Car Loan Payment With Principal Interest Example

Calculate Auto Loan Payments In Excel The principal on your car loan is the sum of money you borrowed from the lender. your typical monthly payment goes toward what you owe on the principal, the accumulated interest and loan fees. the. This means if you had a 72 month car loan with a $15,000 balance at a 10.19% interest rate, securing 5.59% on a car refinance loan would reduce your monthly payment by $126.74. car loan refinance example. original car loan. loan balance: $15,000. loan term: 72 months.

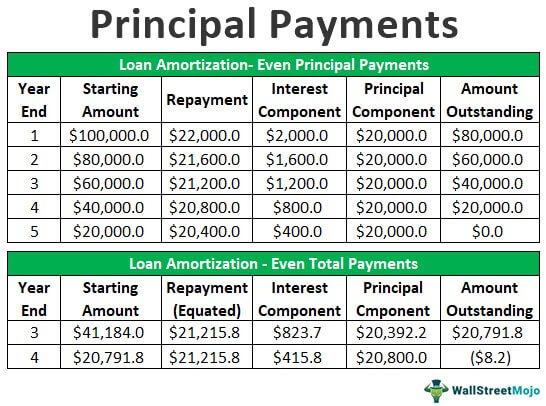

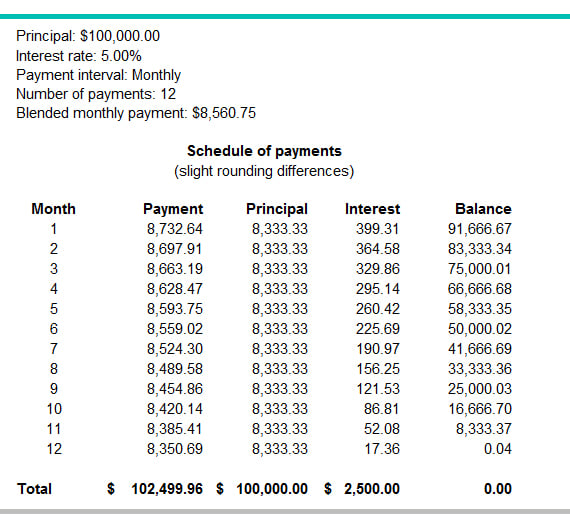

Principal Payment Definition Formula Examples Types Payment example. if you have a $745.72 payment for 60 months at 4.5% interest, here’s what your first and last payments would look like: first payment: $150 goes to interest and $595.72 to principal. last payment: $2.79 goes to interest and $742.93 goes to principal. The auto loan calculator is mainly intended for car purchases within the u.s. people outside the u.s. may still use the calculator, but please adjust accordingly. if only the monthly payment for any auto loan is given, use the monthly payments tab (reverse auto loan) to calculate the actual vehicle purchase price and other auto loan information. If we look at the car amortization schedule for our previous example, the auto loan of $15,000 with a 5% interest rate and a 5 year term, we can see the interest payment declines every month because the loan balance decreases as more principal is paid. since monthly payment is made up of principal and interest, when interest payment decreases. For this field of the auto loan calculator, enter the term of your loan. most car loans are for 60 months or five years. however, shorter and longer loans exist. with shorter loans, you'll frequently have lower interest rates, and you'll pay less in interest overall. however, your monthly payments will be higher. you'll have smaller monthly.

What Is A Principal Interest Payment Bdc Ca If we look at the car amortization schedule for our previous example, the auto loan of $15,000 with a 5% interest rate and a 5 year term, we can see the interest payment declines every month because the loan balance decreases as more principal is paid. since monthly payment is made up of principal and interest, when interest payment decreases. For this field of the auto loan calculator, enter the term of your loan. most car loans are for 60 months or five years. however, shorter and longer loans exist. with shorter loans, you'll frequently have lower interest rates, and you'll pay less in interest overall. however, your monthly payments will be higher. you'll have smaller monthly. The remaining $385 would pay down the principal. in your loan’s second month, $65 would go toward interest and your principal would be reduced by $387. sample car loan amortization schedule. below is a sample abbreviated breakdown of interest vs. principal paid on a car loan over the four year payment period. principal loan balance: $20,000. The principal is the amount of money you borrow to finance the purchase of a new or used car. if you have a $40,000 car loan with a 60 month term and 0% annual percentage rate (apr), you would be expected to repay $40,000 by the end of the 60 month term. in this example, you could satisfy the debt by making 60 monthly payments of $666.67.

Comments are closed.