Cash Value Life Insurance Prioritizing Cash Value Growth Vs Deat

Cash Value Life Insurance Prioritizing Cash Value Growt The many benefits of cash value life insurance. generating tax free cash flow with a proven and reliable asset. although life insurance is oftentimes purchased for the death benefit it provides, there are actually many ways that this flexible financial vehicle can be used – and no one has to die in order to receive monetary benefits. With indexed universal life insurance, the cash value growth is tied to a stock or bond index, such as the s&p 500. the cash value can decrease if the indexes fall. the cash value can decrease if.

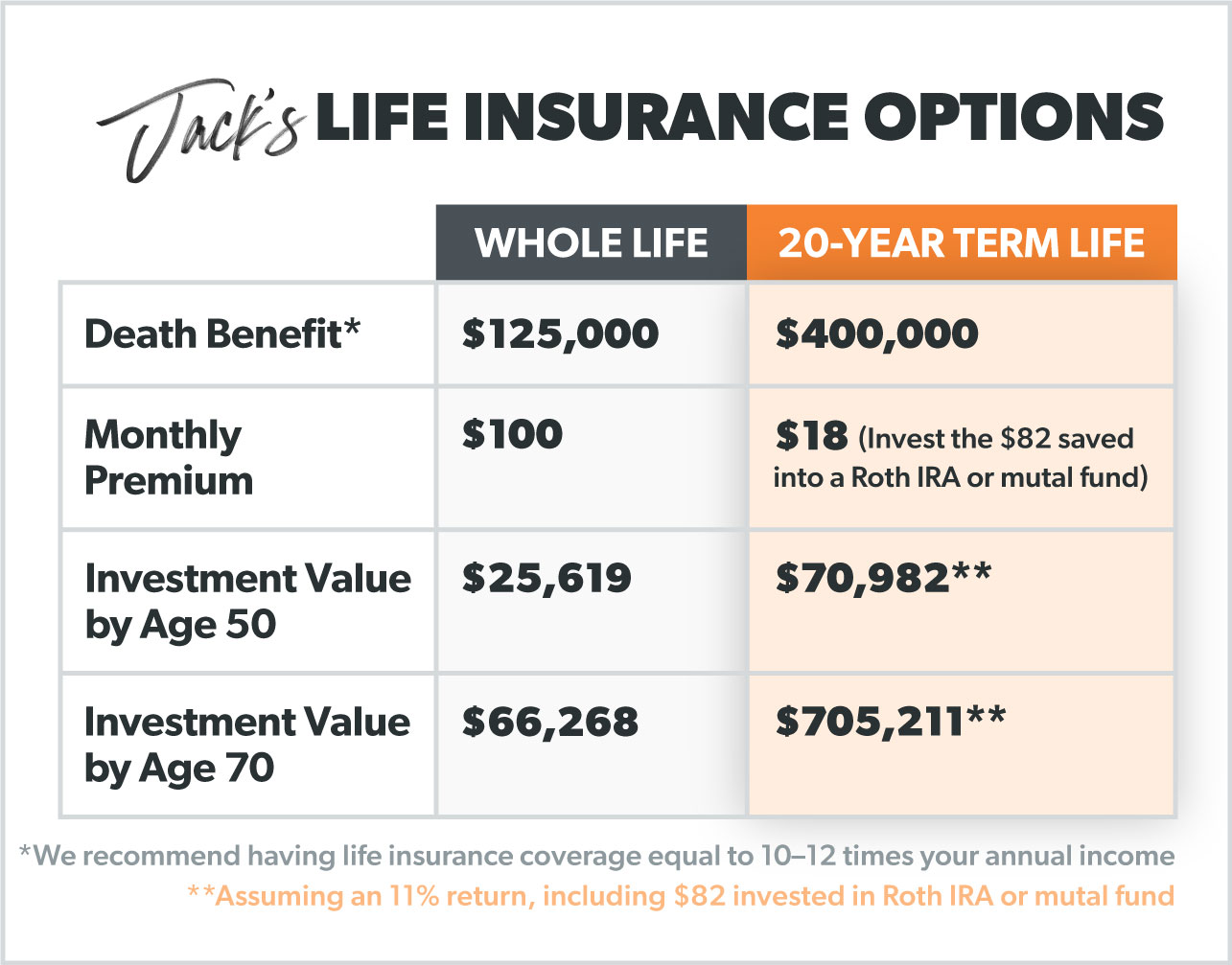

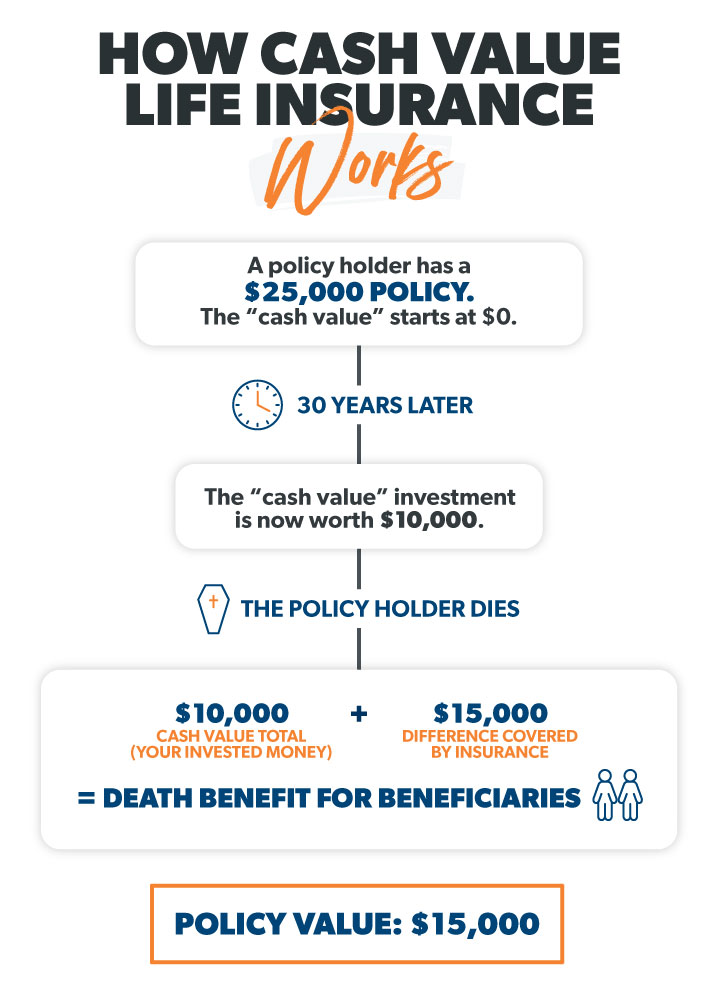

What Is Cash Value Life Insurance Ramsey Cash value life insurance encompasses multiple types of life insurance that contain a cash value account. this cash value component typically earns interest or other investment gains and grows tax. Cash value life insurance refers to any life insurance policy that not only has a death benefit but also accumulates value in a separate account within the policy. each time you make a premium payment, the money is split among three categories: cost of insurance: the amount required to fund the policy's death benefit. Cash value is money that accumulates as you pay your monthly premium on a permanent life insurance policy. you can use this money to save or invest, which increases your policy's value over time. Key takeaways. cash value is a unique feature of a permanent life insurance policy that you can grow and access. taking loans from the cash value of a life insurance policy can result in a reduction of your death benefit if you don’t repay the loan (or die before the loan is repaid). because of its cash value, a permanent life insurance.

Your Guide To Cash Value Life Insurance 2023 Cash value is money that accumulates as you pay your monthly premium on a permanent life insurance policy. you can use this money to save or invest, which increases your policy's value over time. Key takeaways. cash value is a unique feature of a permanent life insurance policy that you can grow and access. taking loans from the cash value of a life insurance policy can result in a reduction of your death benefit if you don’t repay the loan (or die before the loan is repaid). because of its cash value, a permanent life insurance. Key takeaways. permanent life insurance policies offer both a death benefit and cash value. the death benefit is a tax free payout to your heirs when you pass away. cash value is money you can. A cash value life insurance policy integrates a savings component with life coverage, offering a financial cushion that grows over time. this feature is prevalent in specific policies, specifically permanent life insurance. as the cash value in permanent life insurance accrues interest, it enhances the policy's net worth and offers a source of.

What Is Cash Value Life Insurance Finance European Key takeaways. permanent life insurance policies offer both a death benefit and cash value. the death benefit is a tax free payout to your heirs when you pass away. cash value is money you can. A cash value life insurance policy integrates a savings component with life coverage, offering a financial cushion that grows over time. this feature is prevalent in specific policies, specifically permanent life insurance. as the cash value in permanent life insurance accrues interest, it enhances the policy's net worth and offers a source of.

Infographic Life Insurance Cash Value Versus Death Benefit Keys

Comments are closed.