Climate Transition Index How It Fits Into Portfolios Youtube

Climate Transition Index How It Fits Into Portfolios Youtube Sarah hopkins, head of equity solutions, discusses how the cti fits into portfolios. for more, visit willistowerswatson en us insights campai. These 186 new funds bring the total number of climate funds to 636 globally. assets in climate funds have increased by 50% so far in 2021 to reach $275 billion. unsurprisingly given its greater.

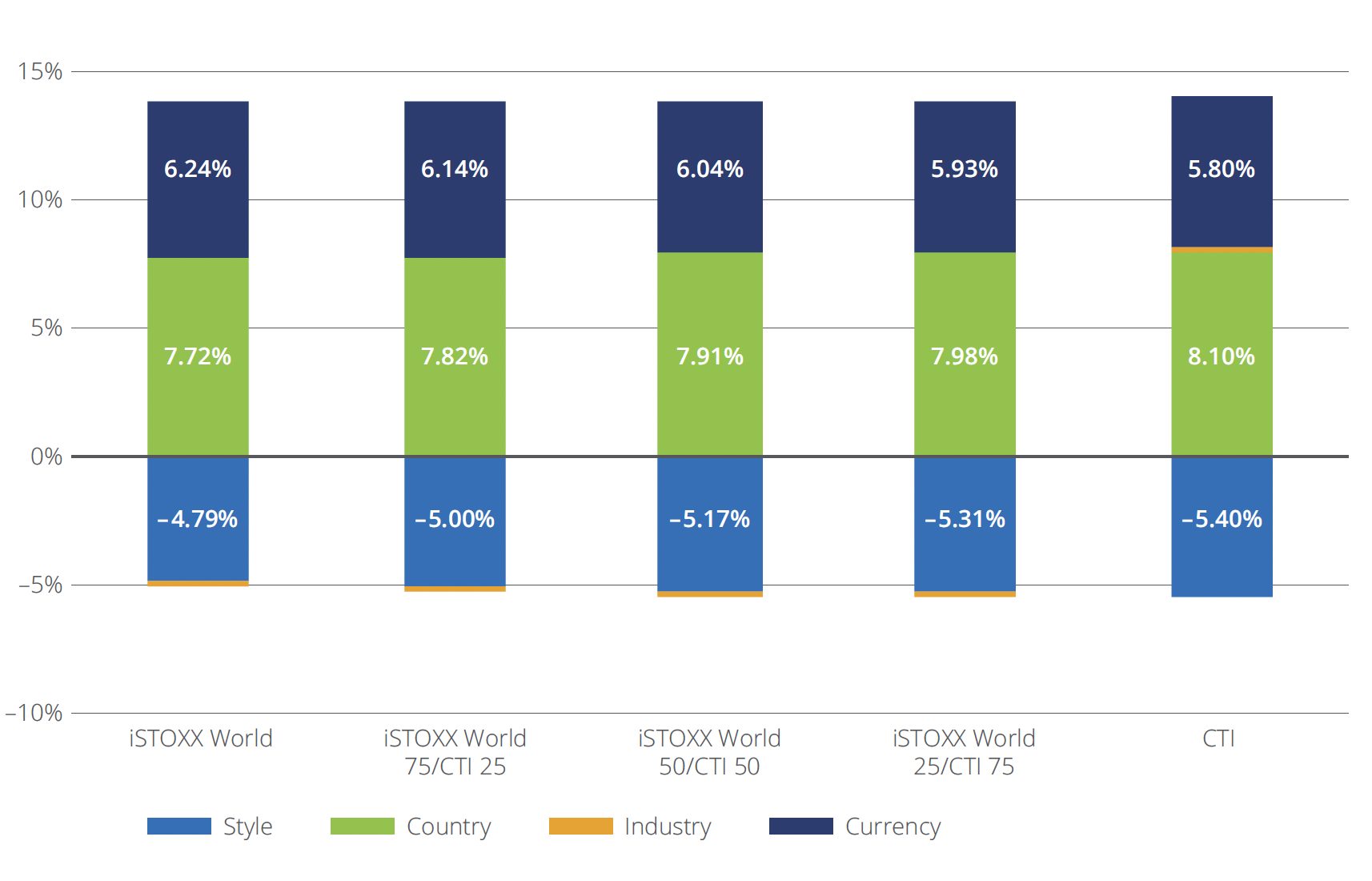

Measuring Portfolio Alignment To Climate Scenarios And Climate “this index can be fit easily into an equity allocation or overall asset allocation, without changing your risk profile,” melissa said. higher returns as the ctis tilt away from companies that are likely to experience meaningful losses in value in a climate transition, and favor those that will benefit, this has strong long term return. The long time horizon also means that: 1) integrating climate into portfolios is likely to be a more natural fit for asset owners with extended horizons, and 2) asset owners who do want to take a more climate aware approach will likely be better served by applying an extended horizon to their investment decisions. Climate change is an economic reality and a growing risk that investors, businesses and governments are learning to address. as the impacts of climate change mount, as shown in display 1, it has become well understood that greenhouse gas emissions resulting from human activity are the primary cause of climate change, and must decrease. Ctvar methodology. transition risk is defined as the loss or gain in value due to the transition to the net zero economy from changes to policy, regulation, technology, and consumer preferences. it is measured by the expected change in today’s prices as a result of the transition – we call this measurement climate transition value at risk.

Climate Transition Indices вђ A Risk Profile Analysis Esg Climate change is an economic reality and a growing risk that investors, businesses and governments are learning to address. as the impacts of climate change mount, as shown in display 1, it has become well understood that greenhouse gas emissions resulting from human activity are the primary cause of climate change, and must decrease. Ctvar methodology. transition risk is defined as the loss or gain in value due to the transition to the net zero economy from changes to policy, regulation, technology, and consumer preferences. it is measured by the expected change in today’s prices as a result of the transition – we call this measurement climate transition value at risk. Investors are aligning their investment strategies with the goal of reaching net zero emissions by the middle of this century. the push to net zero reflects the marked transformation that climate change is expected to exert on the allocation of capital in the years and decades to come 11. in fact, net zero targets may toughen in the run up to. 2. integrating esg and climate into portfolios. climate funds defined as mutual funds and etfs that have “climate” in the product name and include climate specific considerations in the investment strategy. uncategorized climate funds = 106, article 8 climate funds = 45, article 9 climate funds = 72.

Climate Transition Index Implications On The Investment Process Youtube Investors are aligning their investment strategies with the goal of reaching net zero emissions by the middle of this century. the push to net zero reflects the marked transformation that climate change is expected to exert on the allocation of capital in the years and decades to come 11. in fact, net zero targets may toughen in the run up to. 2. integrating esg and climate into portfolios. climate funds defined as mutual funds and etfs that have “climate” in the product name and include climate specific considerations in the investment strategy. uncategorized climate funds = 106, article 8 climate funds = 45, article 9 climate funds = 72.

Comments are closed.