Consumer Debt Statute Of Limitations

)

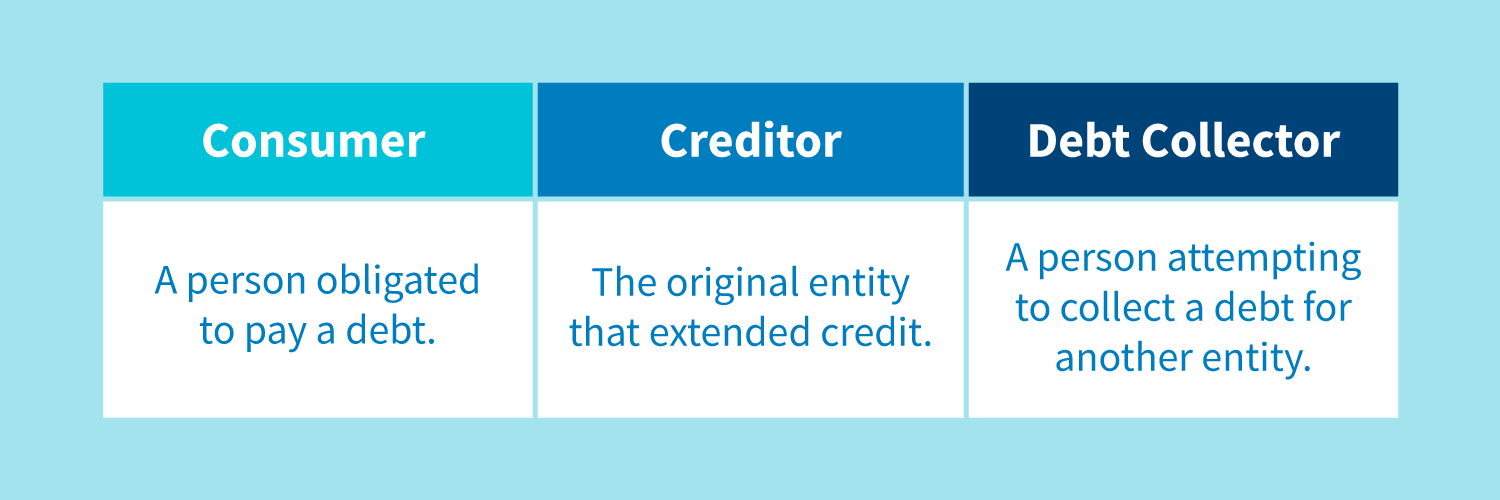

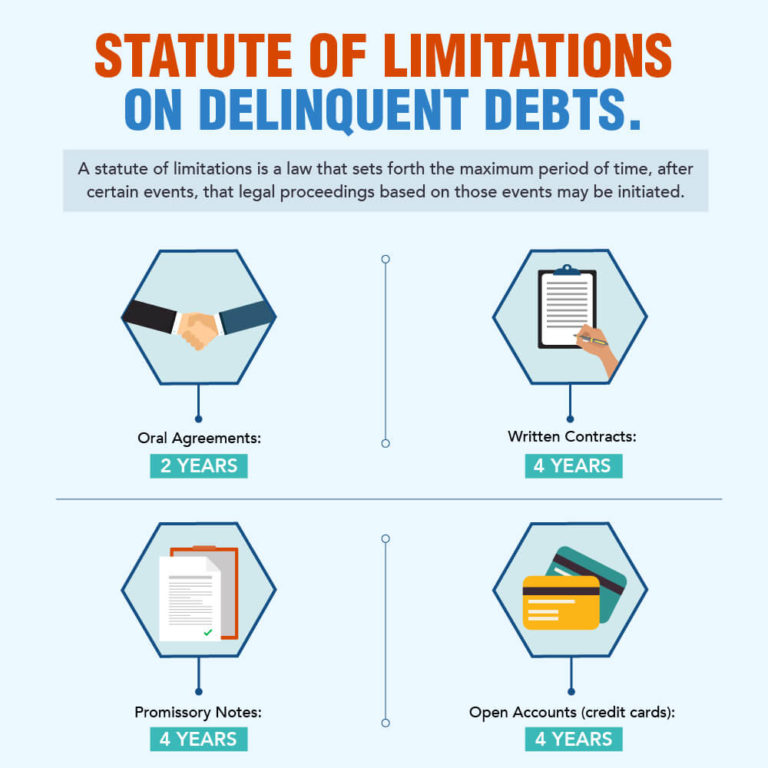

What Determines The Statute Of Limitations On Consumer Debt The statute of limitations on debt collection is the amount of time a bill collector has to file a lawsuit against someone over debt. it protects debtors from being liable for their debts forever. The statute of limitations on debt typically falls within three to six years, although some periods are as long as 15 years. under a rule change enacted in 2020 by the consumer financial.

The Fdcpa Statute Of Limitations Creditrepair The statute of limitations on debt is a rule limiting how long a creditor can sue you for payment on a debt. all consumer debts, from credit card balances to medical bills, have limits on the. For example, massachusetts, connecticut, maine, and vermont have six year statute of limitations for credit card debt, while neighboring new hampshire’s is just three years. here is a chart showing the statute of limitations for all 50 states, plus washington, d.c. state. written contracts. oral contracts. For example, if you miss a payment on a debt with a five year statute of limitations on july 1, 2024, then after july 1, 2029, the statute of limitations will have passed. at this point, the. In some states, if you pay any amount on a time barred debt, or even promise to pay, the debt is “revived.”. that means the clock resets, and a new statute of limitations begins. the collector might be able to sue you to collect the full amount of the debt, which may include extra interest and fees. pay off the debt.

Statute Of Limitations On Debt Including Credit Card Debt In All 50 For example, if you miss a payment on a debt with a five year statute of limitations on july 1, 2024, then after july 1, 2029, the statute of limitations will have passed. at this point, the. In some states, if you pay any amount on a time barred debt, or even promise to pay, the debt is “revived.”. that means the clock resets, and a new statute of limitations begins. the collector might be able to sue you to collect the full amount of the debt, which may include extra interest and fees. pay off the debt. If you have old, unpaid debts, you might be safe from lawsuits to collect them. creditors and debt collectors have a limited number of years to sue you for outstanding debts. this time limit is called the " statute of limitations." the time allowed varies significantly from state to state, and for different kinds of debts. Most states or jurisdictions have statutes of limitations between three and six years for debts, but some may be longer. this may also vary depending, for instance, on the: type of debt. state where you live. state law named in your credit agreement. if you’re sued by a debt collector and the debt is too old, you may have a defense to the.

Statute Of Limitations On Debt In California California Consumer If you have old, unpaid debts, you might be safe from lawsuits to collect them. creditors and debt collectors have a limited number of years to sue you for outstanding debts. this time limit is called the " statute of limitations." the time allowed varies significantly from state to state, and for different kinds of debts. Most states or jurisdictions have statutes of limitations between three and six years for debts, but some may be longer. this may also vary depending, for instance, on the: type of debt. state where you live. state law named in your credit agreement. if you’re sued by a debt collector and the debt is too old, you may have a defense to the.

Statute Of Limitations Sol Expired Debt Credit Dispute Letter Template

Comments are closed.