Cash Surrender Value

:max_bytes(150000):strip_icc()/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

Cash Value Vs Surrender Value What S The Difference 2022 Explore the process, implications, and alternatives to canceling life insurance, whether adjusting your financial strategy or responding to life changes The cash surrender value of life insurance is how much money you’ll receive if you terminate a permanent policy early Written by Graham Ray Senior Writer Graham Ray is a senior writer whose

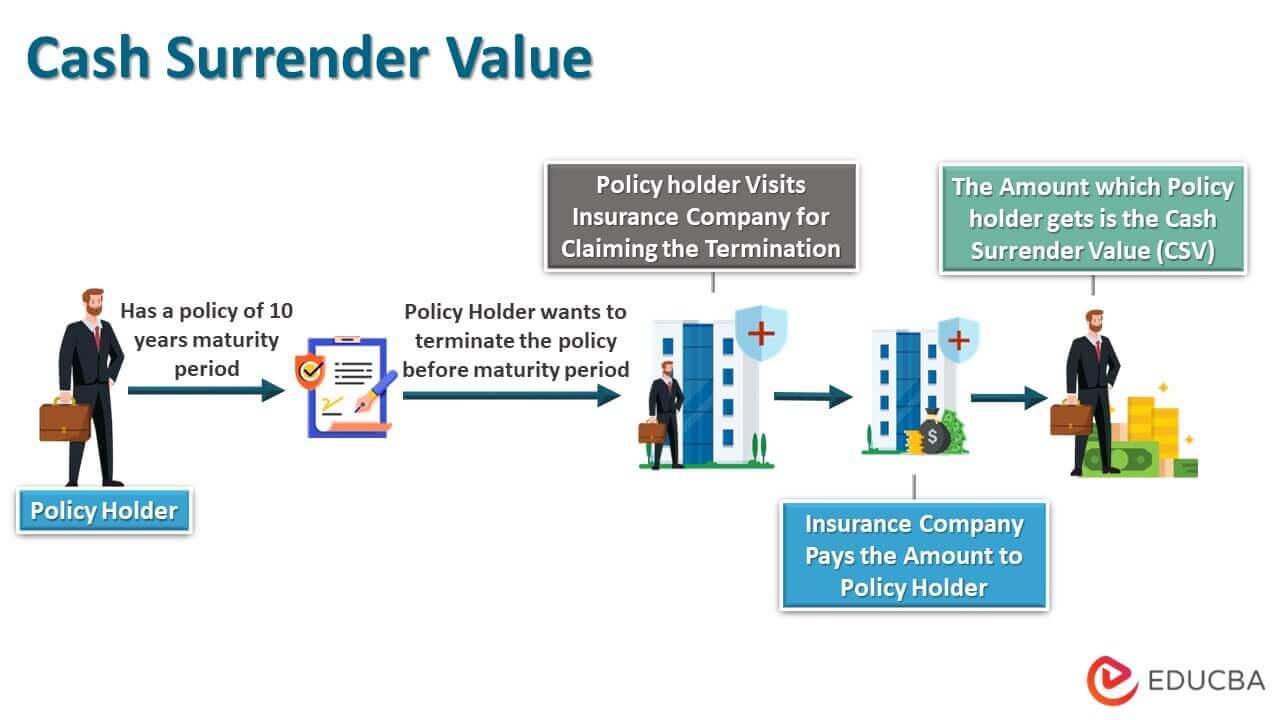

What Is Cash Surrender Value In Life Insurance 2024 Guide You get bonus rewards of 3% cash back at US supermarkets, US gas stations and US online retail purchases Terms apply If groceries, gas and online shopping are significant parts of your If you’re looking for a policy that offers lifelong coverage and flexible premiums, universal life insurance is worth considering Cash surrender value is a feature you can find in permanent life insurance policies Learning what it is will help you understand what you or your loved ones may receive for your policy In insurance, surrender refers to a policyholder terminating their policy before maturity The amount payable to the policyholder upon termination is called the surrender value

Cash Surrender Value How Does Cash Surrender Value Work Cash surrender value is a feature you can find in permanent life insurance policies Learning what it is will help you understand what you or your loved ones may receive for your policy In insurance, surrender refers to a policyholder terminating their policy before maturity The amount payable to the policyholder upon termination is called the surrender value Policyowners of a cash value life insurance policy can surrender it to the insurance company for a cash payout Some reasons you might want to surrender a life insurance policy include Cash value life insurance can offer a benefit to loved ones after opt for accelerated benefits, or surrender the policy and use the resulting cash in a 1035 exchange to put that cash into an Well, times have changed and now your life insurance policy can be appraised in the secondary market for its true value, the amount over and above the life insurance carrier’s cash surrender value If your life insurance policy no longer serves its original purpose, selling it might be a practical way to free up funds While many policies can be sold, permanent life insurance, such as whole or

Cash Surrender Value Of Life Insurance Meaning Examples Policyowners of a cash value life insurance policy can surrender it to the insurance company for a cash payout Some reasons you might want to surrender a life insurance policy include Cash value life insurance can offer a benefit to loved ones after opt for accelerated benefits, or surrender the policy and use the resulting cash in a 1035 exchange to put that cash into an Well, times have changed and now your life insurance policy can be appraised in the secondary market for its true value, the amount over and above the life insurance carrier’s cash surrender value If your life insurance policy no longer serves its original purpose, selling it might be a practical way to free up funds While many policies can be sold, permanent life insurance, such as whole or

What Is A Life Insurance Policy S Cash Surrender Value Policyadvisor Well, times have changed and now your life insurance policy can be appraised in the secondary market for its true value, the amount over and above the life insurance carrier’s cash surrender value If your life insurance policy no longer serves its original purpose, selling it might be a practical way to free up funds While many policies can be sold, permanent life insurance, such as whole or

Comments are closed.