Car Loan Calculator In Excel Sheet

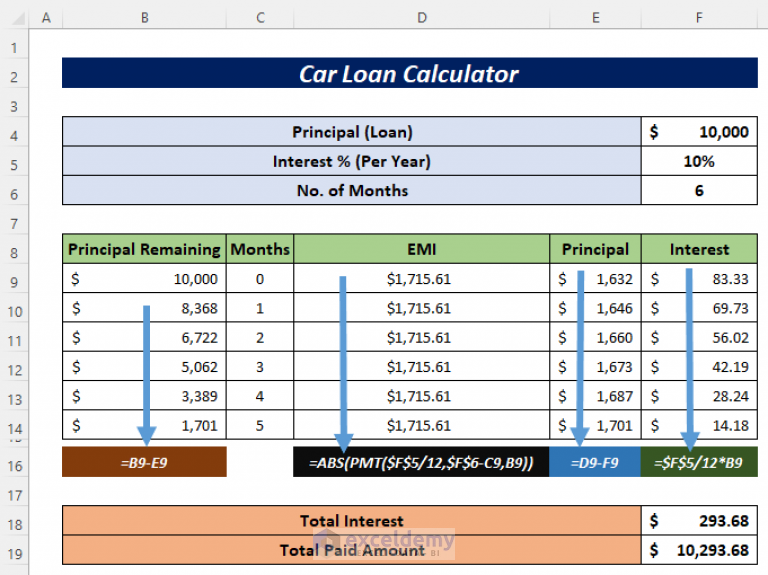

Car Loan Calculator In Excel Sheet Download Free Template You can generate your car loan amortization schedule from this template by inserting the necessary input values. you will get your required regular payments to pay off the loan, and you will get your principal paid, interest paid, and remaining balance after each payment. you will get an output summary focusing on all the important outputs and. Screenshot. 1. use the auto loan calculator worksheet to calculate the amount you will need to finance, based on the sales price of the car, destination charge, fees, sales tax, down payment, cash rebate, and trade in value of an older auto. 2. use the payment calculator worksheet (the featured image above) to create an amortization table based.

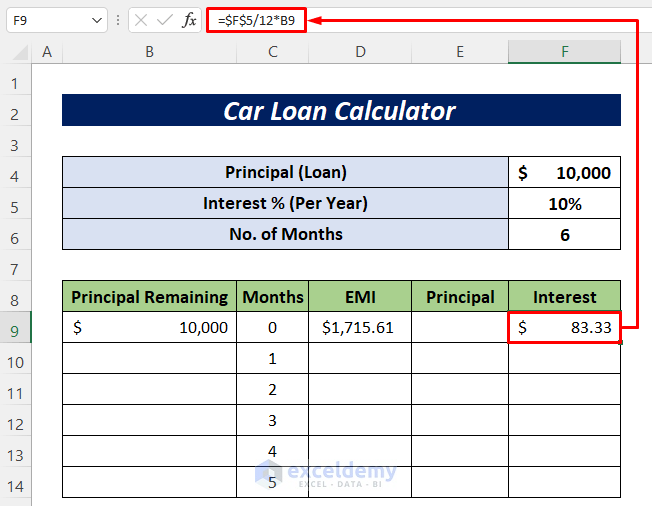

Car Loan Calculator In Excel Sheet Steps. download article. 1. launch microsoft excel. 2. open a new worksheet and save the file with a descriptive name such as "car loan." [1] 3. create labels for the cells in a1 down through a6 as follows: car sale price, trade in value, down payment, rebates, additional charges and amount financed. The apr is an annual rate, but (most) car loans are paid monthly. because of this, you need to divide the apr by 12. if your interest rate variable is in the same place as mine, the input will be c6 12. the nper input is the n umber of per iods the loan will be paid back over. most car loans are 3 5 years. Car loan calculator excel. auto loan for any credit. save up to $565 on your car insurance. car loan calculator excel to calculate the monthly payment for car loans and export the auto amortization schedule to excel. The spreadsheet is easy to use and navigate; required parameters are highlighted, and drop down menus let you change the payment frequency and compounding period. just enter the loan amount, interest rate, loan term, first payment date, payment frequency and loan compounding period. aafter you click a button, the spreadsheet calculates your.

How To Calculate A Car Loan In Excel 10 Steps With Pictures Car loan calculator excel. auto loan for any credit. save up to $565 on your car insurance. car loan calculator excel to calculate the monthly payment for car loans and export the auto amortization schedule to excel. The spreadsheet is easy to use and navigate; required parameters are highlighted, and drop down menus let you change the payment frequency and compounding period. just enter the loan amount, interest rate, loan term, first payment date, payment frequency and loan compounding period. aafter you click a button, the spreadsheet calculates your. To get the monthly payment amount for a loan with four percent interest, 48 payments, and an amount of $20,000, you would use this formula: =pmt(b2 12,b3,b4) as you see here, the interest rate is in cell b2 and we divide that by 12 to obtain the monthly interest. then, the number of payments is in cell b3 and loan amount in cell b4. Step 1: set up the worksheet. create a new excel worksheet and label the cells for loan amount, interest rate, loan term, and monthly payment. in this step, you’ll set the stage for your calculator. label cell a1 as “loan amount,” cell a2 as “interest rate,” cell a3 as “loan term,” and cell a4 as “monthly payment.”.

A Quick And Useful Way To Make A Car Loan Calculator In An Excel Sheet To get the monthly payment amount for a loan with four percent interest, 48 payments, and an amount of $20,000, you would use this formula: =pmt(b2 12,b3,b4) as you see here, the interest rate is in cell b2 and we divide that by 12 to obtain the monthly interest. then, the number of payments is in cell b3 and loan amount in cell b4. Step 1: set up the worksheet. create a new excel worksheet and label the cells for loan amount, interest rate, loan term, and monthly payment. in this step, you’ll set the stage for your calculator. label cell a1 as “loan amount,” cell a2 as “interest rate,” cell a3 as “loan term,” and cell a4 as “monthly payment.”.

Comments are closed.