Chevron Buys Noble In 13 Billion Accretive Deal Similar To Anadarko

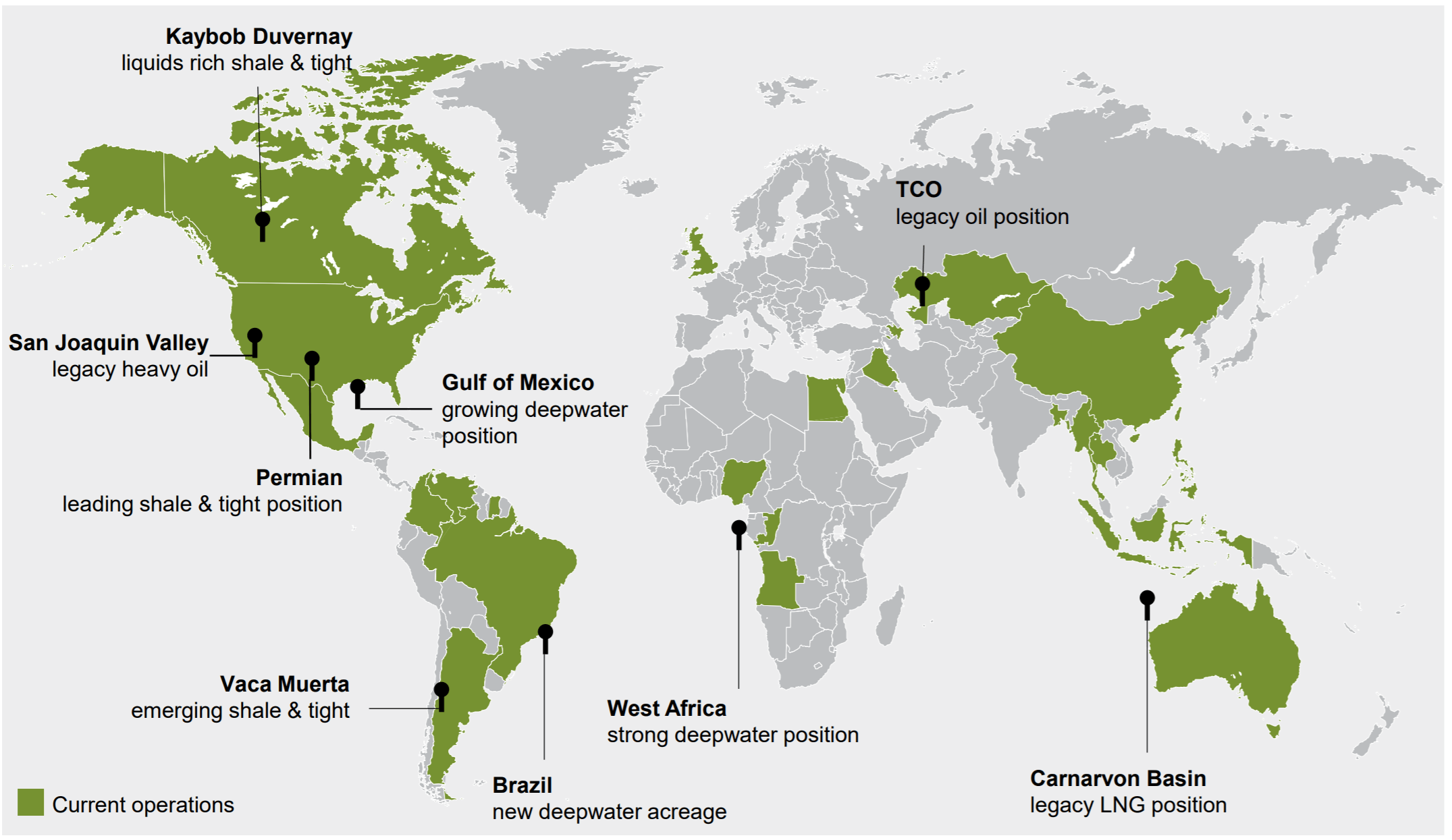

Chevron Buys Noble In 13 Billion Accretive Deal Similar Chevron to buy noble for $5 billion of stock and $7 billion in assumed debt. bulks up permian and rockies exposure, adds promising international assets. similar but smaller deal to anadarko. Roula khalaf, editor of the ft, selects her favourite stories in this weekly newsletter. chevron has agreed to buy noble energy for $13bn including debt in the oil and gas industry’s first big.

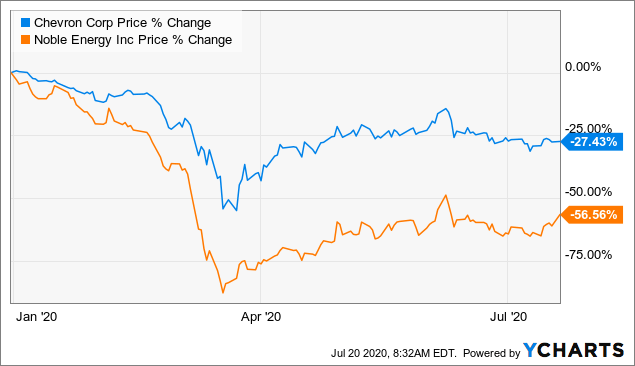

Chevron Buys Noble In 13 Billion Accretive Deal Similar Chevron is set to acquire all outstanding shares of noble in an all stock transaction valued at $10.38 per share or nearly $5 billion. the deal’s total enterprise value will be $13 billion. Chevron ceo mike wirth provides four takeaways from the supermajor’s offer to buy noble energy in a deal worth $13 billion, including debt. in addition to rich u.s. shale assets, the acquisition of noble energy adds long term inventory of cleaner burning natural gas in the east mediterranean to chevron’s upstream portfolio. (source: chevron. By the associated press. published 8:49 am pdt, july 20, 2020. new york (ap) — chevron will take over noble energy for $5 billion in the first big deal announced since the coronavirus pandemic shook the energy sector. chevron has been shopping for assets since last year and with crude prices down more than 30% this year, it jumped monday with. On july 20, 2020, chevron struck the first major energy sector deal since the onset of the pandemic, announcing a $13 billion agreement to acquire u.s. e&p noble energy. the transaction comes 15 months after the oil major bowed out of a bidding war with occidental petroleum to acquire anadarko petroleum, a landmark, $56 billion deal in which.

Chevron Buys Noble In 13 Billion Accretive Deal Similar By the associated press. published 8:49 am pdt, july 20, 2020. new york (ap) — chevron will take over noble energy for $5 billion in the first big deal announced since the coronavirus pandemic shook the energy sector. chevron has been shopping for assets since last year and with crude prices down more than 30% this year, it jumped monday with. On july 20, 2020, chevron struck the first major energy sector deal since the onset of the pandemic, announcing a $13 billion agreement to acquire u.s. e&p noble energy. the transaction comes 15 months after the oil major bowed out of a bidding war with occidental petroleum to acquire anadarko petroleum, a landmark, $56 billion deal in which. The price paid, $5 billion not including debt, is much smaller than the $33 billion proposed for anadarko petroleum. noble's assets will extend chevron's shale presence in colorado and the permian. On monday, hollub unveiled the company’s most profitable year ever, with an annual net income of over $12.5bn — almost double its previous record. meanwhile, it cut debt levels by $10.5bn, or.

Chevron Buys Noble In 13 Billion Accretive Deal Similar The price paid, $5 billion not including debt, is much smaller than the $33 billion proposed for anadarko petroleum. noble's assets will extend chevron's shale presence in colorado and the permian. On monday, hollub unveiled the company’s most profitable year ever, with an annual net income of over $12.5bn — almost double its previous record. meanwhile, it cut debt levels by $10.5bn, or.

Chevron Buys Noble In 13 Billion Accretive Deal Similar

Comments are closed.