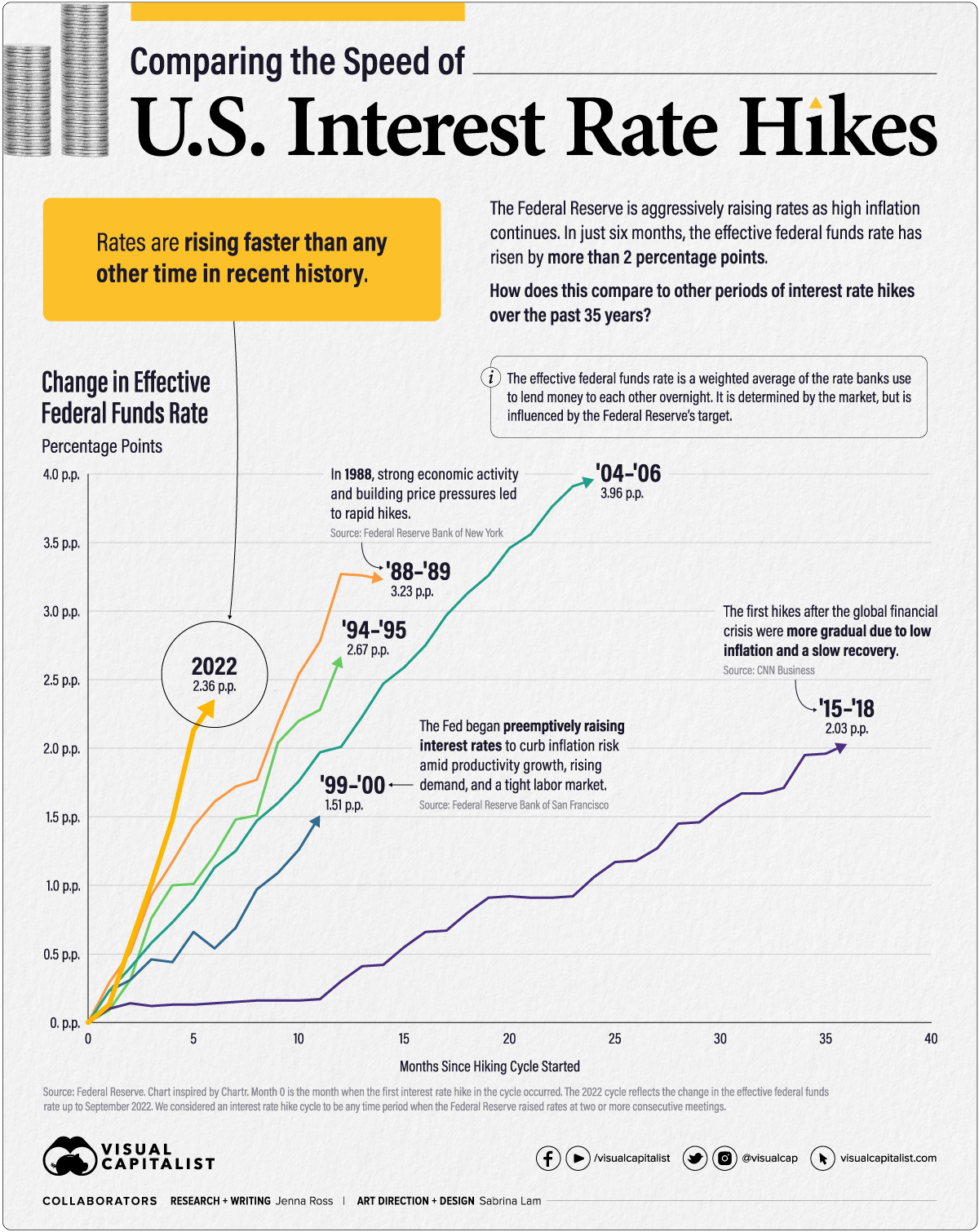

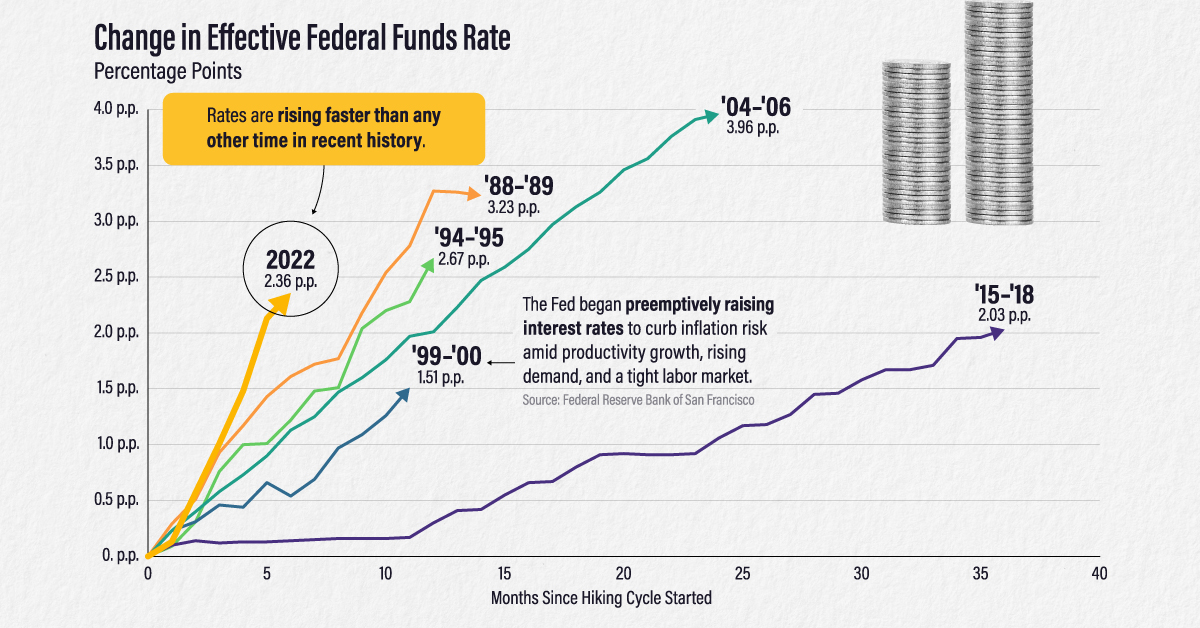

Comparing The Speed Of U S Interest Rate Hikes 1988 2022

Comparing The Speed Of U S Interest Rate Hikes 1988 2022 The 2022 rate hike cycle is ongoing with data as of september 2022. the 2022 rate hike cycle is the fastest, reaching a 2.36 percentage point increase nearly twice as fast as the rate hike cycle of ‘88 ‘89. on the other hand, the most severe interest rate hikes occurred in the ‘04 – ‘06 cycle when the effr climbed by almost four. The 2022 2023 rate hike cycle is ongoing, with the latest hike made on may 4, 2023. when we last compared the speed of interest rate hikes in september 2022, the current cycle was the fastest but not the most severe. in the months since, the total rate change of 4.88 p.p. has surpassed that of the ‘04 ‘06 rate hike cycle.

Comparing The Speed Of U S Interest Rate Hikes 1988 2022 Reser ve's target. source: federal reser ve. char t inspired by char t, month 0 is the month when the first interest rate hike in the cycle occurred. the 2022 2023 cycle reflects the change in the effective federal funds rate up to may 2023. data is monthly based on daily averages apar t from may 2023 data, which uses data as of may 4,2023. As u.s. inflation remains at multi decade highs, the federal reserve has been aggressive with its interest rate hikes. in fact, rates have risen more than two percentage points in just six months. in this graphic—which was inspired by a chart from chartr—we compare the speed and severity of the current interest rate hikes to other periods. Below, we show average annual 10 year treasury yields, a proxy for u.s. interest rates, and their annual percentage change since 1980. data is as of may 2, 2023. over the last four decades, the highest average annual interest rate was 13.9% in 1981, while the lowest was 0.9% in 2020. Through its rate hikes in 2022 & 2023, the fed aimed to contain inflationary forces and maintain “maximum” levels of employment — all while steering the economy clear of recession.

Comments are closed.