Big Changes For Solar In The Inflation Reduction Act Solar Sales

Big Changes For Solar In The Inflation Reduction Act Solar Sales President biden signed the inflation reduction act into law on tuesday, august 16, 2022. one of the many things this act accomplishes is the expansion of the federal tax credit for solar photovoltaics, also known as the investment tax credit (itc). this credit can be claimed on federal income taxes for a percentage of the cost of a solar. The inflation reduction act removes these requirements, and allows energy storage projects to receive the same 30% tax credit, even if they are stand alone facilities. batteries connected to a.

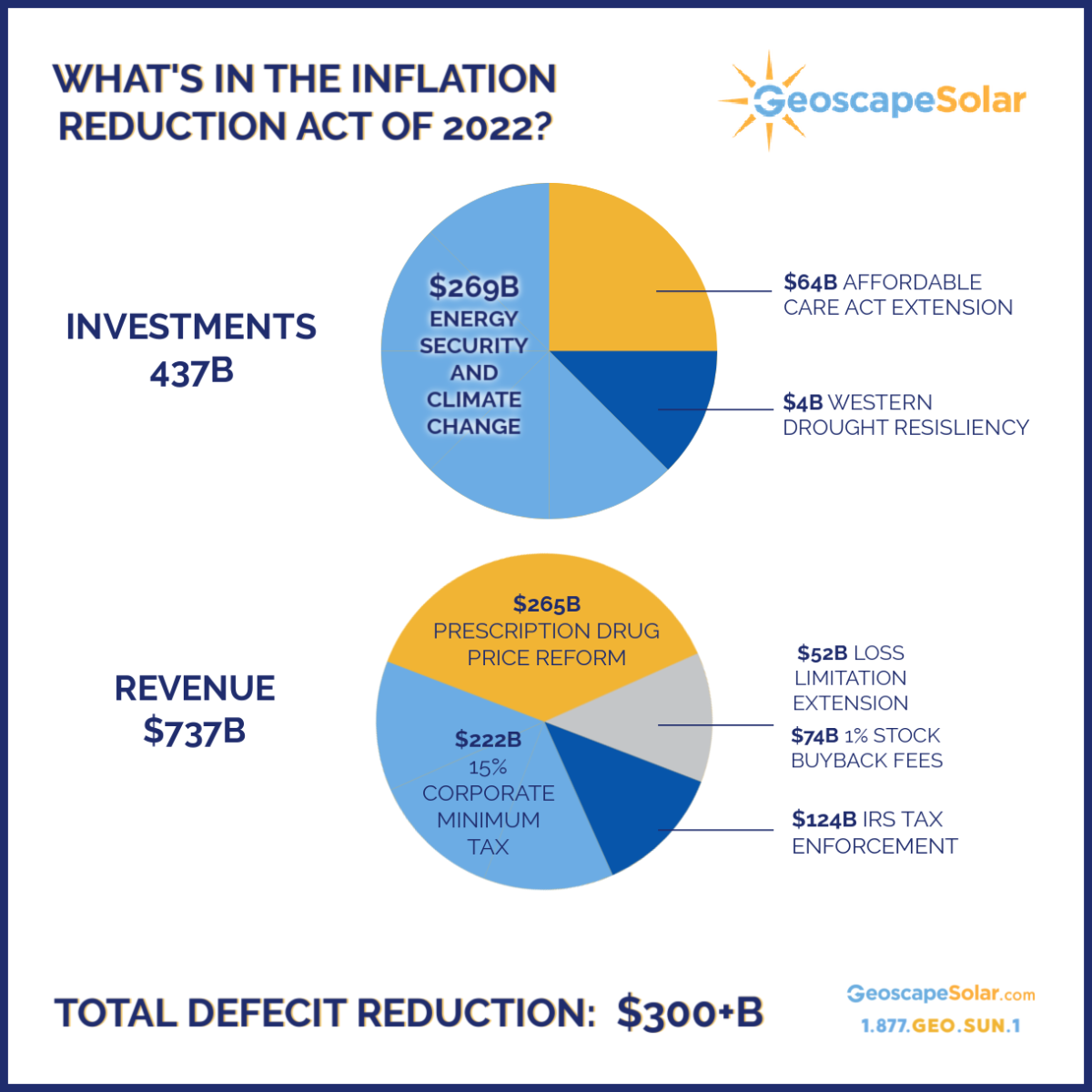

The Inflation Reduction Act And What It Means Geoscape Solar On august 7, the senate passed the inflation reduction act, which includes long term solar and storage tax incentives, investments in domestic solar manufacturing and other critical provisions that will help decarbonize the electric grid with significant clean energy deployment. the inflation reduction act is expected to cut greenhouse gas. It will also helped a solar panel company reap billions of dollars. arizona based first solar is one of the biggest early winners from the democrats’ inflation reduction act, offering a textbook case of how the inside influence game works in washington.(ap photo ross d. franklin, file). The inflation reduction act of 2022 will extend the itc for 10 years while reinstating a 30% tax rebate on the total cost of a solar installation. the solar itc can be redeemed by the owner of a clean energy system on a residential or commercial property. at up to 30% of project expenses, the federal tax incentive can be applied to the total. The solar for all competition, which was created by the inflation reduction act’s greenhouse gas reduction fund (ggrf), will expand the number of low income and disadvantaged communities primed for residential solar investment by awarding up to 60 grants to states, territories, tribal governments, municipalities, and eligible nonprofits to.

How The Inflation Reduction Act Of 2022 Can Lower Your Energy Bills The inflation reduction act of 2022 will extend the itc for 10 years while reinstating a 30% tax rebate on the total cost of a solar installation. the solar itc can be redeemed by the owner of a clean energy system on a residential or commercial property. at up to 30% of project expenses, the federal tax incentive can be applied to the total. The solar for all competition, which was created by the inflation reduction act’s greenhouse gas reduction fund (ggrf), will expand the number of low income and disadvantaged communities primed for residential solar investment by awarding up to 60 grants to states, territories, tribal governments, municipalities, and eligible nonprofits to. New inflation reduction act provision broadens access and boosts return on clean energy tax credits. washington, d.c. — as part of the biden harris administration’s investing in america agenda, the u.s. department of the treasury and the internal revenue service (irs) today released final rules on transferability, a key inflation reduction act provision that is already expanding the. First solar, the largest domestic maker of solar panels, became perhaps the biggest beneficiary from $1 trillion in environmental spending enacted under the inflation reduction act, which biden.

San Antonio Businesses Can Take Advantage Of Incentives By Converting New inflation reduction act provision broadens access and boosts return on clean energy tax credits. washington, d.c. — as part of the biden harris administration’s investing in america agenda, the u.s. department of the treasury and the internal revenue service (irs) today released final rules on transferability, a key inflation reduction act provision that is already expanding the. First solar, the largest domestic maker of solar panels, became perhaps the biggest beneficiary from $1 trillion in environmental spending enacted under the inflation reduction act, which biden.

Comments are closed.