Construction Loans Everything You Need To Know

Construction Loans 101 Everything You Need To Know Down payment: you’ll likely need a down payment of 20% when taking out a construction loan. choice of builder: the lender will need to approve the builder of your new home and verify their licensing and insurance. construction plan: the lender will also need to approve your construction plan. You will typically need a decent credit score (620 or higher), a debt to income ratio of 43% or less and a down payment (20%, in many cases). here’s the process you’ll need to follow to get a.

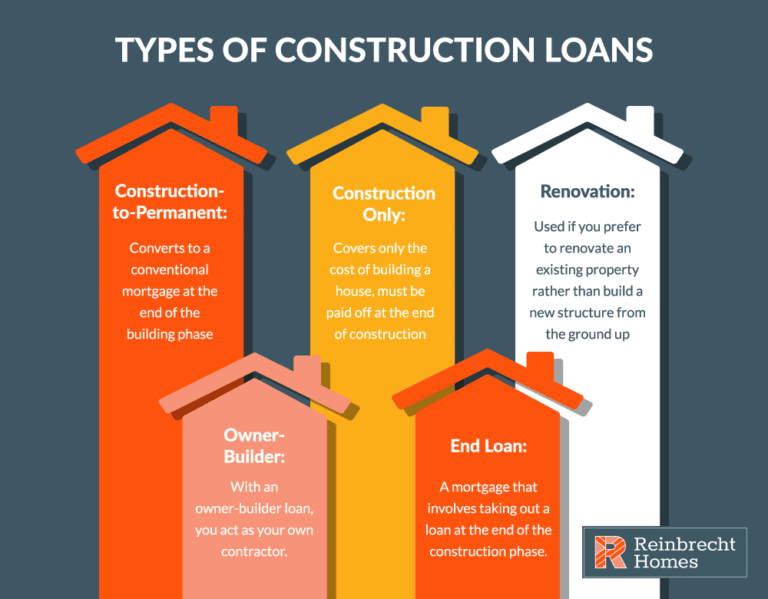

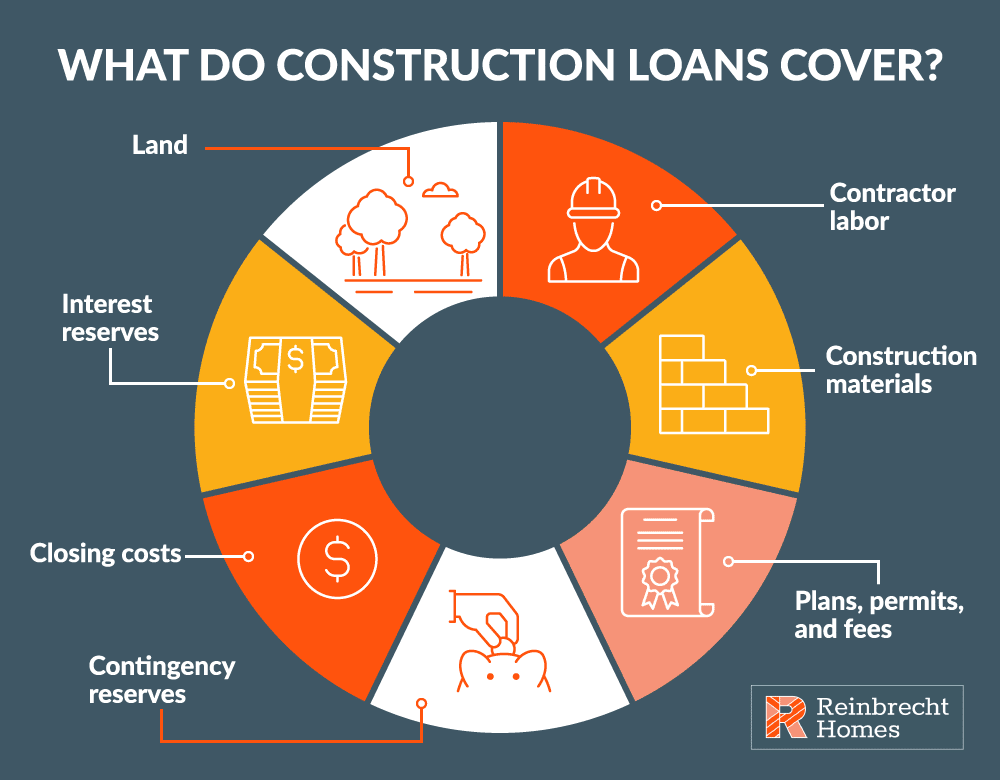

Construction Loans 101 Everything You Need To Know Here's what you need to know about construction loans and how it works. building a house from scratch can be a great opportunity to get the home you’ve always wanted. but construction costs can. In real estate, a construction loan is a specialized type of loan used to finance building residential property. they may also be called self build construction loans, home building loans , construction mortgages, “one time close loan” or “two time close loan.”. either a professional builder or a consumer homebuyer can take out a. To get a construction loan, you’ll need a low debt to income ratio and proof of sufficient income to repay the loan. you also generally need a credit score of at least 680. make a down payment. A construction loan is typically a short term, high interest mortgage that helps finance construction on a property, which could include the cost of the land, contractors, building materials and permits. the interest is typically higher compared to other loans because the investment comes with a bit more risk for the lender.

Construction Loans 101 Everything You Need To Know To get a construction loan, you’ll need a low debt to income ratio and proof of sufficient income to repay the loan. you also generally need a credit score of at least 680. make a down payment. A construction loan is typically a short term, high interest mortgage that helps finance construction on a property, which could include the cost of the land, contractors, building materials and permits. the interest is typically higher compared to other loans because the investment comes with a bit more risk for the lender. How to get a construction loan. here are the basic steps to get a construction loan: 1. confirm your eligibility for any special program. if you’re interested in an fha construction loan or a va construction loan, check out the requirements and processes for each. 2. get preapproved. A construction loan is a short term loan, which covers the cost of home construction projects. construction loans can be used to cover the cost of buying land, hiring a contractor, and purchasing building materials. you can also use your construction loan to pay for all the plans, permits and fees associated with building a home as well as your.

Comments are closed.