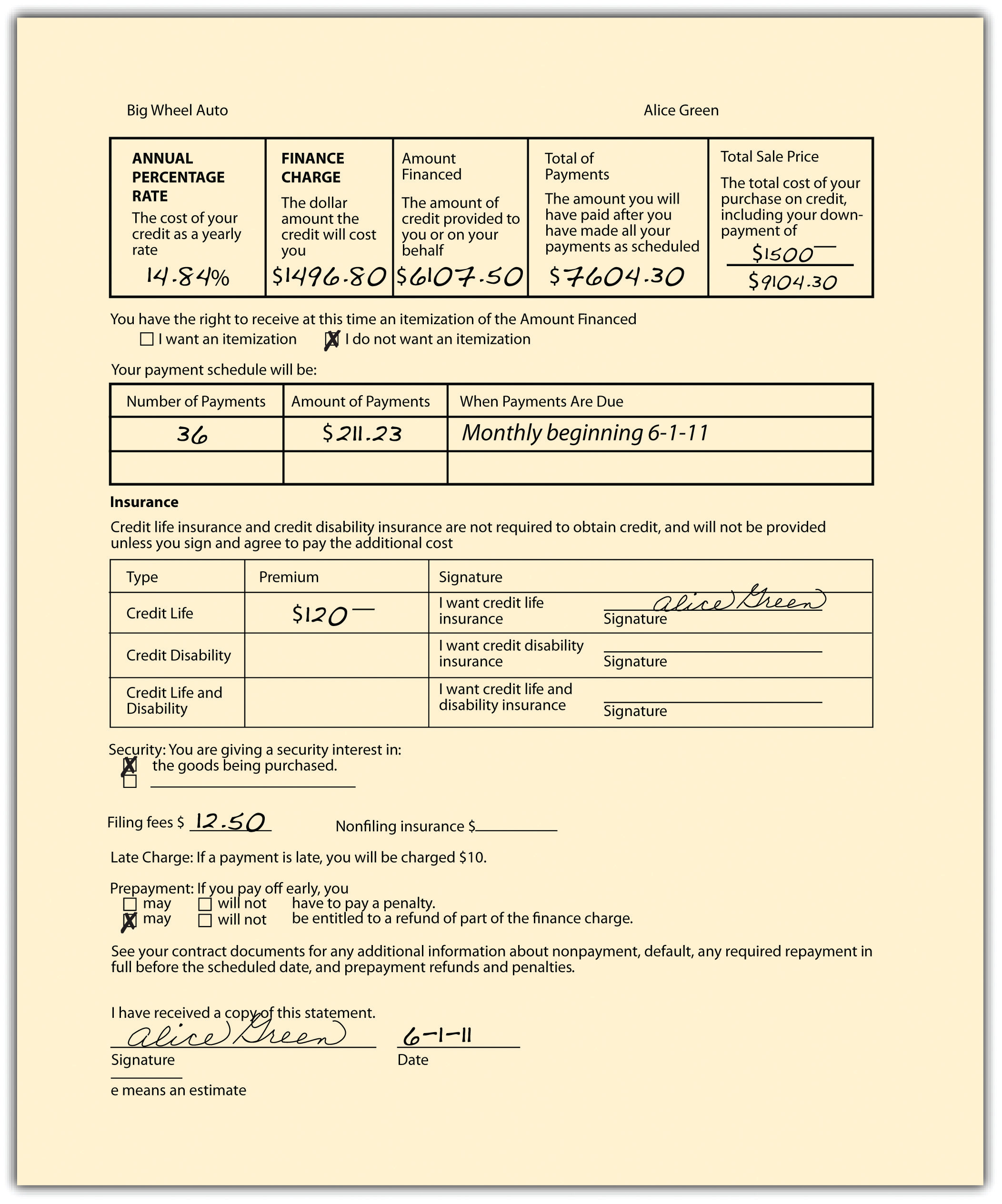

Form Ucs Cc 1 Fill Out Sign Online And Download Fillable Pdf New Consumer credit transaction. the term “consumer credit transaction” means any transaction in which credit is offered or extended to an individual for personal, family, or household purposes. Libretexts. the amount of consumer debt, or household debt, owed by americans to mortgage lenders, stores, automobile dealers, and other merchants who sell on credit is difficult to ascertain. one reads that the average household credit card debt (not including mortgages, auto loans, and student loans) in 2009 was almost $16,000. The truth in lending act (tila) covers your consumer credit transaction when: (1) you are an individual person and the credit is being used primarily for personal, family or household purposes; (2) the transaction involves repayment in more than four installments; and (3) you will incur finance charges. under the tila, you must receive full. View a sample of this title using the readnow feature. detailed treatment of the law with practical, step by step guidance for every stage of a consumer credit transaction. covers 18 major consumer credit laws, including: • truth in lending. • fair credit reporting. • equal credit opportunity. • community reinvestment. • electronic.

Consumer Credit Transactions The truth in lending act (tila) covers your consumer credit transaction when: (1) you are an individual person and the credit is being used primarily for personal, family or household purposes; (2) the transaction involves repayment in more than four installments; and (3) you will incur finance charges. under the tila, you must receive full. View a sample of this title using the readnow feature. detailed treatment of the law with practical, step by step guidance for every stage of a consumer credit transaction. covers 18 major consumer credit laws, including: • truth in lending. • fair credit reporting. • equal credit opportunity. • community reinvestment. • electronic.

Important Guide About Consumer Credit And The 2 Types Of It

Comments are closed.