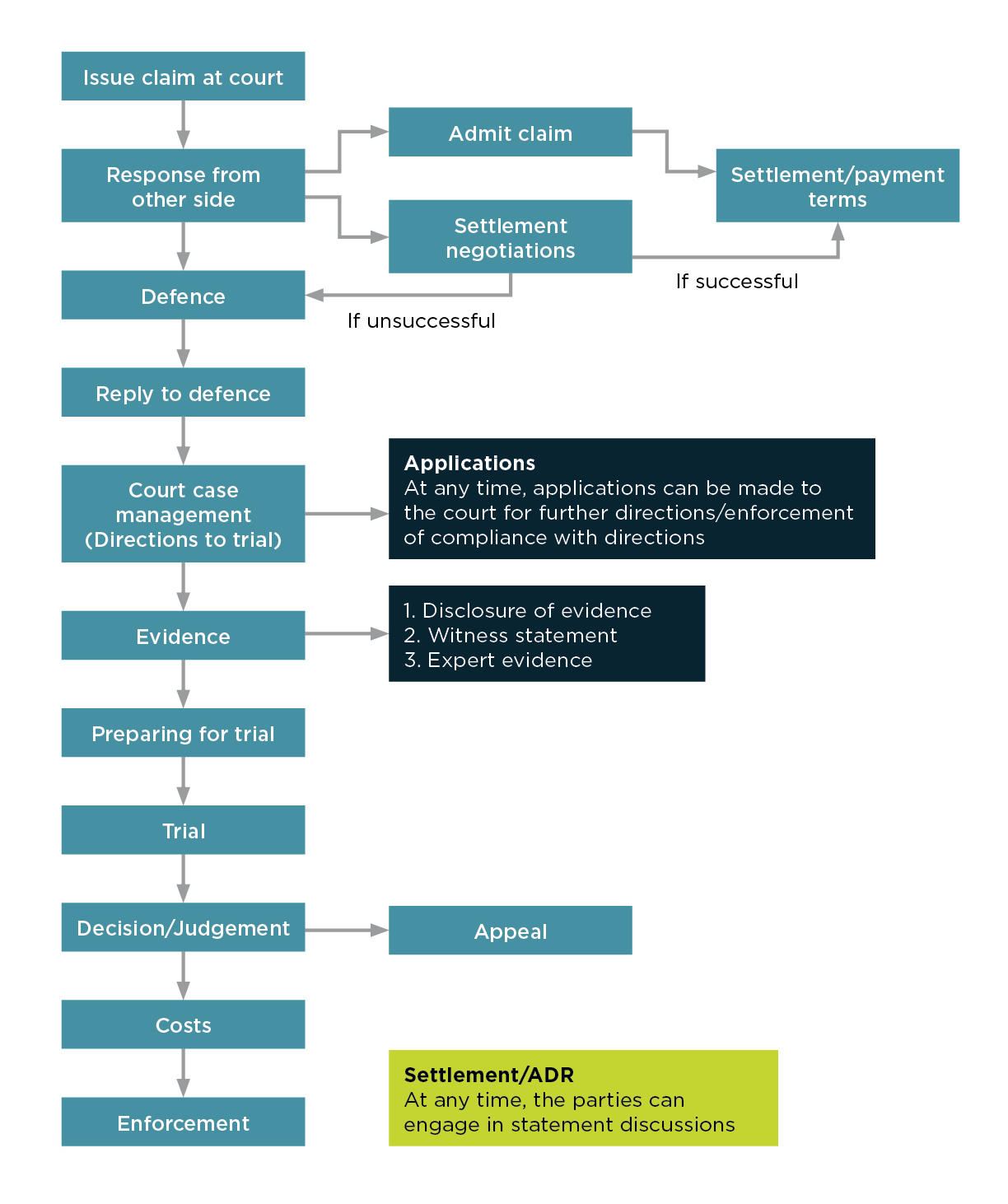

Claim Process Flow Chart

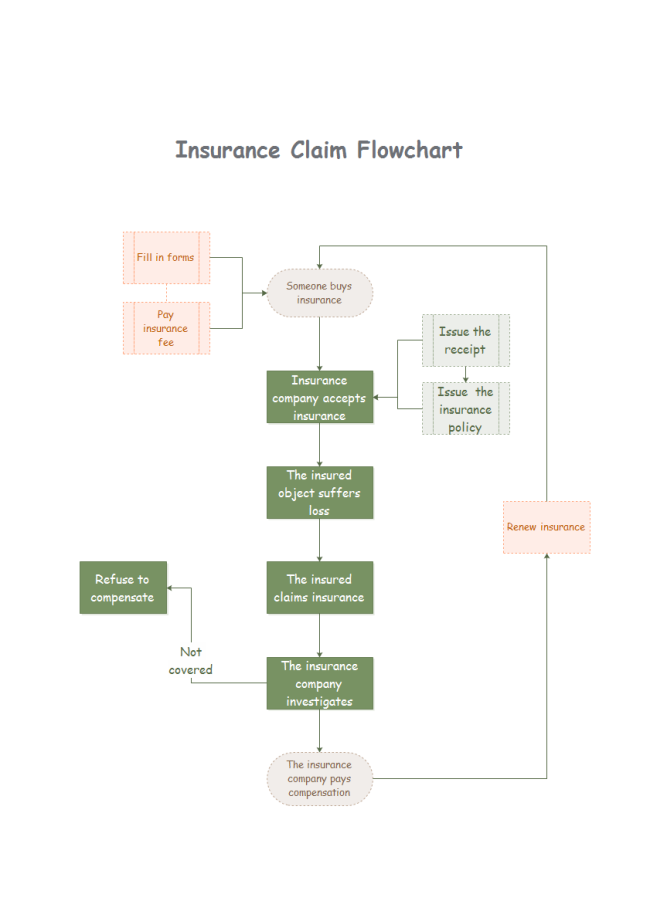

Claims Management Process Flow Chart Template 5: flowchart representing the insurance company claim process. this ppt template is a straightforward tool to help clarify the insurance company claims procedure. the template is efficiently divided into parts using this one step flowchart template, including assurance, investigations, and policy. 1. connect with your broker: establishing the foundation of your claims process. initiating the insurance claims process is a pivotal moment, and your first point of contact is your trusted insurance broker. this initial connection sets the tone for the entire journey, laying the groundwork for a seamless and efficient resolution to your claim.

Insurance Claims Process Flow Chart This flowchart illustrates the sequential progression of the claim adjudication process, ensuring a thorough review and fair payment determination for healthcare providers. by following this structured approach, insurance payers can streamline the adjudication process and enhance the accuracy of payment decisions. This process resolves disputes as to the amount of loss, not coverage. in this process, you and the insurance company will each appoint an appraiser to provide an expert opinion on the claim’s value. these experts then appoint an umpire. when two of the three parties agree, the claim can be settled. 30 to 60 days. step #4: review of evidence. the va reviews all gathered evidence to assess the validity and extent of your disability claim. 7 to 14 days. step #5: preparation for decision. the va prepares to make a decision on your claim based on the evidence and reviews. 7 to 14 days. The above flowchart template shows the insurance claim process of a company. the company claims $1000 on car coverage. the company will deny the fund if insurance does not cover the claim. in this case, the insurer will be responsible for any incurred expenses. in contrast, if the insurance policy covers the claim, the company will provide support.

Comments are closed.