Building A Future Proof Crm Eco System For Global Fintechs And Banks Fives Digital

Fintech Growing More Valuable Financial Tribune Discover how fintechs and banks can build a powerful crm ecosystem to enhance customer experience, streamline operations, and ensure compliance globally. lea. Building a new digital business from scratch is a way to accelerate this process. however, to do it right, banks must excel on multiple fronts, combining the strengths of an incumbent with the agility of a start up. they also need a unique idea, a top notch team, and a clear path to profitability. none of this is easy.

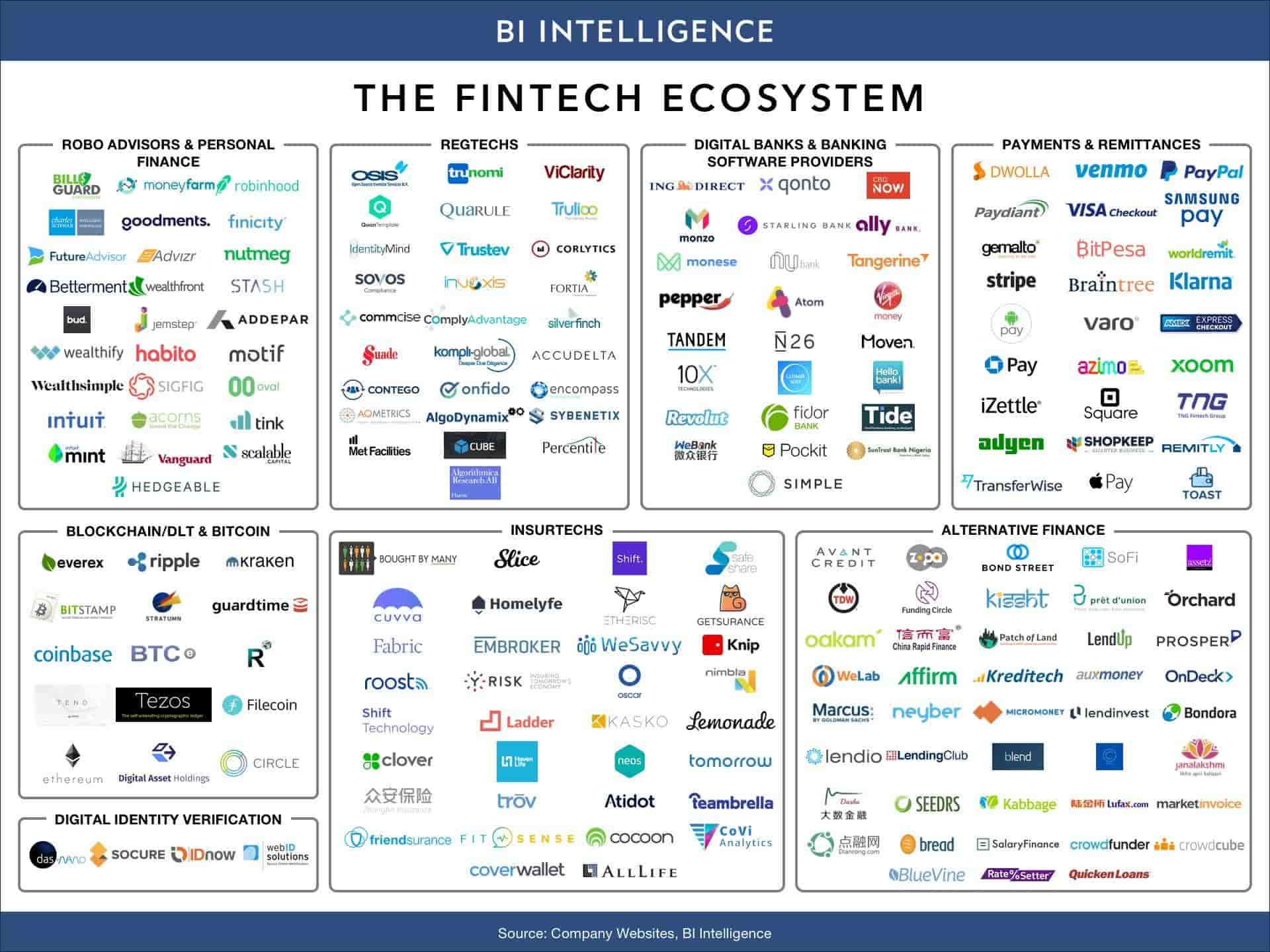

Fintech Ecosystem Bfa Global 3. use ecosystems to learn and experiment. with this strategy, banks and financial services institutions use digital ecosystems as a learning lab to enable experimentation, diversification, and piloting to deal with external opportunities and threats. institutions can use these incubators to explore new products and business models, access new. Global fintech ecosystem and provide insights to inform evidence based decision making. taking a panel research approach, this empirical study surveyed a total of 227 carefully selected fintech companies across five retail facing industry verticals – digital lending, digital capital raising, digital payments, digital banking and savings, and. It's a sign of the capital's continued belief in the promise of fintech and digital banking. u.s. based fintech companies led the charge for this quarter, securing $3.3 billion across 393 deals. Ecosystem stakeholders, we have identified key themes shaping the future of fintechs. to help fintechs capitalize on these themes, we also provide a framework for sustainable growth, based on an analysis of the strategies used by long established public companies that have weathered previous economic cycles. 1 f prime fintech index.

What Is Fintech Fintech Magazine It's a sign of the capital's continued belief in the promise of fintech and digital banking. u.s. based fintech companies led the charge for this quarter, securing $3.3 billion across 393 deals. Ecosystem stakeholders, we have identified key themes shaping the future of fintechs. to help fintechs capitalize on these themes, we also provide a framework for sustainable growth, based on an analysis of the strategies used by long established public companies that have weathered previous economic cycles. 1 f prime fintech index. In brief. banks need to transform their operating model to respond to new market entrants, customer needs and profitability challenges. successful banking transformation programs combine customer, digital tech and data analysis to deliver new operating models that add value for customers. adopting an ecosystem approach can enable banks to. Ecosystem partnerships are making banks more relevant to customers today and may be crucial to bank profitability in the future. in brief. the banking landscape is undergoing a profound transformation, powered by emerging digital technologies, rapidly evolving customer preferences and new competitive threats from fintech and big technology firms.

Fintech Ecosystem Win In A Rapidly Changing Landscape вђ Mindk In brief. banks need to transform their operating model to respond to new market entrants, customer needs and profitability challenges. successful banking transformation programs combine customer, digital tech and data analysis to deliver new operating models that add value for customers. adopting an ecosystem approach can enable banks to. Ecosystem partnerships are making banks more relevant to customers today and may be crucial to bank profitability in the future. in brief. the banking landscape is undergoing a profound transformation, powered by emerging digital technologies, rapidly evolving customer preferences and new competitive threats from fintech and big technology firms.

Comments are closed.