Consumer Portfolio Services An Example From The Subprime Auto

Consumer Portfolio Services An Example From The Subprime Auto Consumer portfolio services, inc. (nasdaq:cpss) is a subprime auto loan asset backed securities ("abs") originator.as such, they arrange the financing for subprime borrowers. as of the last. Consumer portfolio services inc. operates on a simple principle: everyone needs a car. for more than two decades, the irvine subprime auto lender, known as cps, has helped finance vehicles for.

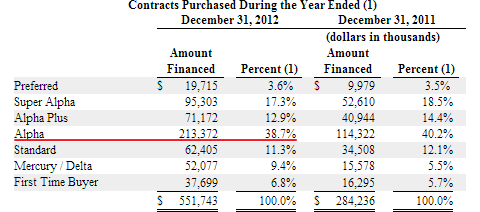

Consumer Portfolio Services An Example From The Subprime Auto A national subprime auto lender will pay more than $5.5 million to settle federal trade commission charges that the company used illegal tactics to service and collect consumers’ loans, including collecting money consumers did not owe, harassing consumers and third parties, and disclosing debts to friends, family, and employers. Equifax released a report on october 6 that stated more than 31% of auto loans are considered subprime loans. A specialty auto lender for those with poor credit. consumer portfolio services (cps) is a finance company that specializes in providing auto loans to people with poor credit histories, low incomes, or limited credit profiles. founded in 1991 and based in irvine, california, cps primarily works with independent and franchise car dealerships to. Consumer finance company focused on sub prime auto market. established in 1991. ipo in 1992. through june 30, 2023, approximately $20.7 billion in contracts originated. headquarters in las vegas, nevada. branches in california, nevada, illinois, virginia and florida. approximately 803 employees as of june 30, 2023.

Comments are closed.